No deal!!!

No deal!!!

That's right, as we expected Team Trump has not been able to make a deal with China and, as of midnight, tariffs increased on $200Bn (not $250Bn) worth of Chinese goods from 10% to 25%, which isn't really that terrible ($30Bn) but President Crazy Train is also looking to add taxes to another $350Bn worth of goods but, to do that one (legally), the U.S. trade representative’s office would need to identify the goods, seek comments on its choices and hold hearings – so it's very possibly just an empty threat from the President and China knows it because they study US law a lot more closely than Trump and his advisers seem to.

So, in the grand scheme of things, $30Bn more tariffs isn't going to break anyone and the total revenues would be $50Bn (25% of $200Bn), not "over $100Bn" that Trump is fantasizing about and how pissed off do you think Puerto Rico is to have Trump BS'ing about sending humanitarian assistance to "poor and starving countries" when they've been waiting almost two years for something besides paper towels to clean up after their disastrous hurricane?

The Futures are down again today and we may revisit yesterday's lows but we went long on Dow (/YM) Futures at 25,600 in yesterday's Live Member Chat Rooom caught a ride back to 25,850 into the close, which gave us gains of $1,250 per contract while our bullish play on the S&P (/ES) Futures also gained $1,250 per contract on a 25-point move back to 2,875.

Of course, those same levels will be in play again today but keep in mind we made the call at 11:58 for our Members – as the indexes were crossing back OVER the lines and momentum was on our side – don't try to be a hero and catch the index while it's moving against you – that can lead to big losses if your line doesn't hold.

In fact, later in the afternoon we analyzed the index moves and determined they were only making bounces off the 5% drop lines according to our fabulous 5% Rule™, which is not TA – just math. Failing the bounce lines means it's more likely we're consolidating for a move down (towards a 10% correction) than up and our bounce lines are:

- Dow 25,200 is the 5% line and the bounce lines are 25,450 (weak) and 25,700 (strong)

- S&P 2,860 is the 5% line and the bounce lines are 2,875 (weak) and 2,890 (strong)

- Nasdaq 7,475 is the 5% line and the bounce lines are 7,540 (weak) and 7,605 (strong)

- Russell 1,550 is the 5% line and the bounce lines are 1,565 (weak) and 1,580 (strong)

In order to get more bullish, we need to see all the strong bounce lines turn green and, if the weak bounce lines begin to fail, then we look for the first index to cross below the 5% line and look to place bearish bets on the laggars and it's the Dow that's lagging this morning at 25,700 – so it makes the best bearish bet of the group and you simply place a tight stop above 25,700 and then look to go long the laggars if the indexes start breaking up.

There, you are now an expert at trading the Futures! Of course we also watch the news and pay attention to companies and events that could drive the indexes but, other than a trade deal being announced (and we think there's no way this week), I think people will be bailing on the market into the weekend. It's not about the $30Bn in new tariffis, it's about the general over-bought nature of the markets – this is just an excuse to sell for fund managers.

On the whole though, this is a nice, healthy sell-off and we're starting to recognize more and more market risks, which makes them less scary for long-term share holders so, if we manage to hold our highs despite all this nonsense – THAT will be impressive!

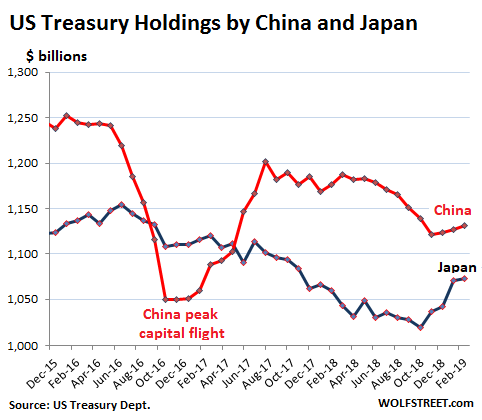

We still have the weekend to get past though and China WILL retaliate and it seems they've already started as no one bought our bonds this week at the note auctions. China is holding $1.1Tn of our Government's debt and they could begin selling it, which would quickly make it hard for us to get a good price at our own auctions and that would quickly drive up US interest rates but it would also devalue their remaining low-interest bonds – so it's a tricky move for them to make. Simply stopping purchases would hurt us plenty.

We still have the weekend to get past though and China WILL retaliate and it seems they've already started as no one bought our bonds this week at the note auctions. China is holding $1.1Tn of our Government's debt and they could begin selling it, which would quickly make it hard for us to get a good price at our own auctions and that would quickly drive up US interest rates but it would also devalue their remaining low-interest bonds – so it's a tricky move for them to make. Simply stopping purchases would hurt us plenty.

China is also America's largest customer for Soy Beans and Soybean Futures have been collapsing, down 15% since April and, if you believe in a trade deal, you can make money playing SOYB bullishly. Right above, our own President is telling the farmers not to worry because he will be happy to help them by buying Soybeans, etc. and handing them out to the poor and of course our President would never lie to farmers so I can't imagine why traders wouldn't jump on Soybean Futures – the September contracts are /ZSU19 at $825 and that gives Trump all summer to come through on his promises. Any takers?

As to SOYB, it hasn't been this low since, well, ever – as the contract began in 2012 at $25 and never really went below $17.50 until the trade war began so $14.50 is quite a bargain and, as much as I hate to bet on Trump doing anything right, it's POSSIBLE we get a trade deal and that will hurt our hedges in the Short-Term Portfolio so, in order to hedge the hedges, a bullish bet on SOYB makes sense. For the STP, we can:

- Buy 50 Nov $14 calls for $1.10 ($5,500)

- Sell 50 Nov $15 puts for 0.95 ($4,750)

That's net $750 and, if SOYB goes back to $16 on a trade deal, those options will be worth $1.50 each for $7,500 on 50 100-unit contracts, which would be a 900% gain of $6,750 – not bad for an offset and our worst case is owning SOYB at 7-year lows and we can then sell calls to reduce our net $15.15 entry.

Have a great weekend,

– Phil