Good morning!

More bad news:

- April Industrial Production: -0.5% to 109.2 +0.0% consensus, +0.2% prior (revised).

- Capacity Utilization 77.9% vs. 78.7% consensus, 78.5% prior (revised).

That was very unexpected.

Volume on sell-off was pretty low. While that's not a great sign (could be a lot more people who want to sell but can't find buyers), it means we can pop right back up on a little good news. The trick is finding the good news - mostly it's earnings. Companies are making money (see M) and, if F'ing Trump would just leave things alone - things would probably be great (again).

New Hedge/Robert - Well I'd go with the July TZA spread above and offset with short puts on something you don't mind buying if the market drops 20% like this:

- Buy 50 TZA July $9 calls for $1.30 ($6,500)

- Sell 50 TZA July $11 calls for 0.65 ($3,250)

- Sell 10 M 2021 $20 puts for $4 ($4,000)

So that's a net $750 credit on the $10,000 spread so the upside potential is $10,750 if the Russell falls and the worst case scenario is you get $22,000 worth of M stock (currently) for net $19,250.

If you want a bigger hedge, I'd suggest selling more than just one put so you're less likely to get burned by one company going lower than we thought. Anything still in the LTP is a good candidate as we've already purged the things we aren't happy to ride out a downturn with.

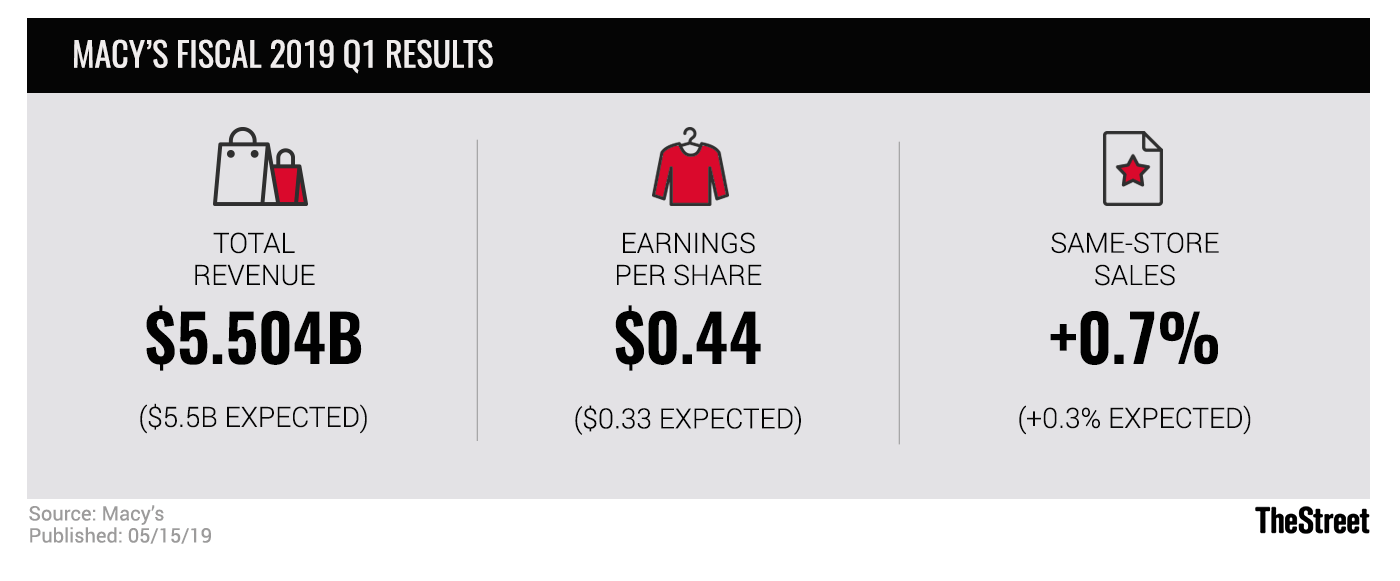

M/DC - What a gift that you still get to buy it cheap after those earnings!

Looking into 2019, Macy's said it sees same-store sales rising by 1% for the full year, with flat net revenues and diluted earnings per share in the region of $3.05 to $3.25, supported by about 25 cents per share in asset sale gains.