We're wating on the Fed.

We're wating on the Fed.

We have "the greatest stock market in history" and "the greatest economy in history" with "record employment" but, if the Federal Reserve doesn't lower rates below the current 2.5% they have set – it will be "a disaster". Clearly, to any rational person, something must wrong with those statements existing at the same time but they all come from our President's lips and far be it for me to call Donald Trump a liar – so I guess we just have to accept that it's all true.

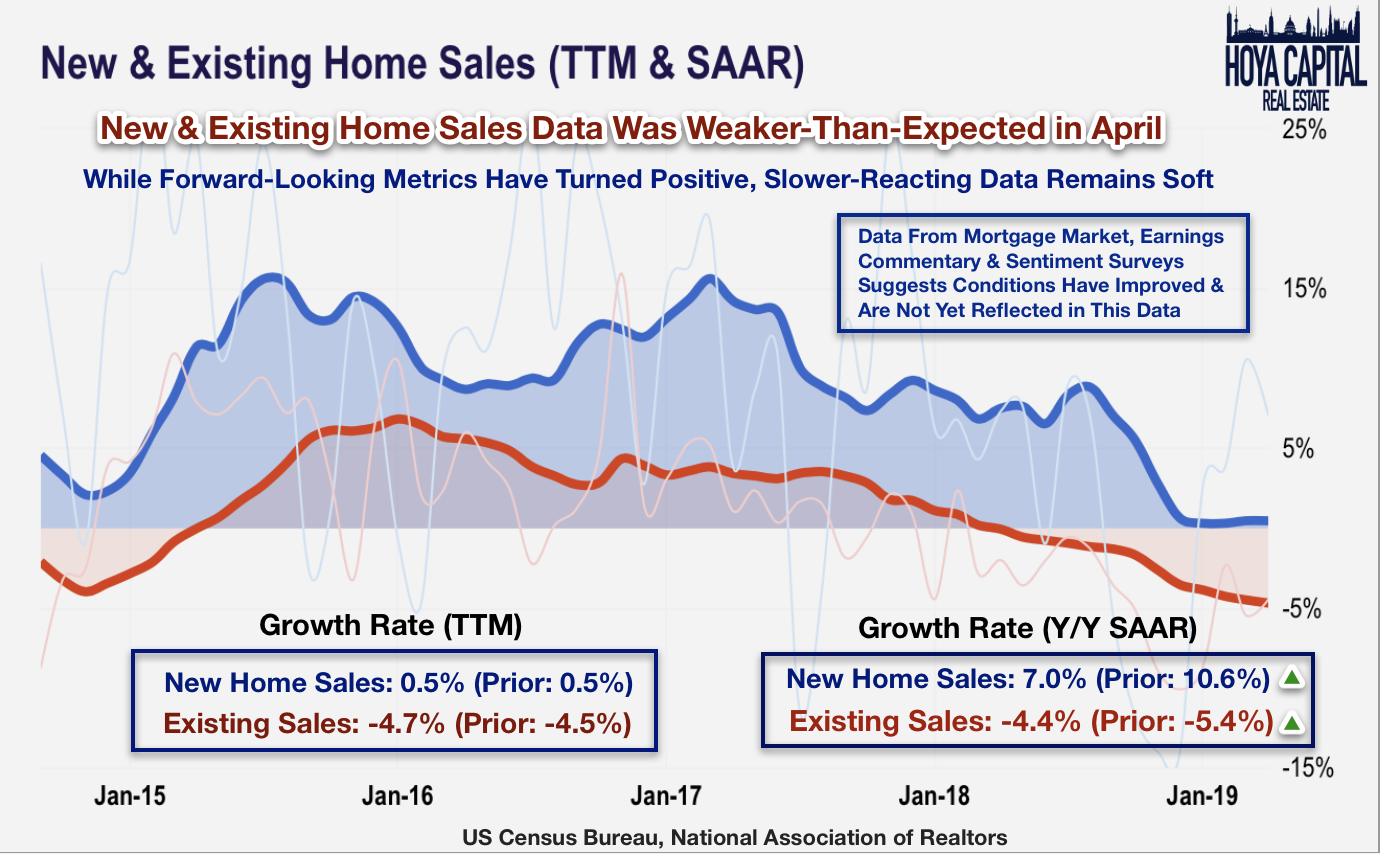

30-Year Fixed Mortgages are still 3.5-4.0% yet Home Sales are still trending lower and that's impacting a lot of high-paying construction jobs which, in turn, impacts the materials industry and even banking, as less people look for loans to buy homes and then the Durable Goods crowd can't sell washing machines, refrigerators, couches and TVs and there's less hardware and paint sales, etc., etc.

Housing, as always, is a major driver of the economy and it's kind of hard to ignore it when it begins to falter – but that's exactly what the market is doing at the moment. This is where the panic is coming from as even a 1% rise in rates last year has caused a 10% decline in housing activity and we NEVER came close to getting back to our pre-2008 levels in the first place.

Housing, as always, is a major driver of the economy and it's kind of hard to ignore it when it begins to falter – but that's exactly what the market is doing at the moment. This is where the panic is coming from as even a 1% rise in rates last year has caused a 10% decline in housing activity and we NEVER came close to getting back to our pre-2008 levels in the first place.

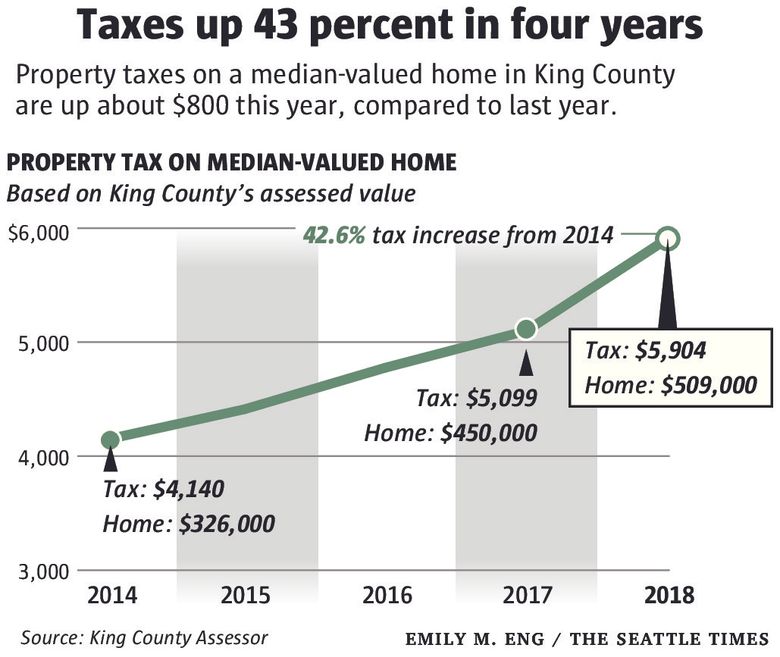

What Trump doesn't understand is that, for the average American, low rates aren't enough to get them to invest in real estate. You can't "take advantage" of low rates on homes you can't afford and very few Americans have $50,000 to plunk down on a $250,000 home – not that there are many $250,000 homes left anymore anyway. Not only that but Property Taxes have risen out of control and Trump has limited their deductability – making the rises much harsher and not many people in the bottom 90% have tax lawyers to get them out of paying their share.

As you can see from this fairly typical example from King County in Washington (chosen because it's nicely done), property taxes are up 43% on 4 years, going from about $4,000 to $6,000 on a $500,000 home. I WISH that's what I was paying in New Jersey, but it's about 4x more than that there. In fact, the taxes on my home in NJ are now more than the Mortgage from 20 years ago, when we bought the house and taxes were about $4,500/yr, now $23,000/yr – that's up 400% in 20 years!

As you can see from this fairly typical example from King County in Washington (chosen because it's nicely done), property taxes are up 43% on 4 years, going from about $4,000 to $6,000 on a $500,000 home. I WISH that's what I was paying in New Jersey, but it's about 4x more than that there. In fact, the taxes on my home in NJ are now more than the Mortgage from 20 years ago, when we bought the house and taxes were about $4,500/yr, now $23,000/yr – that's up 400% in 20 years!

No wonder people can't afford to buy homes, no matter what the "price" of the home is. If the taxes are as much as the mortgage, the home is effectively twice as expensive and what's going on here is the Government is stealing the appreciation of your home because people don't buy a home – they buy a mortgage and mortgages include taxes so if the house was $500,000 with a $3,000 mortgage and $400/month in taxes, that's $3,400/month but if the taxes go up to $2,000/month and the person buying your home can still only afford $3,400 – then the only variable is the price of your home – which has to come down. This is how the Government has stolen a large portion of American's home price appreciation over the past two decades.

Now, you might want to blame the local Government but they generally work under balanced budget rules and the real variable that's changed is that the FEDERAL Government has cut back on the money they send to the states for schools, roads, infrastructure, police, etc and it's the Local Government that is forced to pick up the slack caused by all that Federal Tax-cutting, which leads to service cutting. Because it's an issue that's too complex to fit into a tweet – no one talks about it.

Notice how New Jersey gets back just 0.61 on every Dollar of taxes they pay to the Federal Government while New Mexico gets back $2.03, Mississippi $2.02, Alaska $1.84, etc? You also have to consider that NJ's 9M people pay more in taxes than the Top 10 taker states combined. Populous, high-earning states like New York, Connecticut, Illinois and Massachusetts also get screwed. New York just did a study showing the state pays $47.89 BILLION more to the Federal Government than it gets back in services – and Trump complains about China!

And New York is having a picnic compared to New Jersey, as they get back 0.79 for every Dollar they send to Washington. If those Blue States ever succeeded from the Union – the Union would be bankrupt!

The key takeaway here is that that $48Bn deficit has to be made up locally, by the people through sales taxes and property taxes (and it's also unfortunatel for New Jersey that lots of their residents go shopping in New York and Philadelphia) as, unlike the Federal Government, which had a $208Bn deficit LAST MONTH, states have to balance their budgets so New York's 6M households each have to come up with $8,000 to cover what is given to New Mexico et al. If people actually understood what is going on in this country – there would be a revolution!

About time too! As Thomas Jefferson said: "The tree of liberty must be refreshed from time to time with the blood of Patriots and Tyrants. It is it's natural manure. We need a revolution every 20 years just to keep the Government honest." Seems like we're long overdue according to our Founding Father.

Speaking of revolutions, Hong Kong citizens were takin' it to the streets with 2 Million of Hong Kong's 7M residents marching this weekend and, guess what – they won! And of course they won when 30% of the entire country shows up to protest something because even the entire Chinese army only has 2M people (same as ours) and when the people actually get together and rise up against repression – the people tend to win. Sadly that's a lesson our own children have forgotten.

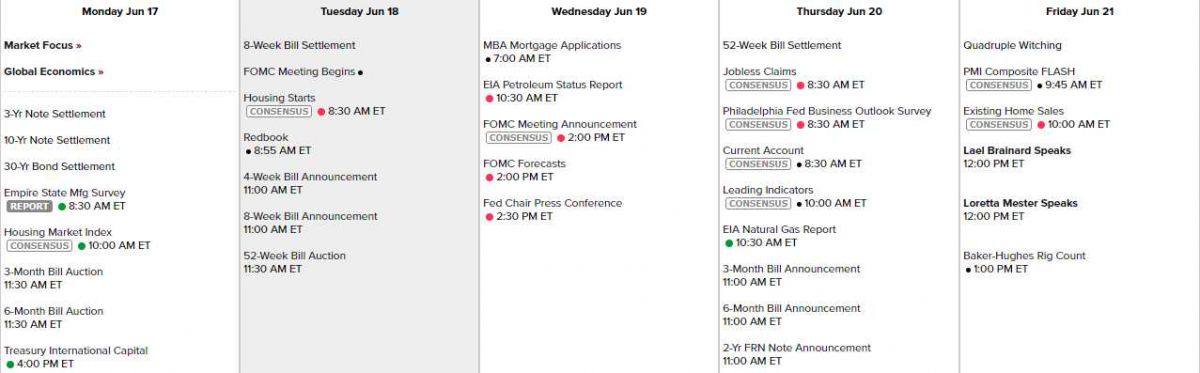

Meanwhile, it's very unlikely that the Fed will suddenly cut at Wednesday's meeting (2pm) but the bulls are looking for some kind of indication that that is their intention for the July meeting or we may see a revolution on Wall Street as the bears overthrow the tyranny of this rally in search of more rational equity pricing. The calendar, otherwise, it very light: