More free money!

More free money!

This is why Goldman Sachs put Mario Draghi in charge of the European Central Bank (ECB) – exactly for a moment like this when they need to boost the US markets and this statement couldn't have been timed better – just ahead of the start of the Federal Reserve's 2-day meeting that will lead to a policy announcement tomorrow at 2pm. Draghi said the ECB is "ready to launch another round of stimulus" as inflation remains below targets.

That target is, of course, 2% and if we were over 2%, they would be raising rates to fight it so the entire process is ridiculous but the most ridiculous thing is basing your entire monetary policy on a singly, unreliable data-point. Of course, the inflation target is just an excuse because, over or under, we've seen Central Banksters call it "transitory" – meaning they will totally ingnore it when it suits them. In this case – the Masters want to see all-time highs in the markets – so low inflation is our #1 excuse to jack up the markets.

Low rates aren't free – taxpayers subsidize the wealthy by artificially reducting rates through Government Debt (where the wealthy lend the Government money to subsidize their rate cuts) and we are being forced to do this (year 10) in order to force the prices that we pay to go unnaturally higher (in order to increase Corporate Profits so the wealthy can have more money). Are you beginning to see a pattern here? It didn't take long for the Oligarch-In-Chief to weigh in on the subject:

Mario Draghi just announced more stimulus could come, which immediately dropped the Euro against the Dollar, making it unfairly easier for them to compete against the USA. They have been getting away with this for years, along with China and others.

By saying it's "unfair" for Draghi to lower rates, he puts pressure on our Fed to do the same for him but it's all a game because the strings are really being pulled by the Banks, who control the Fed as well as the President(s). Trump is also indicating he wants a weaker Dollar, which is better for US exports but another stealth tax on US consumers, whose wages are generally inflexible (so we get less valuable Dollars for the same work) while the capital gains paid through equity in Multinational Corporations are very flexible – so it's yet another way to transfer wealth from the Bottom 90% to the Top 10%.

As a test today, ask all the minimum wage workers you meet today how much money they have tied up in commodities, which also benefit from the falling Dollar and, of course, the stimulus measures aimed at boosting economies. Keep moving up the Income Ladder until you find which of your friends or collegues have commodity investments so we can get a better handle on who benefits from the policies of the Central Banksters and the Oligarchs.

Copper (/HGZ19) is coming off a nice bottom and we like it long above the $2.65 line with tight stops below. Another way to play Copper for a rise is one we reviewed yesterday in our Options Opportunity Portfolio and that's Freeport-McMoRan (FCX) who are all the way down at $10.75 and we have 25 of the 2021 $10 calls, now $2.60 ($6,500), covered by 20 of the 2021 $17 calls, which are now 0.75 ($1,500) and we sold 15 of the 2021 $12 calls for $3 ($4,500) to offset the cost.

So the net of that trade, currently, is now $500 and, should FCX get back to $17 by Jan of 2021, it's a $17,500 spread which means the profit potential is $17,000 (3,400%) – so that's pretty good. The worst case is you end up owning 1,500 shares of FCX at $12 ($18,000) and ordinary margin requirements on the trade are about $3,300 so it's a very efficient use of funds. At $10.75, FCX has a $15.5Bn market cap and last year they made $2.6Bn (p/e of 6) but this year is going to be significantly lower, more like $500M (p/e of 31) as Copper pricing began 2018 at $3.20 so $2.60 is down 19% and that's about their entire profit margin. Still, if you are not going to buy cyclical stocks when they are cheap (when the market conditions are against them) – when are you going to buy them?

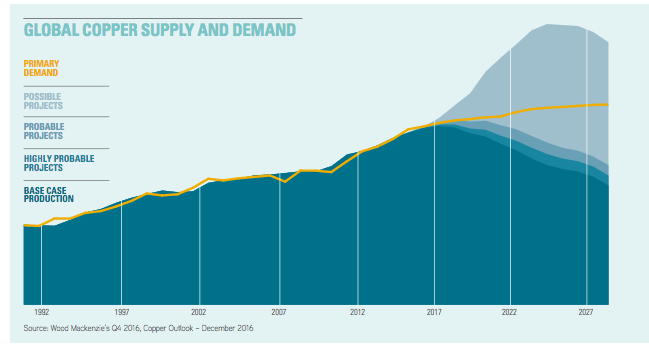

As you can see from the chart, Copper demand is steadily rising but production is trailing off and the trade war has dampened the effect but, over the next few years, prices are very likely to rise and that creates a great opportunity to get in now for the long term. If the economy turns down, Copper could go lower – it bottomed out at $2 in 2016 and was $1.50 back in 2009 but, in general, it spends more time over $3 than under it. These production trends don't change rapidly – FCX just approved the funds to begin construction of an Indonesian smelter in 2020 that will be completed in 2023 – so not many surprises in this space and Infrastructure spending would boost demand significantly.

Speaking of currency debasement – Facebook is rolling out their own cryptocurrency today and they already have a ton of partners who will be accepting it including Visa, Mastercard and PayPal so really that's game over for most other digital currencies. BitCoin is spiking back to $10,000 because people who buy BitCoin don't understand the difference but Libra has a chance of becoming the real thing and Governments should be worried about that too.

Speaking of currency debasement – Facebook is rolling out their own cryptocurrency today and they already have a ton of partners who will be accepting it including Visa, Mastercard and PayPal so really that's game over for most other digital currencies. BitCoin is spiking back to $10,000 because people who buy BitCoin don't understand the difference but Libra has a chance of becoming the real thing and Governments should be worried about that too.

Beyond E-commerce, especially for people in developing countries that lack a banking infrastructure, Libra could be useful for storing and transferring money, without paying high fees. So, if you want to send money to another country, Libra may be a cheaper way to do it than what’s currently available. That's true of any cryptocurrency but Facebook is already being used by half the people on the planet so Libra will have a huge leg up when it comes to acceptance.

Also, Libra is backed by a reserve fund, which should make it far more stable than BitCoin and Libra doesn't allow just any idiot to build on their platform – which should keep it more secure than other cryptos have been. Most important though, is the reserve: Facebook and its partners are backing Libra with a pool of real world money, promising users that they will always be able to trade the cryptocurrency in for cash. The day-to-day value of Libra, which uses the monetary symbol of three waves, is pegged to the average value of a basket of world currencies, made up of U.S. Dollars, U.K. Pounds, Euros, and Swiss Francs.

The currency won't roll out until 2020 so the other cryptocurrencies will say this legitimizes them and they'll likely spike higher but this is a very different direction Facebook is taking and I don't think it will end well for the old-school cryptos. Imagine though, if FB rewards all 3Bn of their users with a little Libra next year. They will instantly become the 2nd most widely used currency in the World – behind the US Dollar.