WBA came through for us but a long way to go:

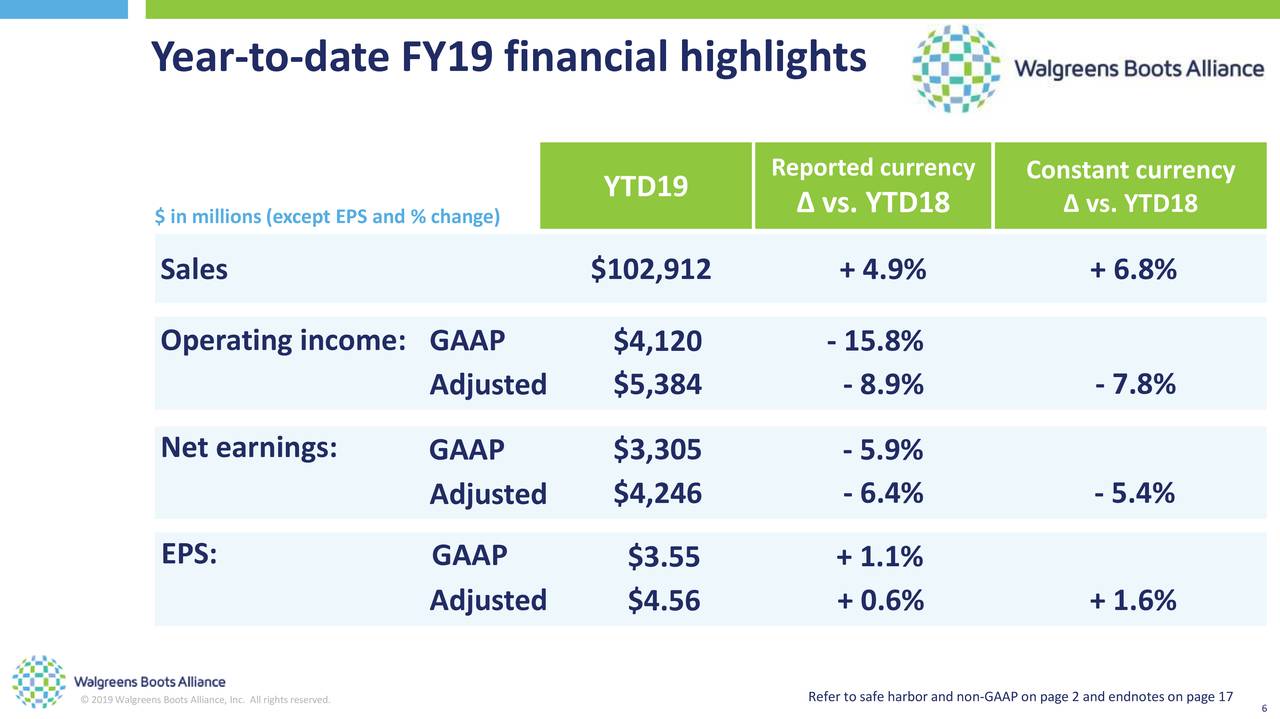

That guidance is around $5.99/ $55 share this year and $6 next year. $55 is $50Bn market cap and, SO FAR this year (this is Q3 for them), they made about $4Bn so well on track for $5.3Bn.

As a new trade on them (we already have them in the OOP and LTP), I'd do the following:

- Sell 5 WBA 2021 $55 puts for $8 ($4,000)

- Buy 10 WBA 2021 $50 calls for $9.40 ($9,400)

- Sell 10 WBA 2021 $65 calls for $3.40 ($3,400)

That nets you into the $15,000 spread that's $5,000 in the money for $2,000 so the upside potential is $13,000 (650%) at $65. TOS says the ordinary margin required $5,476 - so it's a pretty efficient way to make $13,000!