Morgan Stanley says we're in a Recession already.

Morgan Stanley says we're in a Recession already.

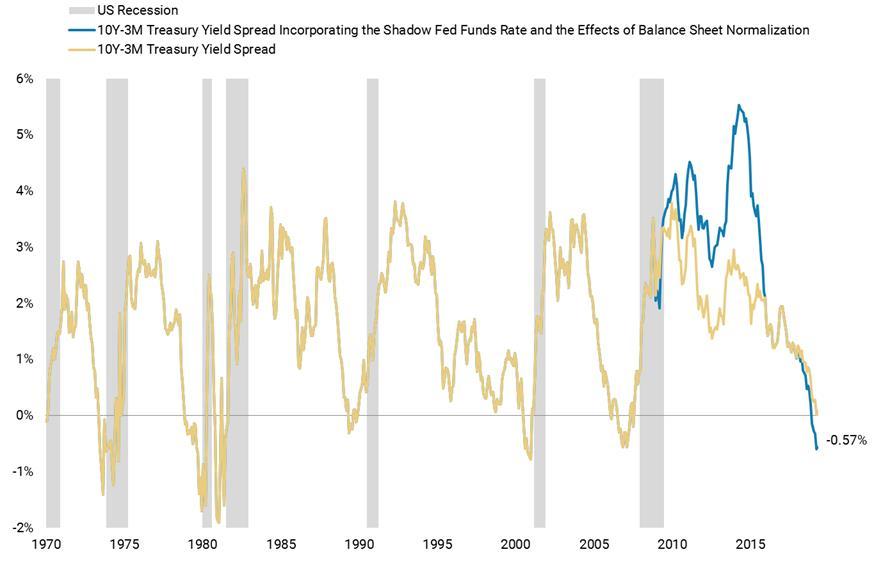

As you can see from this chart, the Treasury Yields are flashing signs we usually don't see until we are already deeply in a Recession only this time we're ignoring those signs, as well as dozens of other Economic Indicators that are screaming recession – to those who are willing to listen. According to MS, "decelerations and disasppointments are mounting":

- Cass Freight Index

- Retailer earnings

- Durable goods orders

- Capital spending

- PMIs

- May payrolls

- Semiconductor inventories

- Oil demand

- Restaurant performance indices…

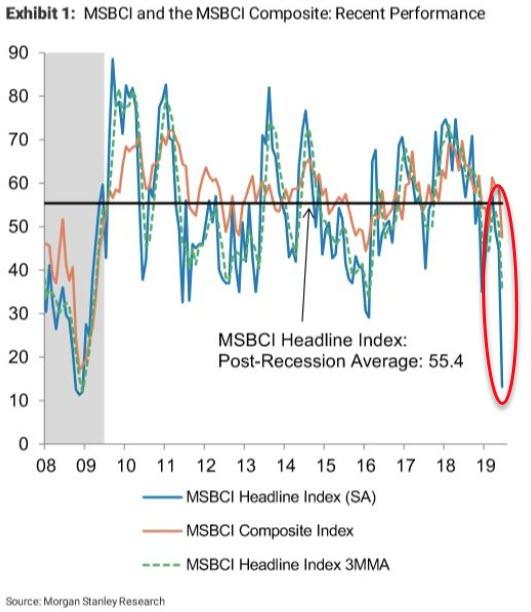

and our own Morgan Stanley Business Conditions Index (MSBCI). Looking at the MSBCI in particular, the headline metric showed the biggest one-month drop in its history going back to 2002 and very close to its lowest absolute reading since December 2008.

This index has a tight relationship with ISM new orders and analyst earnings revisions breadth. Our analysis shows downside risk to ISM new orders (25% y/y), S&P earnings revisions breadth (6-13%) and the S&P 500 y/y (8%) if historical links hold.

MS sees no more than 1% growth for the S&P over the next 12 months and sees no better in Europe or Japan and, like PSW (only later), they are essentially calling for their clients to get much more "Cashy and Cautious" in their portfolios in what is very likely to be the top of the market for quite some time. As they note in their report: "Our concern is that the positives of easier policy will be offset by the negatives of weaker growth: We think a repeated lesson for stocks over the last 30 years has been that when easier policy collides with weaker growth, the latter usually matters more for returns. Easing has worked best when accompanied by improving data."

MS sees no more than 1% growth for the S&P over the next 12 months and sees no better in Europe or Japan and, like PSW (only later), they are essentially calling for their clients to get much more "Cashy and Cautious" in their portfolios in what is very likely to be the top of the market for quite some time. As they note in their report: "Our concern is that the positives of easier policy will be offset by the negatives of weaker growth: We think a repeated lesson for stocks over the last 30 years has been that when easier policy collides with weaker growth, the latter usually matters more for returns. Easing has worked best when accompanied by improving data."

MS cites changes since April (the Q2 outlook) as being:

- A US-China trade deal that was widely expected to be resolved led instead to a new round of tariffs.

- Global PMIs have continued to fall.

- And Morgan Stanley’s Business Conditions Index, a survey of how our equity analysts feel about their companies, suffered its largest one-month decline ever in June. We believe all this signals risk to equities.

Liquidity has dropped off since July – something we've been warning about at PSW and, if you don't sell like selling your stocks when they are expensive and liquid – you REALLY won't like trying to sell them when they are getting less expensive and more illiquid – trust me! While many people still have faith that the Fed will bail them out, both MS and PSW believe that story has about run its course and nothing will be safer than CASH!!! in the next downturn.

Liquidity has dropped off since July – something we've been warning about at PSW and, if you don't sell like selling your stocks when they are expensive and liquid – you REALLY won't like trying to sell them when they are getting less expensive and more illiquid – trust me! While many people still have faith that the Fed will bail them out, both MS and PSW believe that story has about run its course and nothing will be safer than CASH!!! in the next downturn.

Meanwhile, we're a week away from the beginning of Q2 earnings (officially) and, while earnings growth is projected to LOOK like 2.6% over last year, if you take away the effect of stock buybacks – that growth reduces to 0%. Take away Trump's tax breaks and earnings begin to trend negative so all of our economy's "success" is based on how long the Government can continue to run Trillion Dollar Deficits to support Corporate America and how long the Fed can keep giving away money to Corporate America so they can spend it to buy back 2.6% of their own stock every year.

We do have some earnings this week but nothing too exciting and, data-wise, Powell is speaking to Congress tomorrow and Wednesday and the Fed is releasing the Minutes of their recent meeting on Weds at 2pm and Bullard will be spinning those with some comments. There are 11 Fed speeches scheduled this week, including Powell going 3 times, so that will be interesting along with Consumer Credit at 3pm this afternoon, Small Business Optimism 6am tomorrow, the Atlanta Fed Report on Wednesday along with a policy decsion from the Bank of Canada, which should be a hold at 1.75%. Thursday is CPI and EIA and also the ECB will release their minutes and Friday gives us PP:

From a technical standpoint, it will be 3,000 or bust on the S&P 500 (/ES), 27,000 or bust on the Dow (/YM), 7,850 or bust on the Nasdaq (/NQ) and 1,600 or bust on the Russell (/RTY) and, of course, we're expecting bust and already holding a lot of aggressive shorts in our Member Portfolios (see our weekend review).

Be careful out there,

– Phil