TODAY is the day!

TODAY is the day!

I blame Econoday, which had Powell speaking yesterday on Monday's Economic Calendar but it turned out he is speaking today and tomorrow to Congress so the market just drifted along for the most part – continuing the boring trend for the month as we attempt to get over the 3,000 line on the S&P 500 (/ES).

We did the math for the 5% Rule™ in yesterday's Live Member Chat Room and decided that 2,976 would be the inflection point and we closed a bit over the line yesterday but we're right back on the line this morning.

Powell's testimony begins at 10am and goes on for a couple of hours but his official statement being released at 8:30 so we'll see a quick reaction (not necessarily the right one) ahead of the bell. Oil and Gasoline are up 2% off a strong API Report and the EIA Report confirms or denies those numbers at 10:30 – so that's another market-mover to watch this morning AND we have the Atlanta Fed's Business Expectations Report, also at 10 am and, just in case Powell doesn't get us over 3,000, Bullard has a speech lined up at 1:30 – just ahead of the Fed minutes.

8:30 update: So much for waiting for Powell as his statement has popped the Dow 100 points already and here are the key points from his statement:

- Since June, uncertainty continues to weigh on the outlook

- Inflation pressures remain muted

- Uncertainty over trade, global growth

- Business investment slowed ‘notably’

- Brexit, debt ceiling are unresolved

- ‘Crosscurrents have reemerged’

- Fed will ‘act as appropriate’ to sustain expansion

- Baseline is still solid economic growth

- Economy performing ‘reasonably well’

- Inflation to move back over time to 2% objective

Traders are keying off "Fed will act as appropriate to sustain expansion" which indicates they are 100% behind this rally but it's a bit of cherry-picking as Powell is also saying we are on track to hit the inflation target (so easing makes no sense) and the "worries" he has for the economy are still Trade and Brexit (and their effect on Global Growth), which are the same self-inflicted wounds we had in December, when the Fed did raise rates – so what's going to happen if we resolve them?

Traders are keying off "Fed will act as appropriate to sustain expansion" which indicates they are 100% behind this rally but it's a bit of cherry-picking as Powell is also saying we are on track to hit the inflation target (so easing makes no sense) and the "worries" he has for the economy are still Trade and Brexit (and their effect on Global Growth), which are the same self-inflicted wounds we had in December, when the Fed did raise rates – so what's going to happen if we resolve them?

The baseline is still "solid economic growth" and the Fed doesn't want the US economy growing at 4-5%, 2-3% is what they prefer – this is not the environment for monetary easing by any stretch. At the moment, we're hitting Dow 26,825, S&P 2,990, Nasdaq 7,885 and Russell 1,570 – none of them are very good shorting lines but all are tempting….

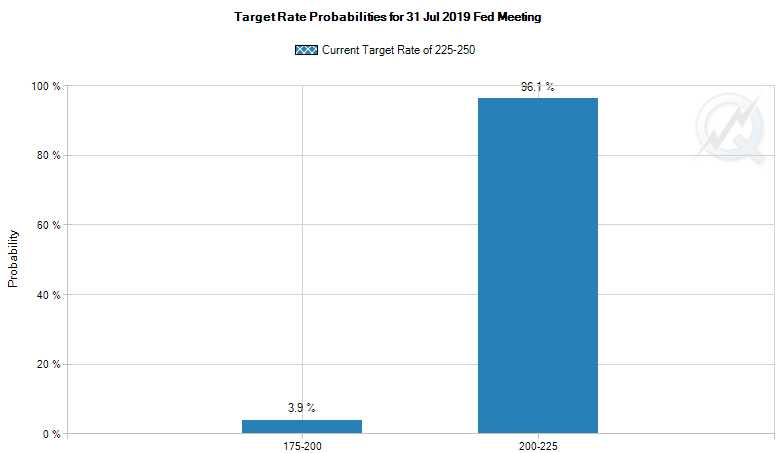

With 100% of traders expecting a rate cut in three weeks (it's just a matter of how much), the chance of disappointing them far outweighs the chance of meeting their expectations and that is how we get sell-offs. But 3 weeks is a long way away so we're not going to worry about it yet. What's really happening this morning is Powell's comments tanked the Dollar buy 0.33% and the indexes rose 0.33% to compensate – that's not a rally – it's a math problem!

So our shorting lines will be 26,900, 3,000, 7,900 and 1,580 and if 2 cross below we look to short the laggards with very tight stops if ANY of them go over the lines again.

Other than that, we're just watching and waiting to see what sticks after Powell testifies and we still have the Fed's Minutes at 2pm and we'll be doing our Live Trading Webinar at 1pm, EST – where we'll try to figure out which way things are heading once the dust settles.