mikezuela (basic)

July 25th, 2019 at 11:43 am | Permalink"The bill [passed by the House] would create a Pension Rehabilitation Administration within the Department of Treasury to provide long-term loans to multiemployer pension plans facing insolvency. The Treasury would sell bonds and lend the money to pension plans at a low interest rate. The plans would pay the loans back over the course of 30 years.

They'll be able to invest the money and be able to grow the fund to the point where they can gradually become solvent — at which time they will be paying the loan back. This will allow the businesses to survive, it will allow the workers to receive their pensions"

To me this says the Fed will have no choice but to prop up asset prices for decades to come, must mean buy buy buy

DOOM/Mike - Yeah, another crazy scheme to sweep things under the rug. Should put GE stock through the roof though as pension obligations are a lot of what's keeping it down. They made $2.5Bn last Q and you can buy the whole company for $91Bn at $10.44.

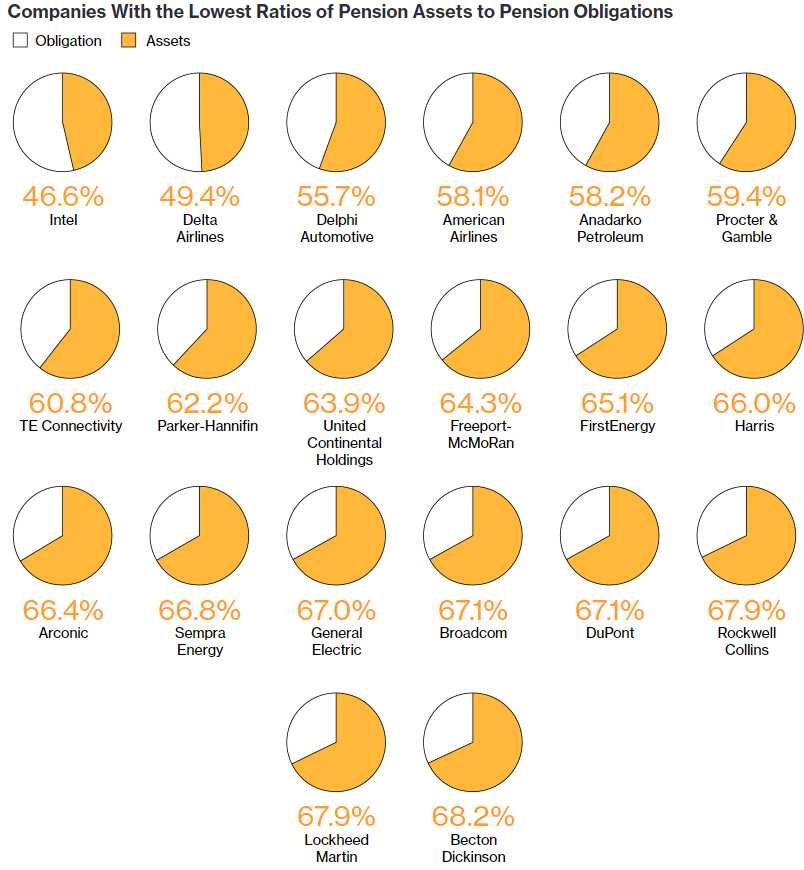

If it passes, we should take a good look at companies that have deficit pension plans.

So, if that bill gets approved, we should make some moves on some of these companies.

F/Ati, Robert - As a new trade on F, I think I would just sell the 2021 $10 puts for $1.65 as that's more than the 0.60 annual dividend and your net entry is $8.35 in 18 months - a $1.20 discount to the current price. If F drops lower in between, then you can establish a long position or just sell more puts and if F goes up, you got a good price for the puts and you can sell the 2021 $10 calls, now 0.87 for $1+ and, as long as you buy F for less than $10, you are in for net $7.35 with a call away at $11 for a 49% profit in 18 months + dividends.