Don't be fooled.

Don't be fooled.

Yesterday, at 3:25 pm, in our Live Member Chat Room, I said we are very likely on the way to 2,700 on the S&P but, before that happens, we were very likely to get at least a weak bounce:

I think we'll have to wait for 2,700 on /ES. If 2,850 is halfway down from 3,000 (5%) then we're looking for 30-point weak bounce to 2,880 and strong would be 2,910 but that's not likely if we we're heading lower so look for a failure at 2,880 and then follow-through below 2,850 over the next few days.

As you can see on the chart, we ended up just under 2,850 at 2,844 and this morning the S&P has bounced to 2,856 after falling to 2,775 overnight. That movement doesn't matter, what matters is how we trade once the volume picks up and our 5% Rule™ tells us that we should expect a 20% retrace of the 150-point drop from 3,000, so that's 30 points (green weak bounce at 2,780) and, if that fails, then it's very likely we are on the way to 2,700, which becomes a 300-point drop and then the bounces we expect double to 60-points (red weak bounce at 2,760).

This morning, the talking heads on the MSM are saying we are bouncing because China didn't devalue the Yuan as much as feared but that's not the real reason we were dropping, that was the White House spin on why we were dropping to deflect the blame away from the President and his idiotic tariffs and yesterday, the US branded China a Currency Manipulator – further escalating trade tensions and making it less likely we'll be coming to an agreement – there's nothing bullish about that.

In addition to the currency move, Beijing said that Chinese companies had suspended purchases of U.S. agricultural products, and that the government has not ruled out putting tariffs on U.S. farm goods purchased after Aug. 3rd. China’s Central Bank said Monday’s depreciation was “due to the effects of unilateralist and trade-protectionist measures and the expectations for tariffs against China.” People’s Bank of China Governor, Yi Gang, said that China won’t engage in competitive devaluation and that the decline was due to market forces.

In addition to the currency move, Beijing said that Chinese companies had suspended purchases of U.S. agricultural products, and that the government has not ruled out putting tariffs on U.S. farm goods purchased after Aug. 3rd. China’s Central Bank said Monday’s depreciation was “due to the effects of unilateralist and trade-protectionist measures and the expectations for tariffs against China.” People’s Bank of China Governor, Yi Gang, said that China won’t engage in competitive devaluation and that the decline was due to market forces.

“The announcements from Beijing represent a direct shot at the White House and seem designed for maximum political impact,” said Chris Krueger, strategist at Cowen Washington Research Group. “We expect a quick—and possibly intemperate—response from the White House, and consequently expect a more rapid escalation of trade tensions.”

Trump has long complained that China keeps the yuan’s value artificially low to make its goods cheaper on global markets. Traders contend that the Chinese government is merely allowing the currency to respond to market conditions as the trade war fuels concern about the global economy. “Other emerging markets are also tanking,” said Win Thin, global head of currency strategy at Brown Brothers Harriman. “If China is going to allow market forces to determine the exchange rate, this is what will happen with the Yuan.”

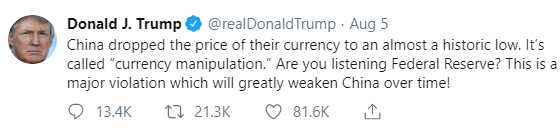

The President, of course, was tweeting about this and a dozen other disturbing things (like "Google is against Trump" and "Why did no one blame Obama for inciting right-wing radicals to commit mass murders when he was President") including this call for the Federal Reserve to act against China's currency move – even though the Dollar went up 2% in the past month and the Yuan only went down 1.9% to reflect the Dollar's move.

The President, of course, was tweeting about this and a dozen other disturbing things (like "Google is against Trump" and "Why did no one blame Obama for inciting right-wing radicals to commit mass murders when he was President") including this call for the Federal Reserve to act against China's currency move – even though the Dollar went up 2% in the past month and the Yuan only went down 1.9% to reflect the Dollar's move.

The Federal Reserve, on their part, made the very unusual move of rebuking the President this morning all 4 living Chairmen: Paul Volcker, Alan Greenspan, Ben Bernanke and Janet Yellen wrote in an op-ed published by the Wall Street Journal that the US central bank must be able to make decisions "based on the best interests of the nation, not the interests of a small group of politicians."

The Federal Reserve, on their part, made the very unusual move of rebuking the President this morning all 4 living Chairmen: Paul Volcker, Alan Greenspan, Ben Bernanke and Janet Yellen wrote in an op-ed published by the Wall Street Journal that the US central bank must be able to make decisions "based on the best interests of the nation, not the interests of a small group of politicians."

"Even the perception that monetary-policy decisions are politically motivated, or influenced by threats that policy makers won't be able to serve out their terms of office, can undermine public confidence that the central bank is acting in the best interest of the economy," they said. "That can lead to unstable financial markets and worse economic outcomes."

On the whole, nothing has really changed since yesterday. You can spin things as you wish but the trade war has deepened and lenghened and, so far, we've had only a very minor correction in response to this very major issue. Most likely, we'll have our weak bounce to 2,870 and, failing that, will begin marching back down until we settle at 2,700. We'd have to cross over the strong bounce line at 2,910 before we'd even consider lightening up on our hedges – which have, so far, saved our portfolios from most of the damage done by this dip.

Be careful out there.