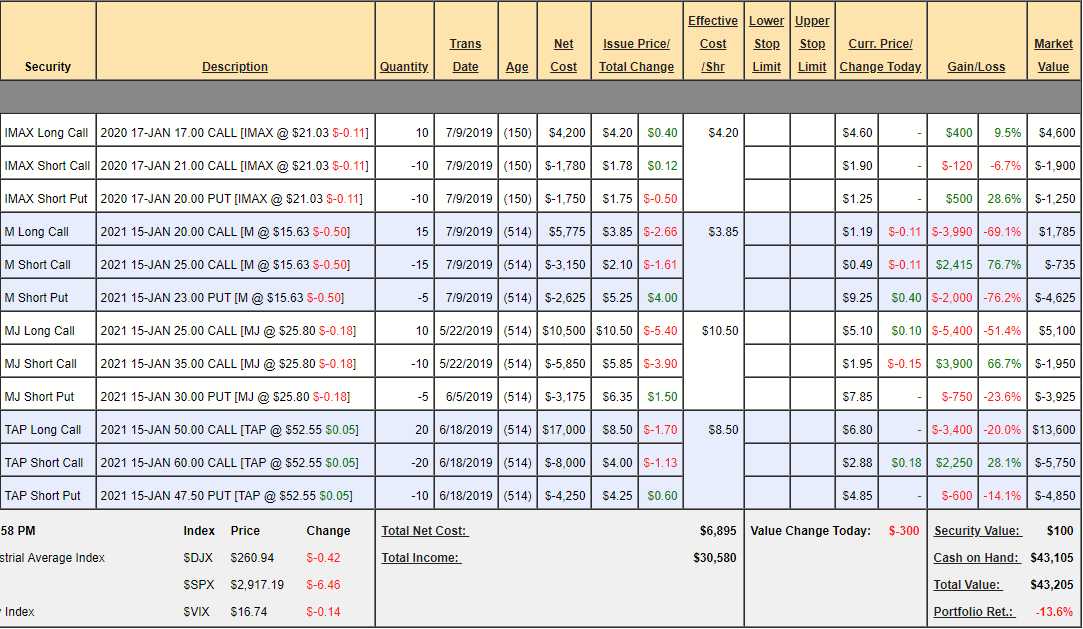

Hemp Boca Portfolio Review: $43,205 is down $6,795 (13.6%) since we started so not off to a good start but that's why we scale into positions. The market sell-off has given us some good opportunities to add to our current positions as well as pick up new ones but we don't want to deploy too much cash until we see the positions we have begin to stabilize.

- IMAX – We're about even on this one and $21 is our goal so, if all goes well, this trade will pay us $4,000 but the current net is only $1,450 so $2,550 (175%) left to gain if IMAX can hold $21 through Jan 17th – not bad!

- M – Macy's fell very much out of favor along with the rest of the retail sector but we like them as a real estate play. I'm still happy with the $23 target – even though it now seems far away but we do have 16 months to get there. For the moment, let's roll the 15 2021 $20 calls at $1.15 ($1,725) to the $15 calls at $2.65 ($3,975) so we're spending net $2,250 to roll $7,500 lower in strike. Let's also buy back the 15 short 2021 $25 calls for 0.50 ($750) as they can only pay us about 0.04/month so we're better off waiting for a bounce to sell something else.

- MJ – The marijuana ETF took a big hit as earnings from some of the big cannabis companies did not live up to unrealistic expections. We should take this opportunity to buy back the 10 short 2021 $35 calls at $1.95 ($1,950) as they are already up 2/3 and, like M, we'll wait for a move higher to sell calls again.

- TAP – They had disappointing earnings but we're in this for the long haul but it's a big position already and would be expensive to roll ($5,000) so it's not a luxury we can afford at the moment and we'll simply wait for it to improve.