"Woah, we're half way there

Woah, livin' on a prayer

Take my hand, we'll make it I swear

Woah, livin' on a prayer" – Bon Jovi

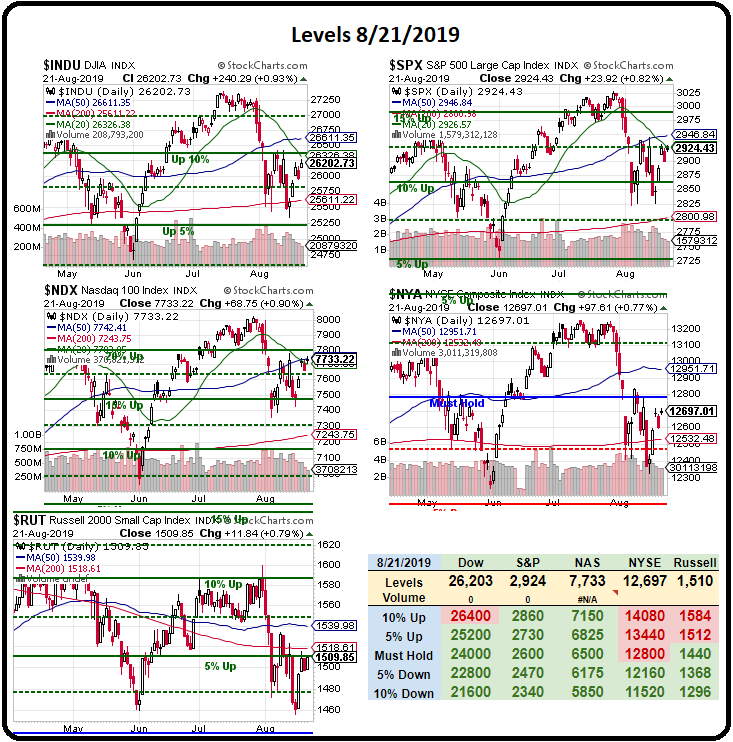

It's too early to tell if we'll have to be playing "Stuck in the Middle With You" into the weekend but we're certainly right in the center of the 50 and 200-day moving averages and exactly halfway back from our recent dip from 3,025 to 2,825 at 2,925 so all we can do is sit back and see what happens tomorrow as Jerry Powell speaks to us from Jackson Hole at 10 am.

The volume has been anemic this week so there are simply no tea leaves to read but, as you can see from the S&P 500 chart, we've fallen comfortably below the 200-day moving average and it is going to take more than lip service to jack the indexes back over the line though it is encouraging to see the 50-day moving average curving up slightly – indicating we could have a sustainable rally if we can keep things together for the rest of the month.

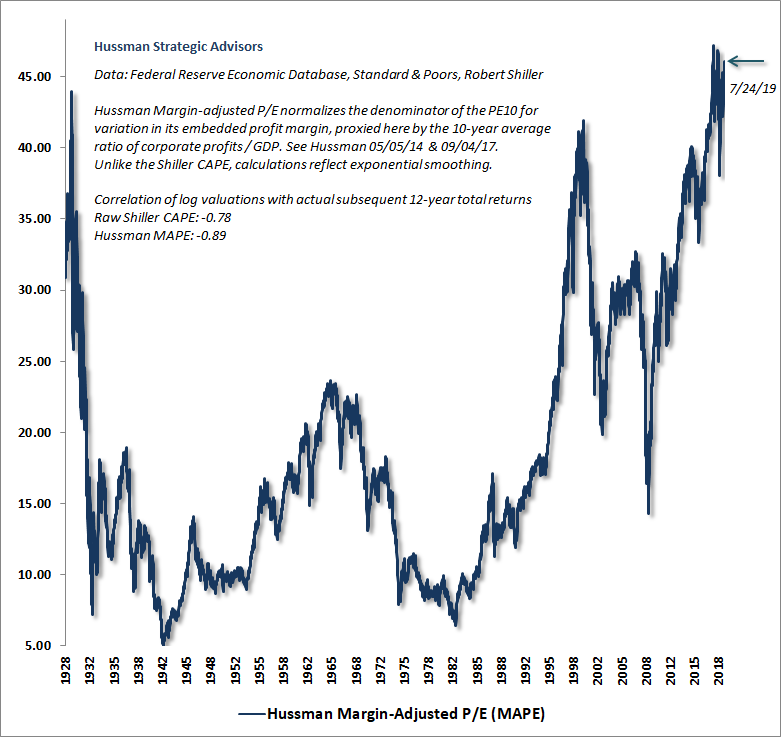

It's all about Jackson Hole on Friday though all we're really going to get there is more Fed spin and, as I noted in yesterday's Live Trading Webinar, I'm getting more and more inclined to cash out our portfolios while we can as we're finding less and less things to buy and, as value investors – that's a pretty good sign the market is putting in a top – something John Hussman agrees with us on in his August letter.

It's all about Jackson Hole on Friday though all we're really going to get there is more Fed spin and, as I noted in yesterday's Live Trading Webinar, I'm getting more and more inclined to cash out our portfolios while we can as we're finding less and less things to buy and, as value investors – that's a pretty good sign the market is putting in a top – something John Hussman agrees with us on in his August letter.

As you can see from Hussman's P/E chart, we've now passed the madness of 1999 and miles above where we crashed in 2008 and he has a dozen other charts and graphs to illustrate the point but my point, which I emphatically made yesterday, is that it simply isn't worth the risk to stay fully invested in a market where you've already made a great deal of money and are simply trading out of GREED.

Our Long-Term Portfolio, for example, lost and gained back over 20% in the past few weeks and of course we hope it will keep going higher but we're getting to the point where we're worried about a 40% drop in our positions (we have leveraged option positions) from which the market doesn't bounce back and then a large amount of our gains (171.5%) of the past two years will be erased and it could take us a few years just to get back to where we are now. How is that risk worth it?

Of course we don't usually average 100% per year in gains. We had a spectacular two years and we timed the December dip and recovery perfectly, which led to a spectacular 2019 (so far) but it's getting harder and harder to lock in those outsized gains through hedging as the hedges are insurance and the insurance is getting more and more expensive to maintain – eating into our profits so, if the profits begin to slow down, then we begin to chew up our gains because we're simply insuring too large of a portfolio to be appropriate in a declining market.

That's why it's sometimes best to just wipe the slate and start again – a call I'm very, very close to making.

We do have some potential positives, mostly it would be rate cuts by the Fed – although they would be a mistake and a long-term negative, in the short run it's a rally we don't want to miss. Then there's China. It's possible we do finally get a trade deal and that would boost the market considerably, maybe 10% but still – If all we can do is rise 300 points to S&P 3,300 but we're worried about falling to 2,700 or lower – then really we're betting our portfolio on a 50/50 outcome and that's just not worth risking our gains over, is it?