A Behavioral Prescription

Courtesy of Michael Batnick

There have been 17 separate 5% pullbacks since stocks bottomed in 2009. Each one of them felt like the top.

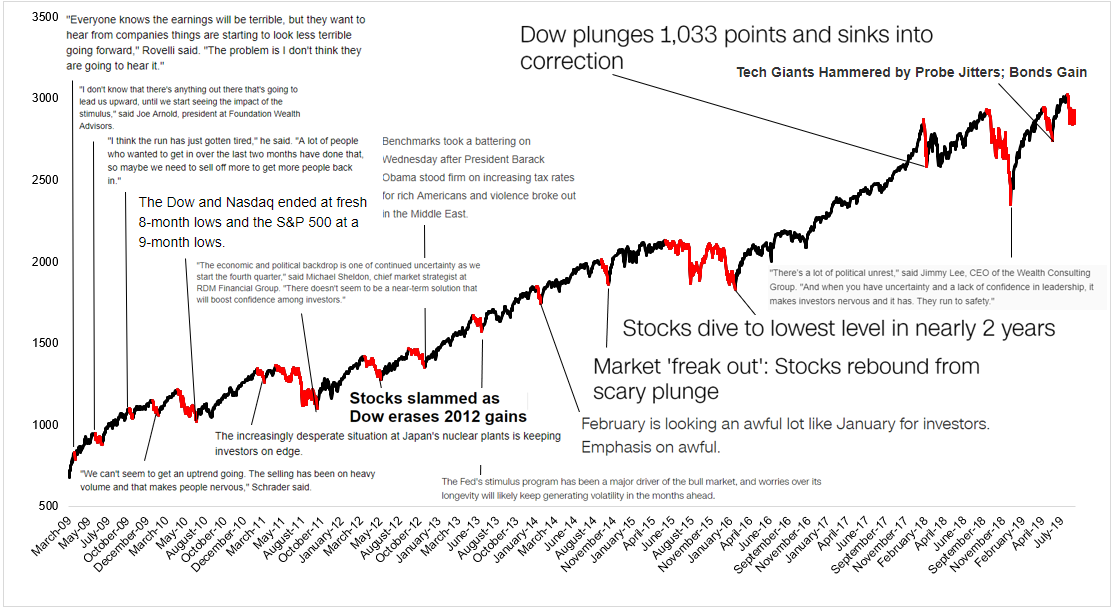

Okay, this is just a bit hyperbolic, but for people who don’t work in the financial services industry, the chart below shows some of the headlines and quotes they might have read when they opened their computer during market declines. Note that each of these 17 items were pulled from the day of the bottom. (Click to enlarge)

It’s hard to see headlines like this and not act on them. We know now that our worst fears did not come to pass, but there was no way to know at the time that each and every one of these pullbacks would resolve themselves to the upside.

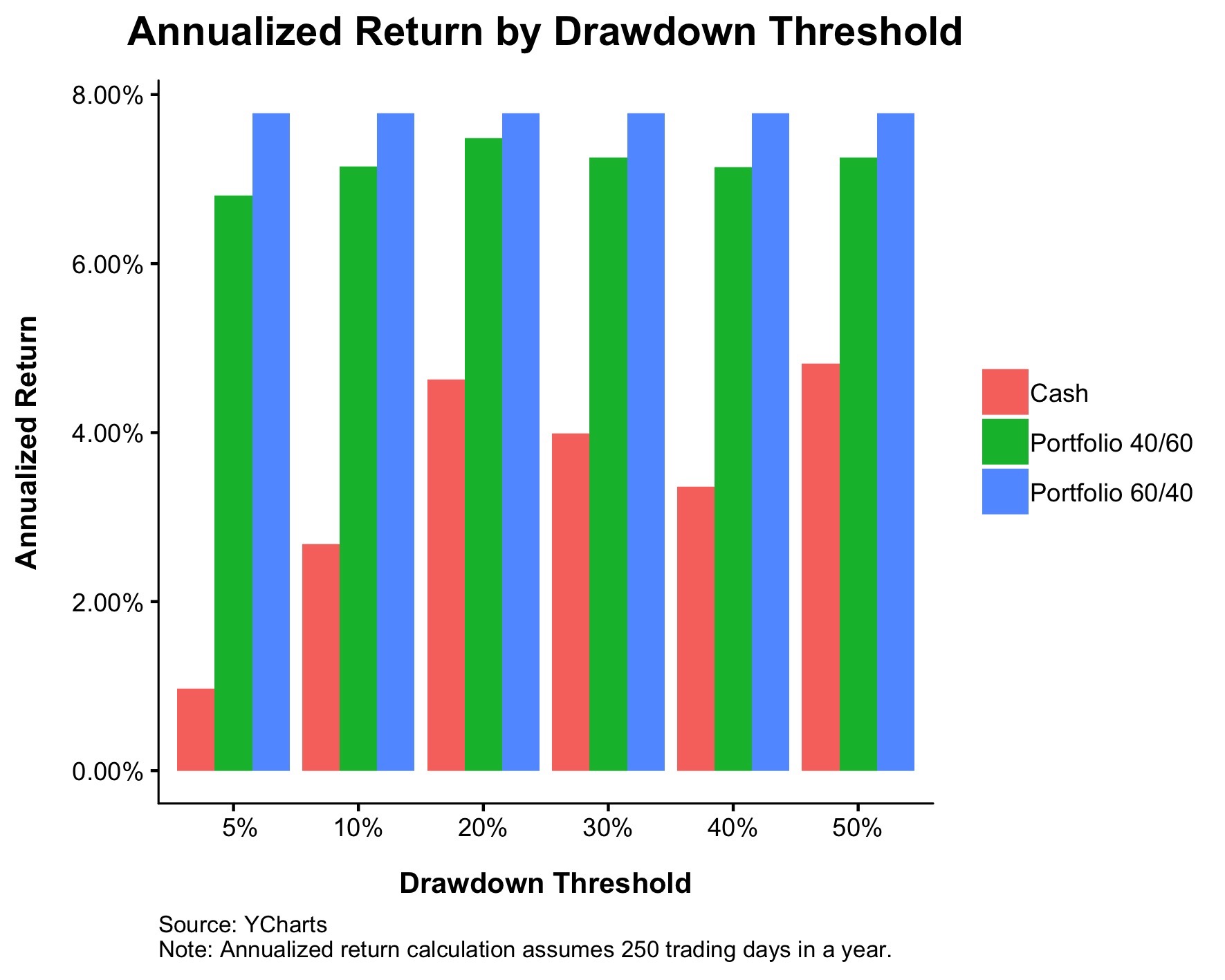

One of the worst things that investors can do is overreact to market volatility. It’s perfectly normal to feel something, but adopting an all in or all out* mentality when the market goes up and down is destined to fail. What if, instead of going to cash every time the market pulls back, you simply get a little more defensive. Sure it will cost you money, but it will keep you in the game. The chart below shows 3 lines, via the data god

- A 60/40 portfolio (blue)

- A 60/40 portfolio that flips to 40/60 every time the S&P 500 has an x% pullback, and flips back to 60/40 when the S&P 500 makes a new all-time high (green)

- A 60/40 portfolio that goes to cash every time the S&P 500 has an x% decline and moves back to 60/40 when the S&P 500 makes a new all-time high

Going from 60/40 to 40/60 when you get anxious is approximately a million times smarter than running to cash and waiting for the dust to settle. You can see this in the numbers below.

Going to cash every time stocks fall isn’t just expensive, it’s mentally crippling. You start hoping the market confirms your views and goes a lot lower. And god forbid you’re right, getting back into the market at lower prices becomes a waiting game that’s impossible to win. You end up acting like this corgi.

Dan Egan gave a killer presentation at Wealth/Stack. One of the themes of his talk was that it’s really hard to change people. We can read all the Kahneman we want, and have all the available data at our fingerprints, but at the end of the day, fear and greed is a stronger motivator than logic and rational thinking. Therefore, investors need to be protected from themselves.

One of the shortcomings of behavioral finance is that it diagnoses an illness without prescribing a medication. Dan has done something about this. He came up with a clever way of nudging investors to make better decisions. When Betterment clients go to change their allocation, they get an alert that shows the tax ramifications of that decision. This has decreased the number of allocation changes by about 80%. Eighty percent!

Backtests assume robot-like behavior, but in the real world, people act like people. Sharing a few Munger quotes and a few data points aren’t enough to short circuit fear and greed. You can’t change people, you have to front run predictably bad behavior. It’s great that the industry has people like Dan not just paying lip service to behavioral counseling, but actually making a difference.

*I forgot I wrote this post in January. Sue me.