OK, so let's see if I can actually bring myself to shut down the portfolios. We'll start with the Hemp Boca Portfolio as it's small and I should go on the show this afternoon (haven't decided yet).

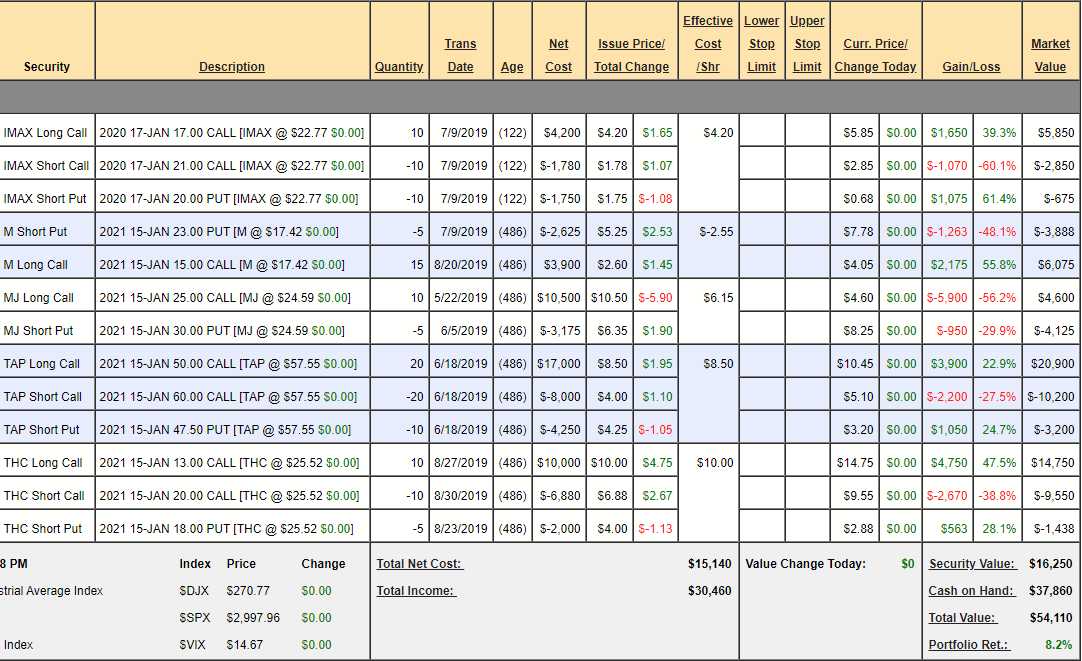

Hemp Boca Portfolio Review: This portfolio is not as constrained as Money Talk as there's a show every Tuesday and I can go on when I want (PSW Investments owns 20% of Hemp Boca). We started back on May 21st so it's 4 months old and we're up 8.2% but we were down about 20% at one point (same positions) so I'm not sure I want to risk Q4 in such a small and new portfolio.

The question is, as it will be with EVERY position in EVERY portfolio this month – do we, right now, want to be in this position if the market drops 20%?

- IMAX – Worst case is owning IMAX for $20 and I'm generally fine with that but you have to keep in mind it's a $50,000 portfolio with $100,000 in ordinary buying power (we're assuming not IB as those guys are crazy!). It's a conservative position that's in the money and we should have good support at $21 and $20.50 held on the last dip so hard to kill – especially as I expect Q4 to be huge box office for IMAX. Max possible on the spread is $4,000 and now net $2,325 so $1,675 (72%) left to gain by Jan seems like one we should keep. Damn it! This is hard…

- M – We are ahead so we're going to kill it. Not actually ahead, down $900 on the overall position but too risky for the small portfolio in an uncertain market.

- MJ – Back to the lows on this one but I want to stick with them.