I'll be on BNN's (Bloomberg Canada) Money Talk tonight at 7pm.

I'll be on BNN's (Bloomberg Canada) Money Talk tonight at 7pm.

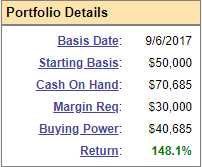

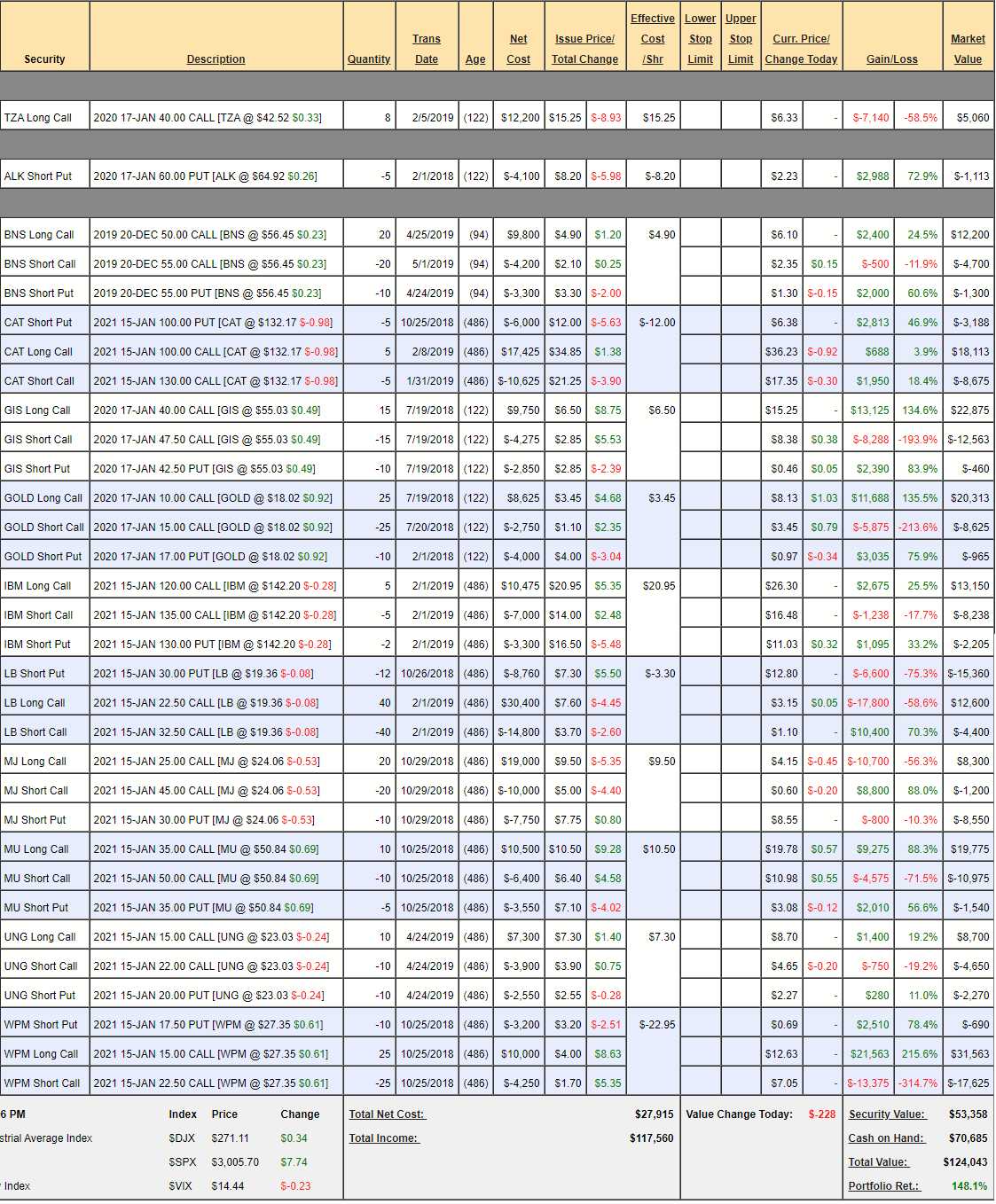

The last time I was on the show was back in on April 24th and we only make changes to the Money Talk Portfolio live on the show so we decided to lock into a neutral position over the summer and that's just where we ended up, dropping to $124,043 from April's $127,663 so down $3,620 for the summer is about as neutral as we can get it and we're still up $74,043 (148%) from our $50,000 start just about 2 years ago on the button.

Since there's a lot of uncertainty going into Q4 and it has been just about 2 years – I think this is a good time to cash out this portfolio and we will begin a new portfolio with a new $50,000 around Thanksgiving – beginning with our still-undecided Stock of the Year.

Our 2019 Stock of the Year is IBM (IBM) and our IBM position is already 100% in the money at net $2,707 out of a potential $7,500 so, if I were going to keep one trade active – that would be the one as all IBM has to do between now and January of 2021 is hold $135 and that spread will make another $4,793 (177%) so we could, for example, put $27,070 of our $124,043 in cash back to work on just the IBM trade and, if all goes well, it will turn into $75,000 – making almost 100% of our original total in just over a year – so why be more complicated than that?

There's still a lot of potential in all these positions, as noted in the April review, the portfolio has the potential to hit over $200,000 by Jan 2020 but, as I noted, if we cash out now at $124,043 and make another $50,000 on the IBM trade – that's $174,000(ish) anyway but we'd have $100,000 in our pockets NOT at risk through the holidays – that is certainly a much wiser way to go – especially in a portfolio we are unable to adjust between shows.

So the decision is final, we're cashing out and endorsing our Stock of the Year, IBM, as a replacement bet to keep some of the cash at work but, on the whole, we'd rather risk missing a bit more of a rally on Fed Easing and a China Deal than risk a drop on Fed Disappointment, ongoing Trade Wars, a Hard Brexit, war in the Middle East and, of course, President Trump's random tweets.

As value investors, we don't fear going to cash because there's always a bargain to be had somewhere in the market. L Brands (LB) is still cheap, the Alternative Harvest ETF (MJ) is still cheap and we just added Teucrium Sugar (CANE) as a Top Trade Alert over at PSW and I would have been adding that here ($6.45) to this portfolio if we weren't shutting it down but it's just an example – we can always find better ways to deploy cash – and we will!

Just some quick notes as we say goodbye to the positions:

- TZA – This was a hedge, we expected to lose the money to protect our longs.

- ALK – Very likely to pay the full 100% but why risk it?

- BNS – Our April pick took off fast and is already a big winner. It's a $10,000 spread that's currently net $6,200 so $3,800 (61%) left to gain if they hold $55 through December. Tempting but not worth the risk.

- CAT – If we make a deal with China, they should fly higher and it's a $15,000 spread currently at net $6,250 so $8,750 (140%) left to gain is very tempting but if there's no trade deal – this could be a disaster so I'd rather take our lovely $5,451 (680%) gains off the table and hopefully we'll have a chance to jump back in next time they take a dive because the CAT always comes back!

- GIS – Nice winner solid company, miles over our target and "only" $2,000(ish) left to gain so an easy cash out here.

- GOLD – Also miles over our target and realizing net $10,723 out of a potential $12,500 but we only have to wait until January to make the last $1,777 so very tempting but – no.

- IBM – As noted above, a keeper!

- LB – This is our 3rd year playing them and disappointing in this round but I still have long-term faith. It's very likely we see LB again in our new portfolio.

- MJ – The cannabis ETF has been hit hard by disappointing performances in their portfolio but, long-term, I think they get higher. 8)

- MU – Right at our target a year ahead of schedule and I love them long-term. This is a $15,000 spread and currently just net $7,260 so more than a double from here is the potential and I would be surprised if they are not over $50 next year so I'd keep this one if you are so inclined.

- UNG – A shame to let this go just when it's picking up. Still only net $1,780 out of a potential $7,000 so miles to gain and the crazy thing is the spread is 100% in the money already – don't you love options? This is another one I'd keep – or even get into from scratch...

- WPM – Another old Trade of the Year and we've played them every year since and the $10,698 (420%) gain from our $2,550 net entry is the reason why. It's an $18,750 spread that's miles in the money at net $13,248 so still $5,502 (41%) left to gain UNLESS WPM DROPS MORE THAN $5 (18%) so I guess I like this on enough to keep as well.

So we are officially shutting down the portfolio but there's 4 trade ideas I still like if you feel like you don't want to be ALL cash going into the holidays. We'd be looking for the Fed not to disappoint and then we'd be looking for real progress on the China deal by the end of October – otherwise I'd be pulling the plug regardless.