CASH!!!

CASH!!!

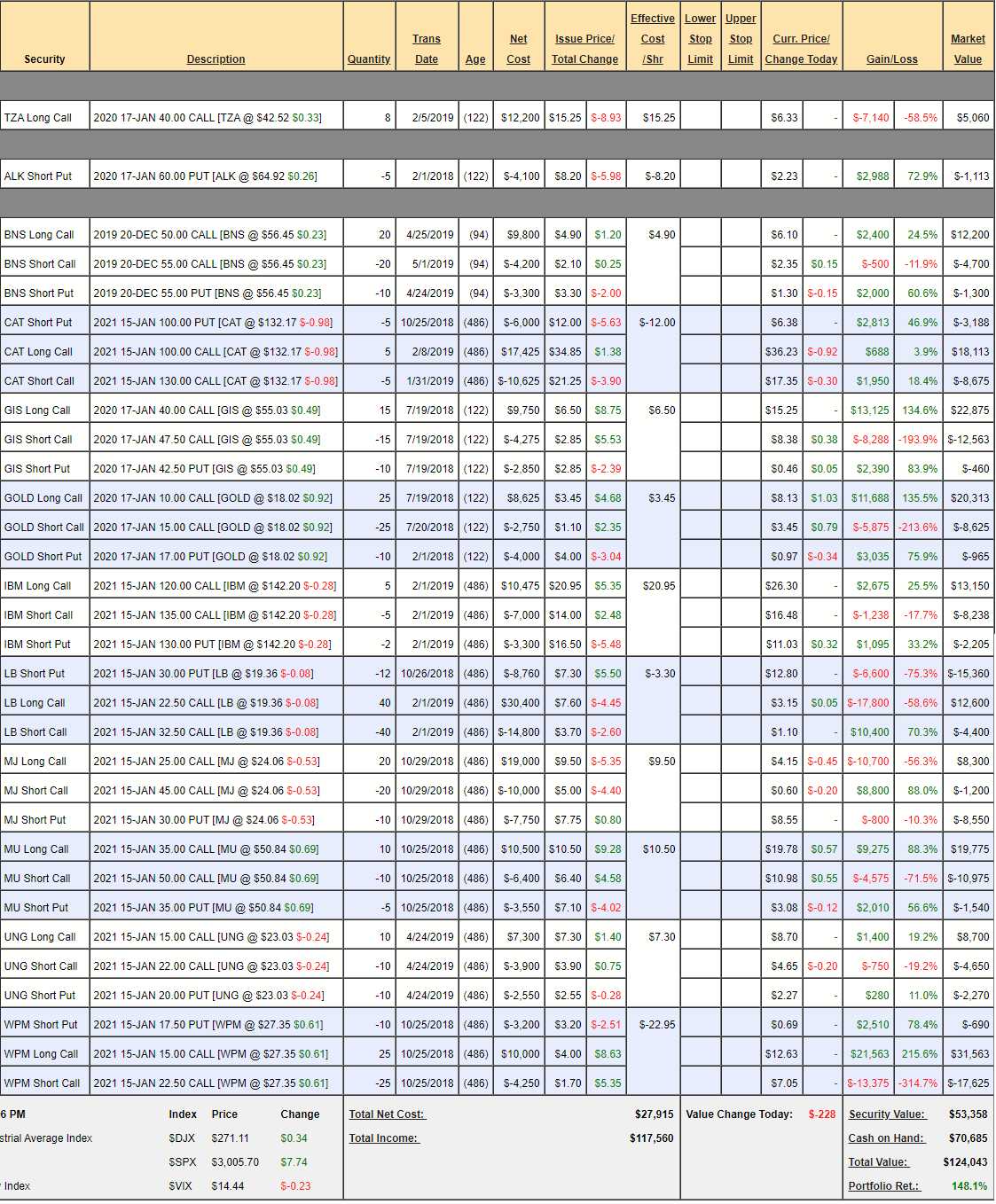

That is our response to market uncertainty and we are officially cashing out our Money Talk Portfolio after a very successful 2-year run where we've taken it from a $50,000 start to $124,043, which is up a whopping 148%. I'll be on BNN's Money Talk Show later this evening to discuss the matter but, in short – it's simply too hard to protect those gains against all the market uncertainty regarding the Fed, Trade, Brexit, the Middle East, Election Interference, Impeachment, Overpriced Stocks & Indexes and, of course, a slowing Global Economy. While the market is, so far, content to "soar and ignore" – I don't think we have more than 10% left in the best of circumstances while the risk is a 20% drop – so I'd rather sit this quarter out.

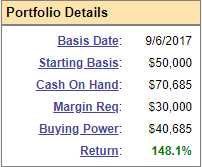

Of course "sitting out" doesn't mean we won't still find things to trade – I just want to get a clean start in 2020 and I don't want to risk what we've made in the last quarter of 2019. We also reviewed our Hemp Boca Portfolio yesterday morning in our Live Member Chat Room and, though it's only 4 months old and only up 8.2% so far, we reduced our risk on that one as well. One difference is I'm on the Hemp Boca show at least once a month to make adjustments but only on Money Talk once a quarter and, between now and January – I really can't condone the risk of holding positions without the ability to make changes!

Our Butterfly Portfolio is market neutral and self-hedging so we simply removed some of the riskier plays but the Options Opportunity Portfolio, which is now up almost 300% in less than two years is going to be completely closed down, as will the Long-Term Portfolio and the Short-Term Portfolio that protects it. As with our Hemp Boca Portfolio, I will be highlighting those trades I think are worthy of keeping but, for the purposes of our educational porfolios – I think there's more to be gained next year starting with a clean slate so we can emphasize portfolio building strategies and stock picking.

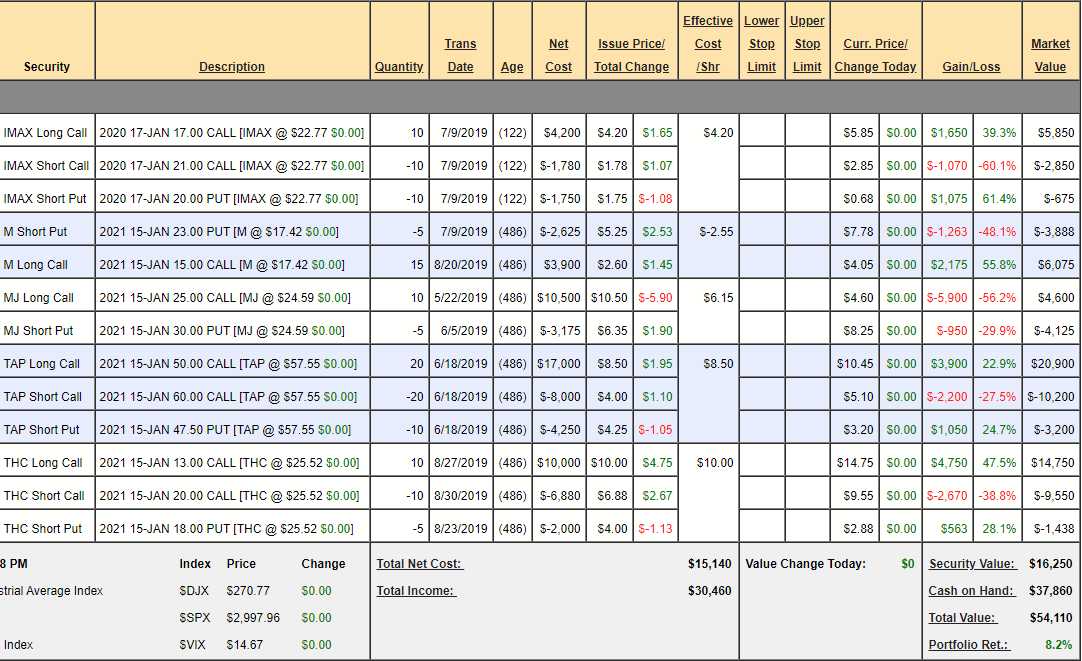

Here's our Hemp Boca Review from yesterday's Live Member Chat Room:

OK, so let's see if I can actually bring myself to shut down the portfolios. We'll start with the Hemp Boca Portfolio as it's small and I should go on the show this afternoon (haven't decided yet).

Hemp Boca Portfolio Review: This portfolio is not as constrained as Money Talk as there's a show every Tuesday and I can go on when I want (PSW Investments owns 20% of Hemp Boca). We started back on May 21st so it's 4 months old and we're up 8.2% but we were down about 20% at one point (same positions) so I'm not sure I want to risk Q4 in such a small and new portfolio.

The question is, as it will be with EVERY position in EVERY portfolio this month – do we, right now, want to be in this position if the market drops 20%?

- IMAX – Worst case is owning IMAX for $20 and I'm generally fine with that but you have to keep in mind it's a $50,000 portfolio with $100,000 in ordinary buying power (we're assuming not IB as those guys are crazy!). It's a conservative position that's in the money and we should have good support at $21 and $20.50 held on the last dip so hard to kill – especially as I expect Q4 to be huge box office for IMAX. Max possible on the spread is $4,000 and now net $2,325 so $1,675 (72%) left to gain by Jan seems like one we should keep. Damn it! This is hard…

- M – We are ahead so we're going to kill it. Not actually ahead, down $900 on the overall position but too risky for the small portfolio in an uncertain market.

- MJ – Back to the lows on this one but I want to stick with them.

- TAP – Had a nice pop and we're on track at net $7,500 out of a potential $20,000 but, if we spend $3,200 to buy back the short puts, we reduce our risk and still have a $20,000 spread – it only increases our net cost from $4,750 to $7,750 but, since that will make us net $10,700 (no more short puts to subtract), then we're in the spread for a very good price without so much downside risk and we still have $9,300 (87%) upside potential.

- THC – We just added these and they blasted higher and we have a 20% cushion to STILL be in the money – what's not to love? The net is now $3,762 out of a potential $7,000 so $3,238 (86%) left to gain – another keeper.

Well, that went terribly. It's very hard to shut down good positions. At least I feel less risky without those high Macy's puts and the big TAP obligation. If all goes well, we have $14,213 of upside potential that we're confident in plus whatever MJ makes and we're up $4,110 already and $18,313 would be 36.6% over 2 years in a $50,000 portfolio we started 4 months ago – that's not a bad start!

Best of all, we are still mainly in CASH!!! so we can DD on any or all of our positions if the market does turn lower.

Note that in the Money Talk Portfolio Review, we also pointed out some "keepers" – especially IBM, which is our 2019 Trade of the Year and that trade idea, as it stands now, is only net $2,707 on 5 contracts and, although that's already up $2,532 (1,446%) from our $175 entry on 2/1, it is a $7,500 spread and still stands to gain another $4,793 (177%) – so it's still good for a new trade and IBM only has to hold $135 into Jan of 2021 to make that money and, as our Trade of the Year – we certainly have the confidence it can ride out a little dip along the way. Still my favorite trade at the moment!

One thing I'd like to emphasize here is how well a portfolio can grow if you are CONSISTENT in your profit-making strategies. Warren Buffett says he only has one rule of investing and that is: "Don't Lose Money" because losing money costs you something more valuable than money – it costs you TIME! If your portfolio stragegy makes you 20% in a good year and loses 10% in a bad one, then your growth can be 100, 120, 144, 129, 155, 140… While a strategy that makes "just" 10% EVERY year yields 100, 110, 121, 133, 146, 161 – even if you win 3 out of 5 times (60%) in the 20/10 strategy, you still get your ass kicked by a consistent 10% gainer.

That's why, although the Hemp Boca Portfolio may seem dull with an 8% gain in 4 months, it's on track to go from $50,000 to $80,000 in 24 months if we consistently make 2% a month but, in reality, as our portfolios begin to gain traction, we are able to take a few more risks to accelerate that growth even further but really, even the MTP's 148% is "only" a consistent 4% monthly gain and that is not hard using our "Be the House – NOT the Gambler" system – we just demonstrated that with last month's PSW Report on "5 Trade Ideas to Make $25,000 in 5 Months" where we are using just $6,565 in cash and $26,659 in margin to make $33,603 (511%) by Jan 17th, 2020 – if all goes well and, so far, it is.

CONSISTENCY is why we are happy to give up some of our gains in order to hedge our portfolio and, at this point in their cycel, the gains in our portfolios and the size of the positions have led us to conclude that CASH!!! is the best hedge at the moment. Other than changes in the Dollar – we can't lose with CASH!!! and we ALWAYS are able to find things to buy – just take a look at 5 years of our Top Trade Alerts – we average between 70% and 80% success rates on those!

At S&P 3,000, a lot of good news is already anticipated by the market and PERHAPS an actual trade deal with China coupled with an easy Fed can take us another 10% higher but then I'd be selling anyway and the trick of the markets – especially the options market – is that you get much better prices selling during a rally than you do in a downturn, especially if you are forced to sell in a hurry. So it makes sense for us to take this opportunity, as we revisit the market highs for the 5th time in two years (2,872 in Jan 2018) to take the opportunity to cash out and start some new portfolios from scratch for 2020.

We'll see what the Fed does this afternoon and, more importantly, what Powell has to say at 2:30 but, if you remember last time (July 31st), the Fed gave us a 0.25% rate cut and Powell could not have been more doveish in his statements but then the President threw a temper tantrum and the S&P fell from 3,020 (higher than it is now) to 2,850 (down 5%). We're just cashing out ahead of the madness – up or down, it's going to be a hell of a ride!