NLY is paying out $1 at $8.89 and used to pay $1.20 but $1 is 11.25% and they were $10 in 2014 but $20 back in 2007 so the question is, would be be able to ride out a move to $5 if it happens? There's nothing wrong with the company, Mortgage REITs are just out of favor but this management team has done a great job riding out everything the market could throw at them.

The problem MReits have in low-rate environments is that all their old paper at 5% or higher ends up getting refinanced at 3.5% (usually by someone else) and their new loans can't get 5% so their margins tend to shrink and less margin means less profit as it's a pretty straightforward lending business. Also, we're at the low end of the cycle in defaults and that hurts an MREIT too when it begins to rise.

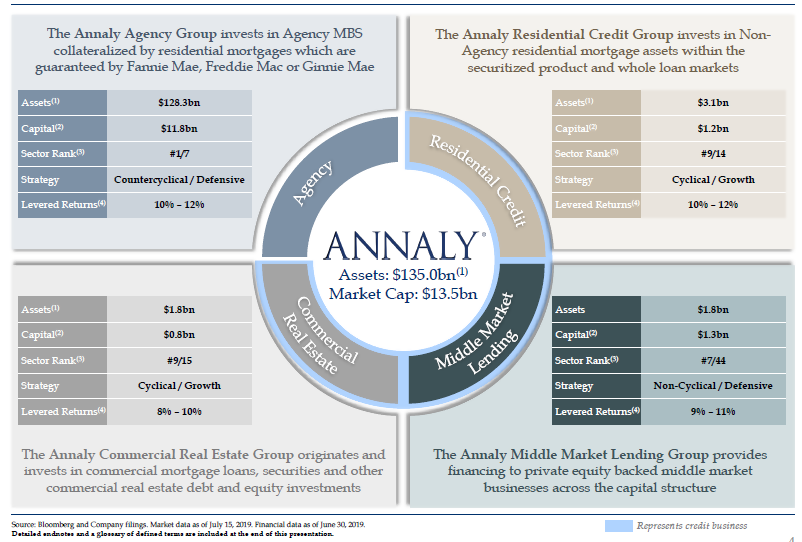

So, for those reasons, NLY's market cap is now under $13Bn, even though they are making about $1.5Bn a year.

| Year End 31st Dec | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | TTM | 2019E | 2020E | CAGR / Avg | |

| $m | 4,619 | -115 | 1,159 | 2,267 | 2,808 | 2,283 | -1,644 | 3,926 | 4,297 | -13.1% | |

| $m | 3,738 | -837 | 463.8 | 1,431 | 1,576 | 51.8 | -4,505 | -57.5% | |||

| $m | 3,730 | -842.1 | 466.6 | 1,434 | 1,570 | 54.4 | -4,495 | 1,542 | 1,582 | -57.1% | |

| $ | 3.74 | -0.96 | 0.42 | 1.39 | 1.37 | -0.062 | -3.32 | ||||

| $ | 3.77 | -0.96 | 0.43 | 1.34 | 1.37 | -0.027 | -3.28 | 1.05 | 1.07 | ||

| % | +101.1 | +211 | +1.8 | +2.58 | |||||||

| x | n/a | n/a | 8.50 | 8.29 | |||||||

| x | n/a | n/a | 3.29 | 0.82 | |||||||

| Profitability | |||||||||||

Since I have a lot of confidence in them being around for the long-haul (they are 3-4 times bigger than the average MREIT with solid management) and since they do have long-term options, this is one I'm comfortable adding to our Dividend Portfolio:

- Buy 2,000 shares NLY for $8.92 ($17,840)

- Sell 20 2022 $7 calls for $2.15 ($4,300)

- Sell 10 2022 $10 puts for $2.50 ($2,500)

That makes our net entry just $11,040 or $5.52/share so, even if we are forced to buy 1,000 more at $10 ($10,000) that's $21,040 for 3,000 shares or $7.01/share (and then we'd sell more calls, of course).