Things are going up, up, up – so why worry?

Things are going up, up, up – so why worry?

Things LOOK so good in the market that we've even capitulated on our CASH!!! position and moved some into new portfolios for Short-Term trades, Dividend trades and Earnings trades and our Butterfly Portfolio has always been open – as is our newer Hemp Boca Portfolio.

We wanted to go to CASH at the end of September in the old Long-Term, Short-Term and Options Opportunity Portfolios because they had done very well and we didn't want to risk it all into Earnings, Brexit, China Trade, Mid East Unrest, Impeachment and what looked like a Slowing Economy.

The market did take a nice dive just after (or maybe because) we cashed out in early October but, since then, Brexit has been delayed, Earnings haven't been too bad, China sort of has a deal with us, the Mid East is a disaster and getting worse – but no one seems to care, Trump is being impeached and no one seems to care and the economy is definitely slowing – and no one seems to care.

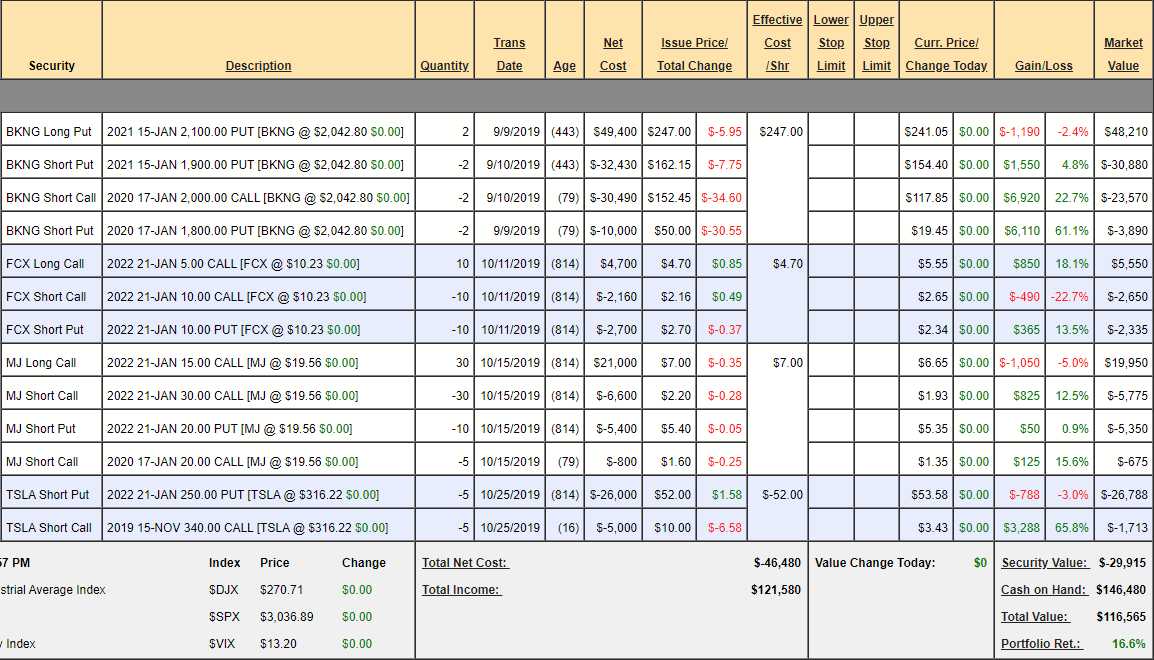

As a Fundamentalist, it's still kind of hard for me to want to take risks in this environment but I also have to go with the flow and the crowd is pouring back into equities so we'll take some quick dips, with as little risk as possible. Our Short-Term Portfolio has the most risk but also is getting the most reward – up 16.6% for our 2nd month already on just 4 trades so far:

We're using the STP to teach various options trading techniques to our Members. The BKNG trade is one of our Extended Butterflies and the MJ trade is an Income Producer as we look to collect $800(ish) every quarter for an additional $6,400 over 8 quarters – it's great the way small amounts can add up. That way, our $8,200 net cash entry drops to near zero and ANYTHING of value left in the spread becomes our profit – and it's a $45,000 spread if MJ climbs to $30 or more!

FCX is what we call an artificial buy/write, where we use the bull call spread with the short puts in lieu of owning the stock. The spread is a net $160 credit and our worst-case scenario is owning 1,000 shares of FCX for $10 ($10,000) less the $160 credit while the upside potential if they simply hold $10 is $5,000 – a 50% gain had we bought the stock now for $10K but we're using just $1,822.50 of ordinary margin to "artificially" own the stock instead.

TSLA is our riskiest trade but a good example of selling risk premium as we sold the $340 calls on Friday, while the stock was flying up and collected $10 and, already, they are down to $3.43 for a 65.8% profit. We have an unrealized loss on the puts but hopefully TSLA calms down and holds $250 but doesn't get over $340 and we collect the entire $31,000 – though not until 2022, unfortunately. Our intent is to sell calls many times while we wait for the short puts to expire and, at $5,000 per month – this could be a fun trade indeed!

So that's how we're passing our time while we're waiting for the Fed to remove that layer of market uncertainty. Yesterday we reviewed our 5 Trade Ideas to Make $25,000 in 5 Months and that article was from August 29th and I'm happy to report that, after just two months, our 5 trades are already up $26,800 so goaaaaaallllllllllll – though there are still a couple you can play for nice gains in the last 3 months – Merry Christmas!

We have a Live Trading Webinar today at 1pm, EST and we'll review the Fed Rate Decision and Powell's Speech as it happens – you can JOIN US HERE.