The Dow is up another 125 points (0.5%) this morning.

The Dow is up another 125 points (0.5%) this morning.

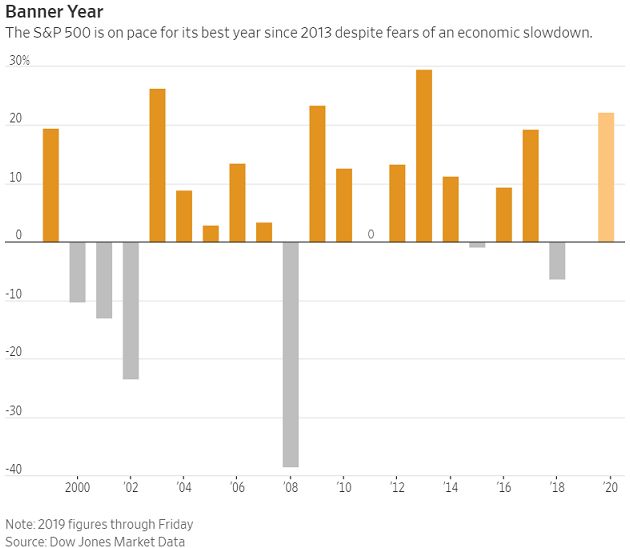

The S&P is already up 22% for the year and, as you can see from this WSJ chart, We've had lots of good years lately with the 2 down years in the last 10 combining for a total loss of less than 7% while the 8 positive years have added 142% but keep in mind that's cumulative, with the gains compounding each year – giving us the incredible new highs the market is at right now – despite having first dropped almost 40% in 2008.

On Fox News this morning, a guest was saying that we can't raise taxes now because the economy is so good that there's bound to be a recession coming so we need low taxes to fight off the recession. Of course, when there is a recession – they'll tell us that they need to lower taxes too. I've been watching a lot of Fox News this weekend as I'm on a ship and it's the only US news channel. By the way, when are the Democrats going to stop harassing poor Presient Trump?

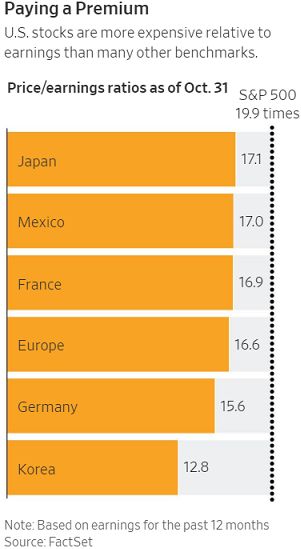

Our market rally has clearly been led by the Information Technology sector, which is up 36% and companies like Apple (AAPL), Chipotle (CMG) and Target (TGT) are up over 60% for the year, boosting the large-cap sector. The S&P 500 is now trading at 20 times the earnings of it's components – another all-time high and significantly higher than other countries are trading.

Our market rally has clearly been led by the Information Technology sector, which is up 36% and companies like Apple (AAPL), Chipotle (CMG) and Target (TGT) are up over 60% for the year, boosting the large-cap sector. The S&P 500 is now trading at 20 times the earnings of it's components – another all-time high and significantly higher than other countries are trading.

When will the music stop – if it ever does? The "normal" p/e ration for the S&P 500 is 16 – so we're 25% above that but "normally" there are other things you could do with your investment capital, like put it in the bank, bonds or housing but the banks and bonds now CHARGE YOU to hold your money in many countries and don't pay enough to keep up with inflation in the US while bonds are ridiculously low thanks to the Fed – certainly not a place you want to invest.

Real Estate is what led the last market correction so investors are sensibly gun-shy about tying up their assets in that sector again and that pretty much leaves equities so perhaps there's some sense to the premium equities are currently commanding but – just like the last bubble was fueled by unsustainable loans – this equity bubble is fueled by unsustainably Low Tax Rates, unsustainably high levels of Corporate and Consumer Borrowing and unsustainably low Fed Funds Rates.

As I noted last week, the European Central Banks have already gone negative and the unintended consequences of low rates are already getting them to begin unwinding those. The United States is the World's #1 borrower of money, needing $100Bn in loans each month just to finance our current annual Deficit but we're also borrowing $200Bn a month as we roll over our existing $23Tn in debt so, while we may WISH for low rates to continue – if other countries begin offering higher rates to attract lenders – we will be forced to do the same.

Unfortunately, when a country begins raising rates, the value of the existing low-rate bonds starts to decline. If you have a 30-year bond that pays 2%, let's say $100,000 becomes $160,000 in 30 years – then a 30-year bond at 4% would become $220,000 in 30 years. Your bond is literally now worth $60,000 less than a current bond, which can be purchased for the same $100,000. So what happens to your bond? You will be forced to sell it for a discount – possibly taking a very significant loss on your low-rate bond if you wish to cash it out.

As you can see from the chart above – it's been many, many years since bondholders have had significant losses but rates are not likely to keep going down forever and that day will eventually come and that's going to cause massive turmoil as $23Tn in US Bonds begin to lose their value.

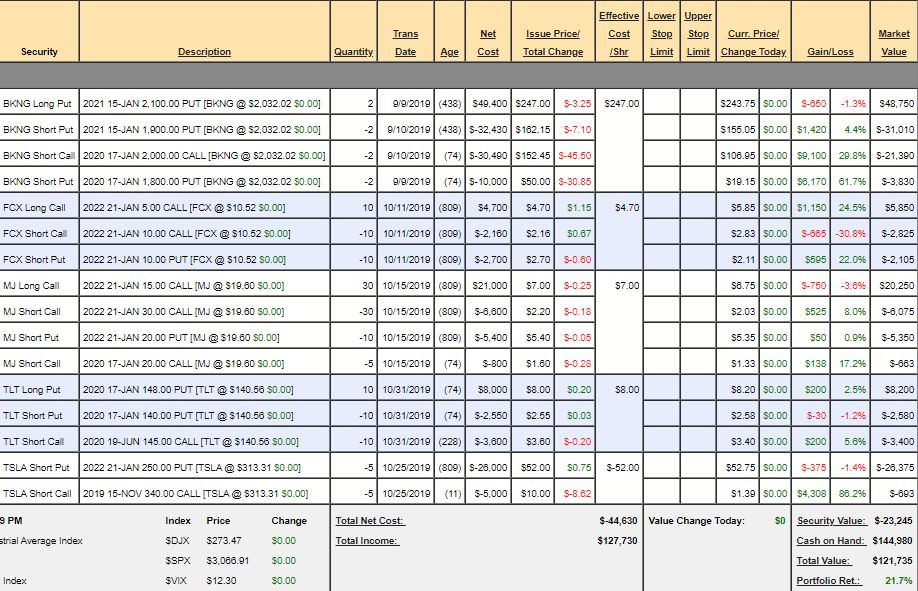

Last Thursday, we discussed a short play on TLT for our Short-Term Portfolio but, if you are a bond-holder, you may want to consider using a short on TLT as a hedge to the value of your bonds. That trade is already up $370 but that's nothing as our goal is +$5,750, so it's still good for a new trade. Overall our STP is up 21.7% in its first month, led by a very nice recovery in our Booking (BKNG) short – despite the broad-market rally.

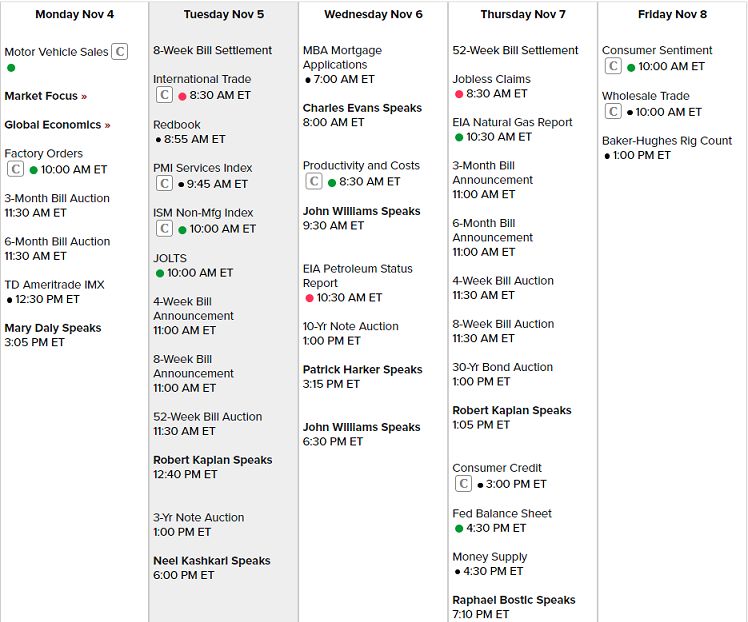

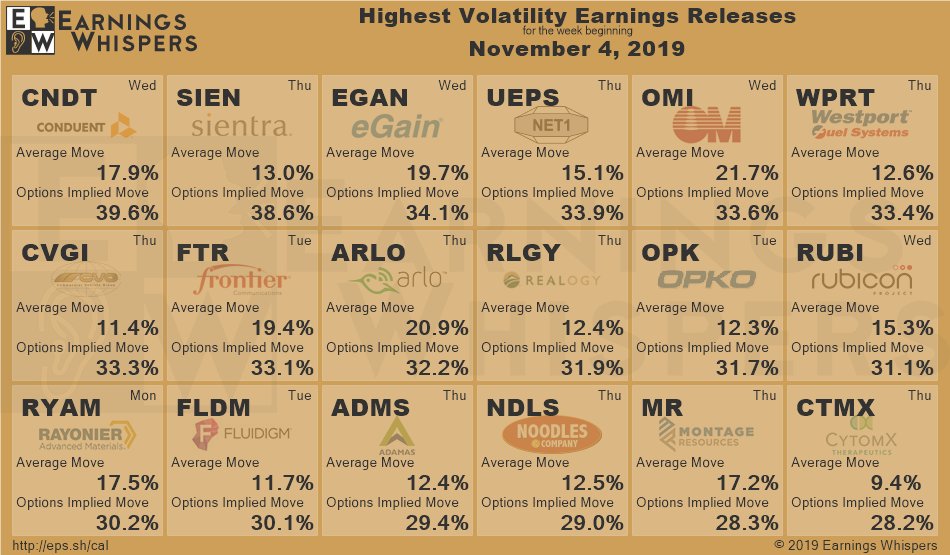

This week, we still have plenty of earnings reports and PLENTY of Fed Speak with 9 scheduled speeches in 4 days and 4 on Wednesday around the 10-year note auction at 10am – so I think they may be a little worried about how that goes with the new, lower rates. Today we begin with Factory Orders and tomorrow we have PMI Services and ISM Non-Manufacturing and Consumer Sentiment is Friday but not all that much exciting on the data front so earnings will remain the key focus and so far, so good with those.

In 1999, the Nasdaq went up 100% even after a fantastic run in the past decade. By the middle of 2000, it was half of where it started 1999 but were the people who sat out the 100% rally and the subsequent drop right or did they miss something? I was one of those people and I still couldn't tell you whether or not it was the right move. It's easy to say you should have caught the rally and magically assume you would have also optimized your exit. I thought this market was too tricky to risk in September and it still seems that way to me.

While we're happy to do some earnings plays and short-term trades – even some dividend plays – it's still very hard to put together a premise for risking large sums of money in long-term positions at these high valuations. Sure there are bargains to be had – and we'll see how earnings play out but we're still very Cashy and Cautious at the moment.