The rally continues.

We've been promised a trade deal and we've been promised tax cuts and the S&P has soared over the 3,000 level and is testing 3,100 with the Dow at 27,500, Nasdaq (100) 8,236 and the Russell is dragging behind at 1,603 as it was over 1,700 a year ago but no sense picking nits – this is a Hell of a rally!

Of course the Dollar has been pushed down 2% since the Fed last Wednesday and 2% of 3,000 is 60 and we're 60 points over the previous high so it would be nice to see the S&P and the other indexes REALLY make new highs without the help of a weak Dollar or trade or tax promises but these are not the kind of parents that are willing to let their children succeed or fail on their own merits – are they?

“It’s very clear we’re seeing lots of celebration in the market, not just in stocks, but in emerging market assets such as the Yuan and coming out of havens like the Japanese Yen,” said Jane Foley, head of foreign exchange strategy at Rabobank. The cut in interest rates by the Federal Reserve last week has added to investors’ optimism, she said. “The rally can extend for a one to three month view.”

Per Bloomberg: China is seeking the roll back of U.S. tariffs on as much as $360Bn worth of Chinese imports before President Xi Jinping agrees to go to the U.S. to sign a partial trade deal with President Donald Trump, according to people familiar with the matter.

Per Bloomberg: China is seeking the roll back of U.S. tariffs on as much as $360Bn worth of Chinese imports before President Xi Jinping agrees to go to the U.S. to sign a partial trade deal with President Donald Trump, according to people familiar with the matter.

Negotiators asked the Trump administration to eliminate tariffs on about $110Bn in goods that were imposed in September and lower the 25% tariff rate on about $250Bn that began last year. China has also previously demanded that Trump cancel plans to impose duties on roughly $160Bn in imports, scheduled for Dec. 15th, which would hit consumer favorites like smart-phones and laptops. At the very least, those tariffs have to be taken off the table for Xi to get on a plane to meet Trump.

Nonetheless, Trump and all the White House dwarves have been out talking up a trade deal and I think it will happen because Trump NEEDS a win — especially one that can come right in the middle of the impeachment hearings – so it's very possible the Administration will punt on issues like Intellectual Property, Censorship and Foreign Investment, which were once supposed to be the whole point of the tariffs. President Xi reiterated China’s commitment to economic openness and the global trading order at a speech in Shanghai, striking a somewhat softer tone than his address to the same conference a year ago, where he took some veiled swipes at Trump’s “America First” polices.

All this is supposed to happen a week from Sunday (Nov 17th), which was the date of the now-defunct APEC Conference in Chile. We are still very much in CASH!!! and betting carefully in our Member Portfolios and we should all be concerned about Gold holding $1,500. If things are so great – what are gold hoarders worried about?

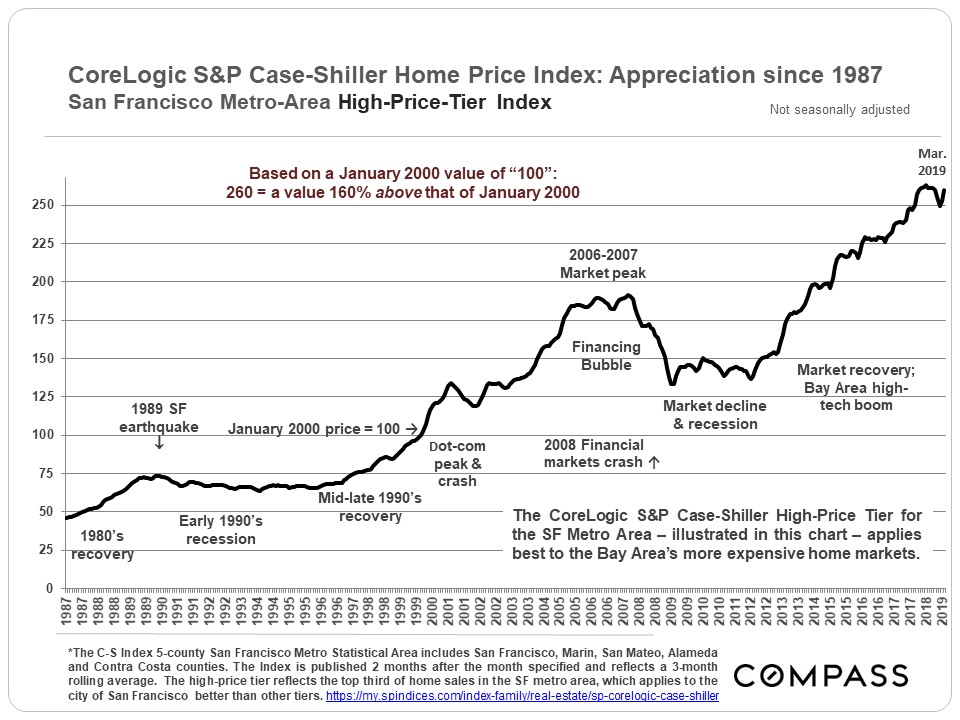

I mentioned yesterday that it does feel a bit like 1999 but 1999 was a great year in the market, 2000 – not so much… I was going to pull up a 1999 chart to illustrate but then I saw this chart that shows where our housing prices are compared to the over-inflated bubble that led to the last major market crash 11 years ago – just another very scary data-point we so easily ignore: