I feel like we're playing Peek-a-Boo!

I feel like we're playing Peek-a-Boo!

You know, the game in which you are able to surprise a baby over and over again with the same simple trick? Yeah, "peek-a-boo" – whose got a trade deal? You have a trade deal! Good boy. Where's the trade deal? Peek-a-boo! There it is? Look, it's a trade deal. Where's the trade deal? Where is it? Peek-a-Boo! There it is! Who's a good boy? Where's the trade deal? Do you see a trade deal? Peek-a-Boo! There it is!

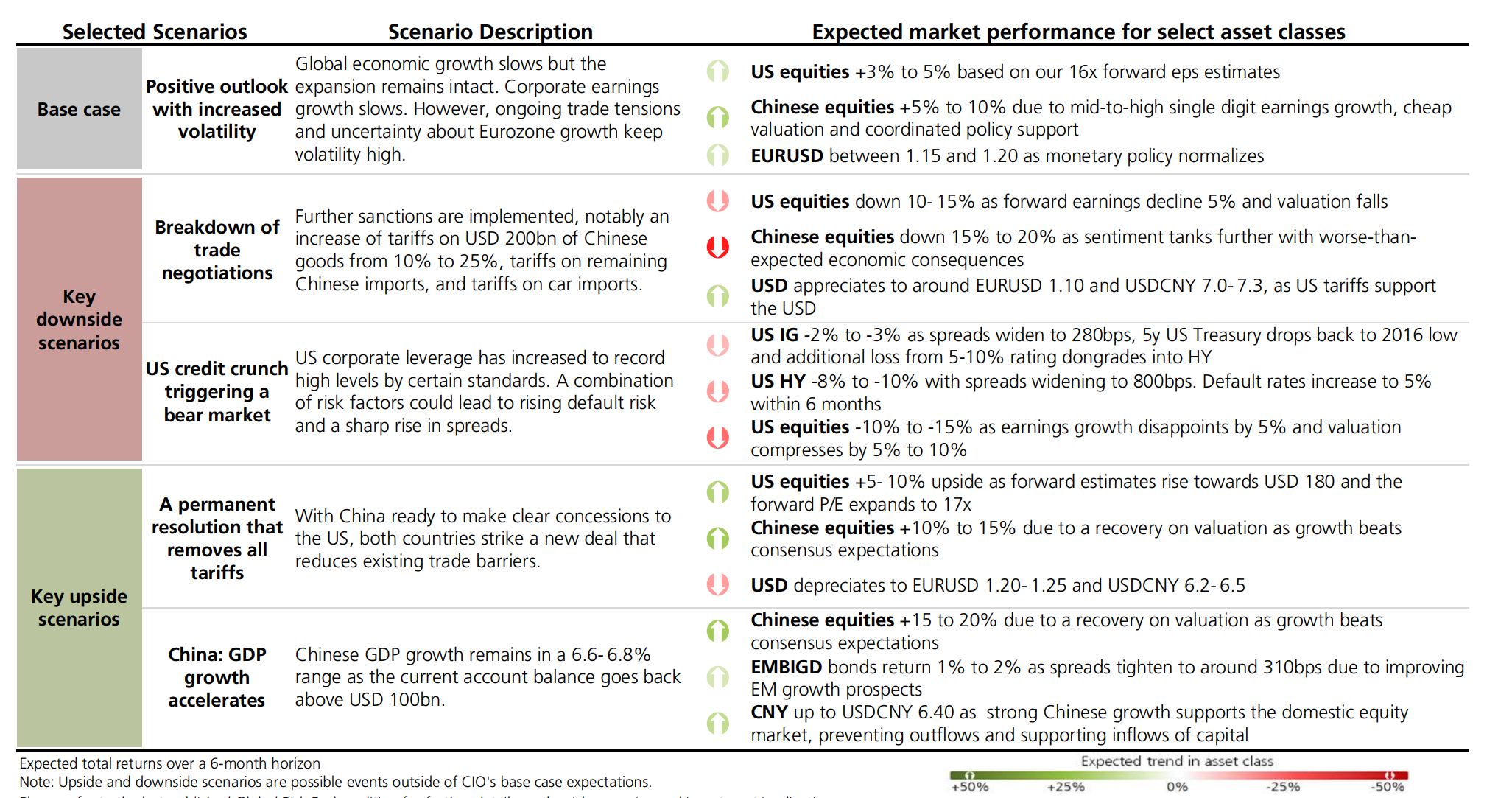

Isn't that fun? I could play that game for months and, apparently, every time I play the market goes higher – no matter how many times I show some small amount of progress towards a trade deal WE FRIGGING HAD TWO YEARS AGO! There is no imagined scenario in which the US is actually getting a "better" deal than the free trade deal we had BEFORE Trump began messing around. Trump has forced China to make other trading alliances – and China is not going to throw that away just to please the unreliable US.

Today's big reveal, that's good for a 150-point (0.5%) gain on the Dow is because Beijing, WITHOUT saying there will be a deal, laid our a framework for phasing out tariffs over time. Officially, according to the WSJ:

BEIJING—China’s Commerce Ministry said China and the U.S. have agreed to lift some tariffs on one another in stages if the two countries reach a partial trade deal, a goal both have been building toward since October.

“If the phase-one deal is signed, China and the U.S. should remove the same proportion of tariffs simultaneously based on the content of the deal,” spokesman Gao Feng said at a regular press briefing Thursday. “This is what [the two sides] agreed on following careful and constructive negotiations over the past two weeks,” he said.

That's right, that's what your fellow pre-market investors are throwing a party over – IF pigs can fly THEN they are going to have to wear goggles, because their eyes are too big and it would be uncomfortable. Sure, why not? If something happens, then something else needs to happen but that doesn't change the odds of something happening.

Phasing out tariffs could be a face-saving way for Washington to claim it has worked out a system to get China to comply with terms in a potential agreement. The Wall Street Journal reported this week that U.S. and Chinese officials were considering rolling back some tariffs to clinch a partial deal. The Commerce Ministry’s Mr. Gao reiterated China’s longtime stance that the U.S. is the instigator of the dispute and should take responsibility in de-escalating tensions: “The trade war started with increasing tariffs and should end in removing all tariffs,” he said.

Phasing out tariffs could be a face-saving way for Washington to claim it has worked out a system to get China to comply with terms in a potential agreement. The Wall Street Journal reported this week that U.S. and Chinese officials were considering rolling back some tariffs to clinch a partial deal. The Commerce Ministry’s Mr. Gao reiterated China’s longtime stance that the U.S. is the instigator of the dispute and should take responsibility in de-escalating tensions: “The trade war started with increasing tariffs and should end in removing all tariffs,” he said.

“There are some indications that the Trump administration may be getting desperate,” said Nick Marro, a trade analyst at the Economist Intelligence Unit. “China may pick up on this and start playing hardball, because they know that—at least politically—they have the upper hand.” At a conference in Beijing last weekend, several Chinese speakers, including former government officials, said they expect disputes between the U.S. and China to stretch on for decades, whatever the prospects for a near-term agreement. “The frictions are not just about trade,” said Liu Shijin, deputy director of economic affairs at China’s legislative body. “A lot of areas [for disagreement] haven’t even started yet.”

There are still a lot of ways this can all play out and I think it's a bit premature to be back near 3,100 on the S&P Futures (/ES) so I like shorting up here or below 25,600 on the Dow Futures (/YM) – both with tight stops above as you can't really short this market . We'll see if the Russell (/RTY) fails the 1,600 line – that would be a good short too with VERY tight stops above (that's what makes it a good short – having a very obvious place to stop out with a small loss vs a large, potential gain).

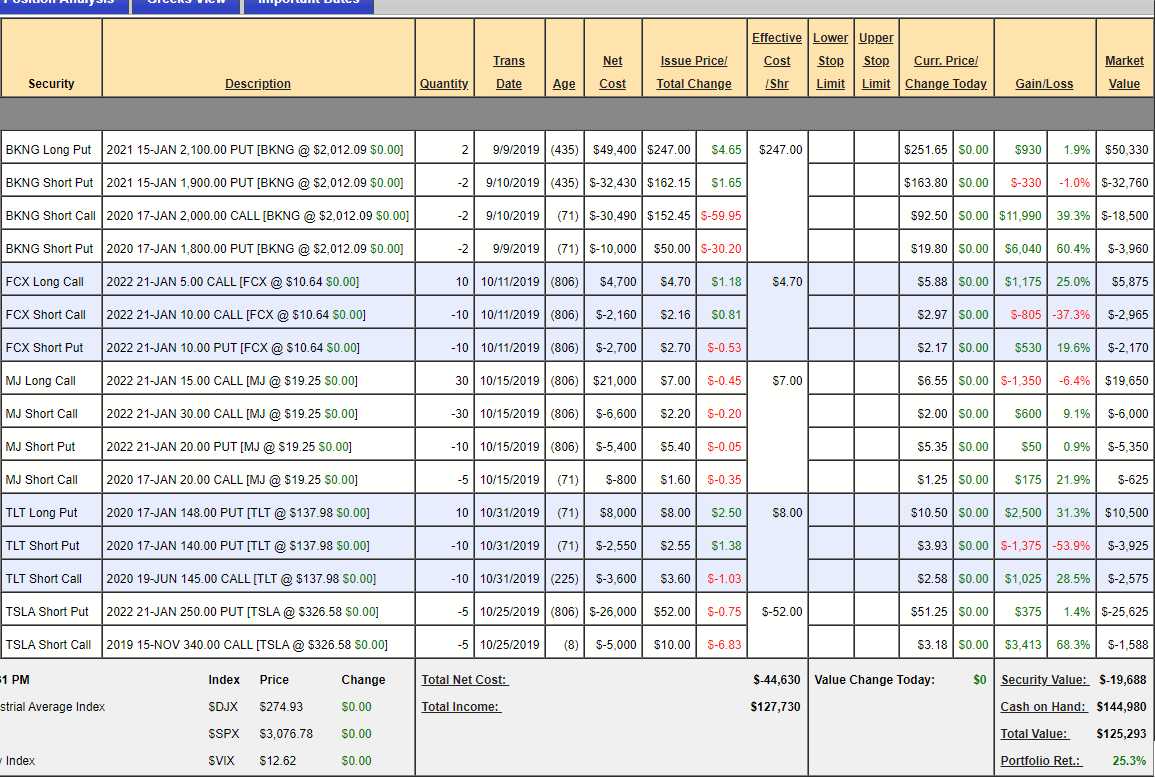

Not that we should complain about the market. We haven't touched our Short-Term Virtual Portfolio since we published it in Monday Morning's Report (sign up HERE to get our Reports every day or to access all our Member's Virtual Portfolios) but we've gained another $3,558 (3.5%) in 3 days just leaving our 5 beautiful positions alone (and we are averaging 2.5% per week in gains – very nice!). Now that I'm back in the Command Center (I was on a cruise ship) – I'm sure we'll find more fund things to trade…

- Booking (BKNG) is a $40,000 spread currently trading at net -$4,890 so there's $44,890 (917%) left to be gained if all works out on that spread PLUS we will be able to sell more short-term puts and calls along the way. This one is a keeper!

- Freeport MacMoRan (FCX) is a $5,000 spread currently trading at net $740 so there's $4,260 (575%) left to be gained if all works out on that spread and it's already 100% in the money. Don't you love options?

- Alternative Harvest ETF (MJ) is a $45,000 spread currently trading at net $7,675 so there's $37,325 (486%) left to be gained and I was very encouraged by Innovative Industrial's (IIPR) earnings last night as they turned a nice profit (Disclosure: PSW Investments works with IIPR in San Diego and they will be part of our $100M Cannabis Fund).

- 20-Year Treasury ETF (TLT) is a $8,000 spread that's already in the money at net $4,000 so it can only double from here for another $4,000 (100%) – the rund of the litter!

- Tesla (TSLA) is a wildcat in a paper bag and has been all over the place. We need it over $250 but under $340 with 8 days to expiration but it's really a complex 2-year play where we will sell many sets of calls (but hopefully just the one set of puts). I'd be thrilled to collect just our initial $26,500 and the current net is $24,037 so we're up just 2,463 so far – about 10%.

So there's 5 trade ideas we initiated over the past two months that are on track to make another $116,975 (117%) over the next 2 years – not a bad way to play with our sidelined CASH!!! while we wait for the markets to calm down.

There are still plenty of bargains to be had and a week from Sunday we'll see if there really is a trade deal but all indications are that we're pushed into at least December, when Trump is scheduled to add more tariffs. If that happens, China retaliates and we're back to scratch and the market tanks so forgive me for preferring to just play cautiously (yes, making $116,975 on 5 stocks is us playing cautiously!) for the time being.