Money Talk Portfolio at TheStreet.com: New Portfolio, New Trades!

In case you missed Phil on Money Talk last month, watch video here.

[These trades were originally posted on 11-13-19]

We are featuring some of our Member Portfolios over at TheStreet.com starting with our Money Talk Portfolio, which kicks off this evening on BNN (Bloomberg Canada) at 7pm this evening. Through the end of this quarter, the Money Talk tab usually found on PSW will ALSO be found on TheStreet but, over time, they will get the exclusive on that and a couple of other portfolios as well as some PSW content (also a subscription).

We are featuring some of our Member Portfolios over at TheStreet.com starting with our Money Talk Portfolio, which kicks off this evening on BNN (Bloomberg Canada) at 7pm this evening. Through the end of this quarter, the Money Talk tab usually found on PSW will ALSO be found on TheStreet but, over time, they will get the exclusive on that and a couple of other portfolios as well as some PSW content (also a subscription).

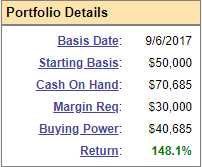

We closed the old Money Talk Portfolio after two years with a 148.1% gain on Sept 18th as I didn't trust the upcoming quarter enough to risk the gains. Turned out I was premature in my worries (as I often am because I'm a worrier) but I'm still worried so we're going to start with a couple of conservative trade ideas and see how things go. The rule of the Money Talk Portfolio is we only do trades we announce on the show, once each quarter so it's a very low-touch portfolio using our options strategies to hedge the risk and lever our returns.

When closing down the MTP, I did make the following suggestion for a good use of our $124,042 of cash:

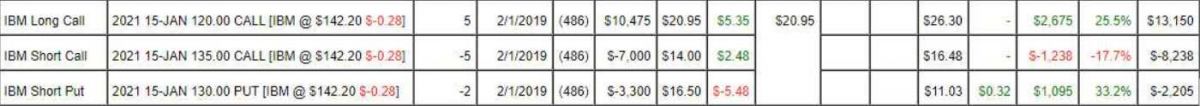

Our 2019 Stock of the Year is IBM (IBM) and our IBM position is already 100% in the money at net $2,707 out of a potential $7,500 so, if I were going to keep one trade active – that would be the one as all IBM has to do between now and January of 2021 is hold $135 and that spread will make another $4,793 (177%) so we could, for example, put $27,070 of our $124,043 in cash back to work on just the IBM trade and, if all goes well, it will turn into $75,000 – making almost 100% of our original total in just over a year – so why be more complicated than that?

There's still a lot of potential in all these positions, as noted in the April review, the portfolio has the potential to hit over $200,000 by Jan 2020 but, as I noted, if we cash out now at $124,043 and make another $50,000 on the IBM trade – that's $174,000(ish) anyway but we'd have $100,000 in our pockets NOT at risk through the holidays – that is certainly a much wiser way to go – especially in a portfolio we are unable to adjust between shows.

So the decision is final, we're cashing out and endorsing our Stock of the Year, IBM, as a replacement bet to keep some of the cash at work but, on the whole, we'd rather risk missing a bit more of a rally on Fed Easing and a China Deal than risk a drop on Fed Disappointment, ongoing Trade Wars, a Hard Brexit, war in the Middle East and, of course, President Trump's random tweets.

That trade is still about the same price so we're going to be officially adding it back to the MTP although I believe we will go with different strikes, as follows:

- Sell 4 IBM 2022 $135 puts for $20 ($8,000)

- Buy 8 IBM 2022 $120 calls for $23 ($18,400)

- Sell 8 IBM 2022 $140 calls for $12 ($9,600)

That spread is net $800 on the $16,000 spread so $15,200 (1,900%) upside potential if IBM is over $140 in Jan of 2022 – something we have a lot of confidence in. Your worst case is that you are assigned 400 shares of IBM at $135 ($54,000) so we'll put a stop on 2 of the 4 short puts at $30 ($6,000) which would cause us to take a $2,000 loss, driving our net to $2,800 but still allowing for $13,200 (471%) upside potential. Then the rest we could would adjust along the way – it's good to be prepared.

The ordinary margin requirement on the aggressive short puts is just $10,658.60 and would drop to half of that if we are forced to buy back half the short puts – so it's very unlikely to make us uncomfortable along the way.

IBM was our 2019 Trade of the Year (2-year cycles) and we've been looking over candidates for 2020 and my top pick is Sunpower (SPWR) but, unfortunately, they are spinning off a division and that will make them too messy to trade in a portfolio we don't touch often but, at $8.50, we can sell the 2022 $8 puts for $3 and that nets us in for $5 so, split or no split – I want to sell 10 of those for $3,000, using $2,894 of margin in a fairly efficient manner.

If it were not for the restriction of the MTP, I would also buy 20 of the 2022 $5 ($5)/10 ($2.70) bull call spreads for net $2.30 ($4,600) and that would put us in the $10,000 spread for net $1,600 with $8,400 (525%) of upside potential at $10+. The split would make it messy but we don't mind getting dirty for 525% returns – it's just too difficult to leave it restricted to quarterly adjustments.

So, if Sunpower isn't going to be our Trade of the Year, what is?

In an uncertain market, we are looking for stocks that are fairly recession-proof and have good value for the money – something very hard to find in the current market. CBS (CBS) was one of the top candidates in our Live Member Chat Room on Monday and we did, in fact, sell puts on that one in our Short-Term Portfolio:

So that's official for the STP, we're going to sell 5 CBS 2022 $40 puts for $8 ($4,000) in the STP.

Teva (TEVA) is a good value but too uncertain, Oil Service ETF (OIH) also a good value but also too choppy with a dim demand outlook and the uncertainty of the Aramco IPO (will they flood the market with oil trying to make numbers?). GME and BBY already got away from our lows but Tanger Factory Outlet (SKT) is still unloved and we think they are still stupidly cheap at $15.88 but a bit too Fed dependent to be the Stock of the Year (we don't want something where factors out of their control can hurt their business). L Brands (LB) is still stupidly cheap but the Biotech ETF (LABU) already popped 40% while we've been considering it.

Mittal (MT) we would like to see a bit cheaper or at least break over $17.50 finally, Travelers (TRV) is the best bargain on the Dow and a possible play, Northern Dynasty (NAK) is a penny stock but, at 0.57, I'd buy 10,000 shares for $5,700 and forget about it for 5 years – just in case they ever get their permit (I'd also sell half if they hit $1.14 so I'd have 5,000 shares at net $0!).

Frontier (FTR) is down to 0.75 so do we buy them before or after restructuring? I'd say 1,000 shares now ($750) and plan to spend $4,250 once they announce a new CEO and get a reaction.

Barrick Gold (GOLD) is reasonable again at $16.44 and at $15 I'd certainly want to buy them and we can do that with options so very tempting… Cleveland Cliffs (CLF) is being hurt by the China Trade Issues but, as a North American Iron Ore Manufacturer, they have certain advantages and should really pop if we ever do get a deal. Capril Holdings (CPRI) already took off on us, IMax (IMAX) is stupidly cheap at $21.25 but hard to call a Stock of the Year as they are a slave to Hollywood's releases to make their share of the money.

Lockheed Martin (LMT) is our stock of the Decade for the 2020s but that's way higher now than when we picked it. Annaly (NLY) is too cheap at $9.12 and pays a nice dividend but options aren't exciting enough for a Stock of the Year. Walgreens (WBA) was our first choice for Stock of the Year but someone else liked them so much they offered to buy the whole company and they already popped 25%. The rest of our Watch List is still too expensive to consider so, given the above, our Stock of the Year for 2020 is: GOLD!

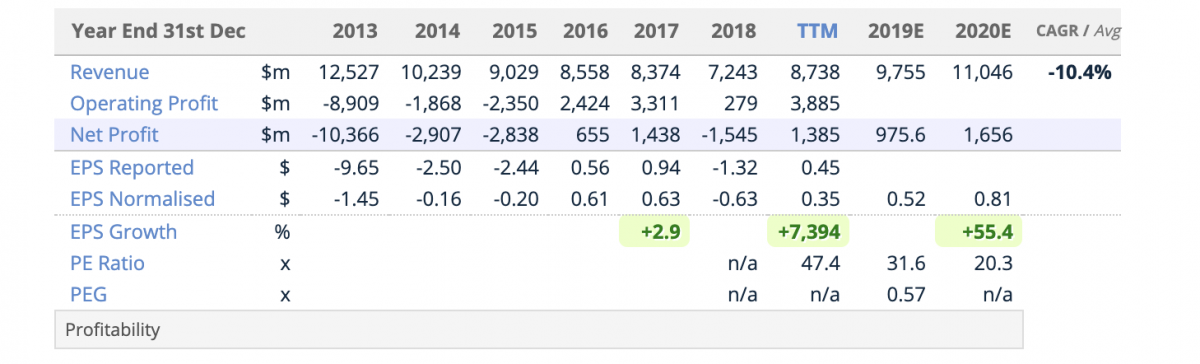

After due consideration I'm going to go with Barrick Gold (GOLD), who recently merged with Rangold (was GOLD) back in March and, spun off underperforming assets last Q which left them with an average production cost of $984/oz – still much higher than GOLD used to be at before the merger. We can trust Barrick Management to keep pushing those costs down while Gold (/YG) itself has jumped to an average selling price of $1,476/oz and the spread between the two is where gold miners make their money and GOLD is on pace to sell over 5M ounces of it next year – along wtih 400M pounds of Copper (/HG), which is costing them around $2.75 to pull out of the ground and is selling for about $2.65 at the moment (China again).

It has been lower and may be lower again but the ongoing global uncertainty could push Gold (/YG) while a trade deal with China can get copper back closer to $3, making profits on that side of the mine as well. If it were just about the business, GOLD would not be our stock of the year but it's also about what kind of trade we can set up and how certain we are it will pay off and here's where GOLD shines. Our Trade of the Year will be:

- Sell 15 GOLD 2022 $17 puts for $3.50 ($5,250)

- Buy 30 GOLD 2022 $13 calls for $5 ($15,000)

- Sell 30 GOLD 2022 $17 calls for $3 ($9,000)

The net cash outlay on the spread is $750 and it pays $12,000 if GOLD is over $17 in Jan of 2022 for a profit of $11,250 (1,500%). The ordinary margin requirement on the 15 short puts is $4,971.75 so it's a very efficient way to make $11,250. The worst-case scenario is you are assigned 1,500 shares of GOLD at $17 plus the 0.50/share loss from the $750 outlay so $17.50 is not much worse then the $16.44 you'd have to pay now to buy the shares yet you only need it to stay flat to make $11,250 – seems like a good deal to me.

As is customary, we will guarantee that this spread is up at least 200% (net $2,250) before November of next year (2020) or we will give a free 1-year subscription to anyone who signs up for (or renews or extends) and Annual Subscription between now and December 31st. We have NEVER had to pay on 8 years of making these picks – 100% success rate!

You do not have to make the trade to play along but you do have to buy a 1-year subscription!