Almost there!

9,000 on the Nasdaq 100 (/NQ) is so close we can taste it. Well, not so much taste it as short it as big levels like this are usually excellent spots for corrections. At 8,500 we pulled back to 8,200 and our first attempt at 8,000 (only 2 months ago) was rejected for 200 points before getting back on the bull train so the odds of getting a pullback here, at 8,995 are certainly worth the risk of stopping out at 9,001 with a $120/per contract loss while even just a 100-point drop back to 8,900 would be a gain of about $2,000 per contract.

Finding very positive reward/risk scenarios is the key to good Futures trading – something we discussed in yesterday's Live Trading Webinar. Where we shorted the S&P (/ES) at 3,258 and the Dow (/YM) at 28,740 and both of those had quick stop outs at 3,260 (-$100) and 28,750 (-$50) but our long on Gasoline (/RB) was 2 contracts at $1.646 and we're already at $1.657 for a quick $462 so far (they are good to next week's webinar) and now we can add an /NQ short at 8,990 and another at 8,998 to average 8,994 with a stop at 9,001 for a $140 loss against the potential $4,000 gain at 8,900 – that's a fair way to play, right?

If we're still testing 9,000 at the open, that should be about $20.50 on the Nasdaq Ultra-Short ETF (SQQQ) and we can play for a quick pullback by simply taking the Jan $21 calls at 0.40 so let's say we risk the same $140 by taking 14 of those for $560 and stop out at 0.30 for a $140 loss but hopefully we make well over $1,000 on a nice pullback.

Apple (AAPL), of course, has been a big contributor to the Nasdaq's recent gains as it's run up 50%, from $200 in August to over $303 at yesterday's close and, since AAPL is 12% of the Nasdaq 100 – it's good for 6% of the run from 7,500 so 450 of the 1,500 points comes from just Apple and, of course, Apple suppliers tack on another 3% as they follow Big Daddy so 675 (45%) out of 1,500 points is pretty much AAPL and Co's contribution to the rally.

So, if we're going to short the Nadaq, it means we must think Apple is a bit overbought at $303, which is about $1.3Tn and that's about 25x earnings, which is a bit high for AAPL but GOOG and MSFT are trading at 30x earnings and FaceBook trades at 34x earnings and AMZN trades at 84x earnings and NFLX trades at 108x earnings so why not $400 for AAPL, which would be $1.7Tn – or about the same as Aramco? Why not – because that's RIDICULOUS – that's why!!!

In fact, those 5 stocks, who lead the Nasdaq 100, are "worth" $4Tn between them already – that's the ENTIRE GDP of Germany, the 4th largest economy in the World with 83M people! Japan is bigger at $5Tn with 127M people and it's amazing to think that just 445,000 people at 5 companies are "worth" more than they are, isn't it?

Come on people, get a grip! This is the same idiocy we were doing during the Dot Com bubble – using one silly valuation to justify another one with no regard at all as to whether 3% ROIs (at 30x earnings) is worth the risk of owning stocks. News flash – IT IS NOT! Sure if they have great growth or some other great story but, as a rule of thumb – HELL NO! You can get a 3% dividend in a relatively safe stock like AT&T, which is also stupidly high at $39.37 now but at least that's only 18x earnings and the dividend is $2.08 (5.33%) and we can hedge it as follows:

- Buy 500 shares of T at $39.37 ($19,685)

- Sell 5 T 2022 $33 calls for $7 ($3,500)

- Sell 5 T 2022 $33 puts for $2.80 ($1,400)

That drops your net to $14,785 or $29.57 per share and, if you are assigned 500 more shares at $33, your average cost of 1,000 shares would be $31.285 and, if you get called away at $33, you get $16,500 back for a $1,715 profit plus an anticipated $2,080 in dividends over 2 years is a total profit of $3,795 (25.67%) or 12.8% essentially risk free per year (T just has to hold $33 vs buying Tesla at $500 and hoping it goes to $628 before someone realizes that they'll be lucky to make $5 a share (1/125th of the price of the stock at $628)).

This is how stock bubbles collapse – under the weight of logic though it takes a while for logic to chip through the emotions of a bubble rally. While not "risk-free", it's hopefully obvious to you that making 12.8% on T is MUCH safer than trying to make 20% more on Tesla, or even AAPL this year – and that's coming from a huge Apple fan!

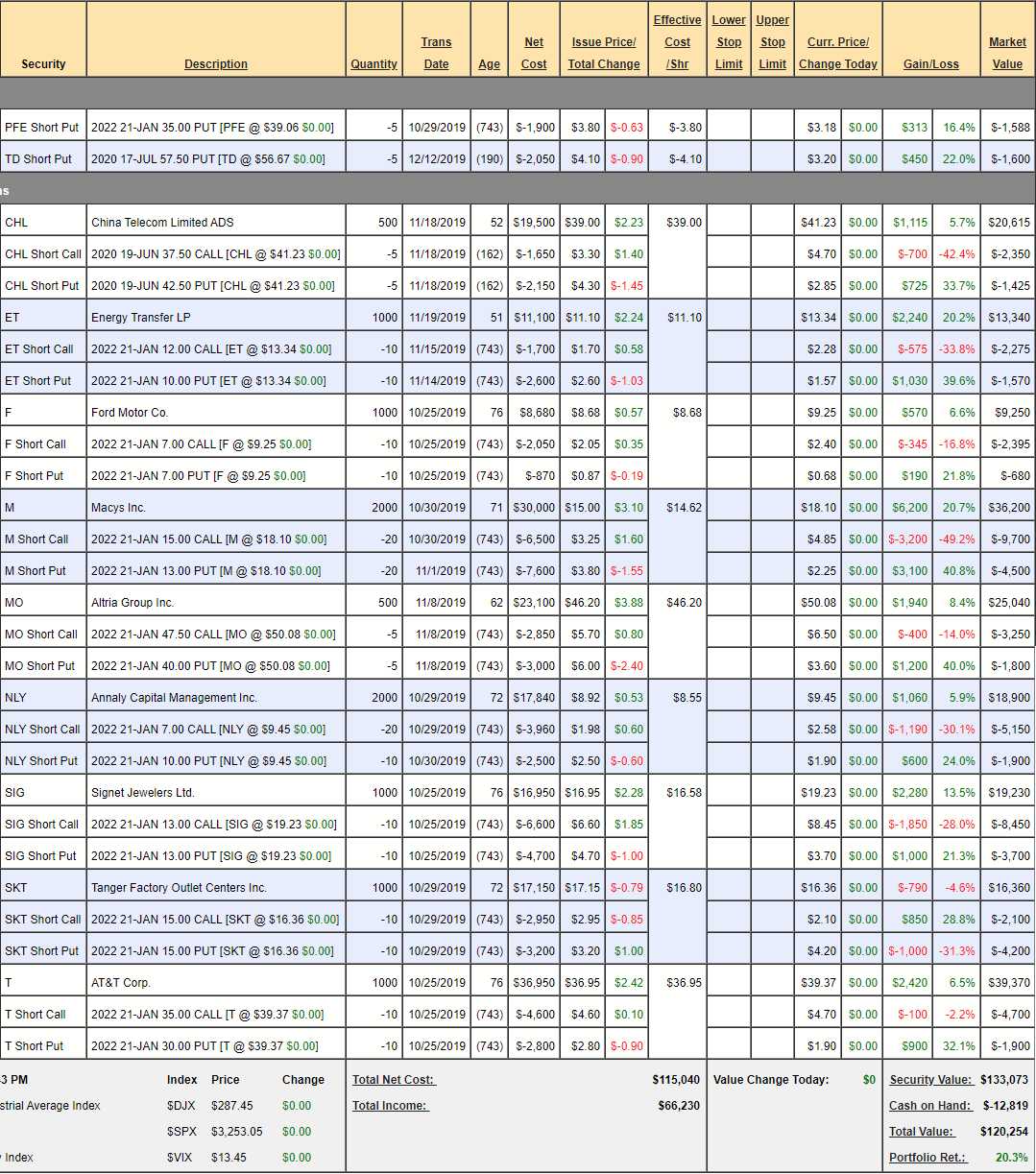

We did put together a Dividend Portfolio for our Members back on October 25th and, so far, we have 11 positions and we're already up over 20% in less than 3 months using the same strategy we discussed on T above. In fact, T was one of the first stocks we added, back when it was "only" $36.95 but it was about the same net as 1,000 more at $30 would bring the average to $33.47. Keep that in mind: This portfolio is up 20% in two months and it's FAR, FAR, FAR less risky than whatever nonsense you are probably in. Is it really worth the risk?

Be careful out there!