What a boring weekend!

What a boring weekend!

For a change, there wasn't any news – things just sort of drifted along but, poof!, half of January is already behind us and already we're moving into the heart of Earnings Season with 10% of the S&P 500 reporting this week followed by over 20% next week and we'll be half done by the end of the month and then it's February already – boy time flies…

This week we concentrate on earnigs from the Financial Sector and I find Schwab (SCHW) very interesting at $48 as that's $61Bn after they swalled Ameritrade but they are only making $3.6Bn this year, just $300M more than last year with Q4 likely to be down from last year – not too supportive of a record-high valuation.

![]() It will be a good test to see how rational traders are getting (if at all) in this ultra high-value market environment. Bank America (BAC) and Wells Fargo (WFC) are also expected to be making less money than they did last year and they too are at year highs – might be an interesting time for a little correction?

It will be a good test to see how rational traders are getting (if at all) in this ultra high-value market environment. Bank America (BAC) and Wells Fargo (WFC) are also expected to be making less money than they did last year and they too are at year highs – might be an interesting time for a little correction?

WFC, of course, is coming off fake account scandal but it hasn't really cost them a lot of cutstomers after 3 years as Revenues were $88Bn in 2016 and $85Bn in 2019 and profits are down 10% but, of course, the stock is up 10% from the 2016 highs ($50) and 20% off the lows ($45) because – well because it's part of the overall Valuation Rally – where everything is more expensive than it used to be.

Still, a good case can be made for shorting them here and WFC reports tomorrow morning and it seems very unlikely they are going to hit $55 so the way I would play it is:

- Buy 10 WFC March $52.50 puts for $2.10 ($2,100)

- Sell 10 WFC March $50 puts for $1.05 ($1,050)

- Sell 5 WFC March $52.50 calls for $1.30 ($650)

That's net $400 on the $2,500 so there's $2,100 (525%) of upside potential in 67 days if WFC is below $50. If earnings are good and they stay above $52.50, we will owe the short callers money but we can always roll them and put up a bullish spread to cover (since earnings are so good) so let's add this trade to our Earnings Portfolio and see how it does.

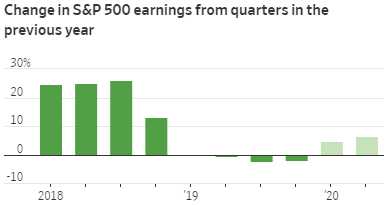

After we see how WFC, C and JPM do tomorrow morning, we'll have a better idea on how we want to play the rest of the sector. As you can see below, 2019 was not a good year overall for earnings and no help is projected to come in Q4 but guidance is supposed to improve for 2020. If it doesn't, watch out below!

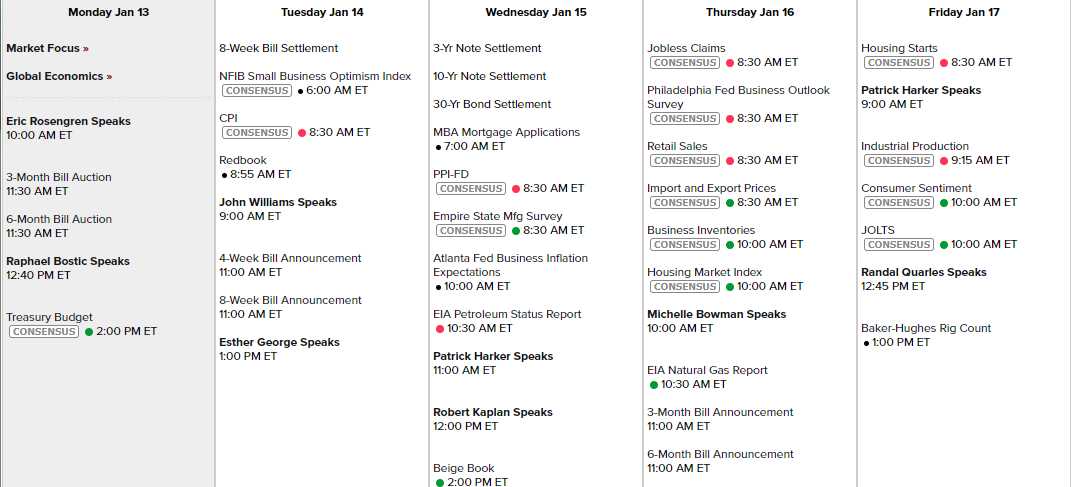

We'll be working on all of our Member Portfolios this week as January options expire on Friday, so there will be plenty to do and it's a busy week with 9 Fed Speakers scheduled as well as CPI, PPI, NY, Philly & Atlanta Fed Reports, the Beige Book, Retail Sales, Consumer Sentiment and Industrial Production.

We're still shorting the indexes (2 contracts each) at Dow (/YM) 28,915, S&P (/ES) 3,276 and Nasdaq (/NQ) 9,024 and we'll go for 3 contracts if we can still get those prices at the open. These are the same shorts we began scaling into during last Wednesday's Live Trading Webinar (replay available here) and they are hedges for our $100,000 Portfolios against one of those sudden moves down the market likes to make these days…

As I said, it was a dull weekend, nothing much in the news, which leaves us with Earnings and the re-start of Trump's Impeachment as well as lingering tension with Iran that can blow up at any minute – of course we want to be hedged! Trump signs that Trade Deal on Wednesday but the actual deal isn't very exciting and then what will they use to prop up the markets?

- Trump Trade Deal Raises Issue of Trusting China to Deliver

- Fury at Air Crash Cover-Up Puts Iran’s Leaders Back on Defensive.

- Mnuchin Says Boeing Woes Could Lop a Half-Point from U.S. GDP.

- Oil Comes Back to Haunt Asian Currencies as Volatility Increases.

- How the Strait of Hormuz, a narrow stretch of water where ships carry $1.2 billion of oil every day, is at the heart of spiraling tensions with Iran.

- Citi’s Morse Sees Better Year for Commodities But Flags 7 Risks.

- Ford Signals More China Trouble on the Road Ahead

- Investors Are Counting on Earnings to Rebound in 2020

- Bank Stocks Had a Bonanza in 2019. Earnings Will Be More Blah.

- Dell just put out a mammoth 43-inch monitor for traders — and we tried it for a week.