Courtesy of Pam Martens

By Pam Martens and Russ Martens

Photo of the Trading Floor at the New York Fed (Obtained by Wall Street On Parade from an Educational Video)

The New York Fed is so protective of its surreptitious trading relationship with Wall Street that it previously denied Wall Street On Parade a photo of its trading floor. (We obtained the one pictured here from a Fed educational video.) It is, by the way, the only one of the 12 regional Federal Reserve banks to have a trading floor.

The New York Fed has been allowed by Congress to insert itself so deeply in markets that it’s highly possible that history will find it at least partly responsible for the next market implosion.

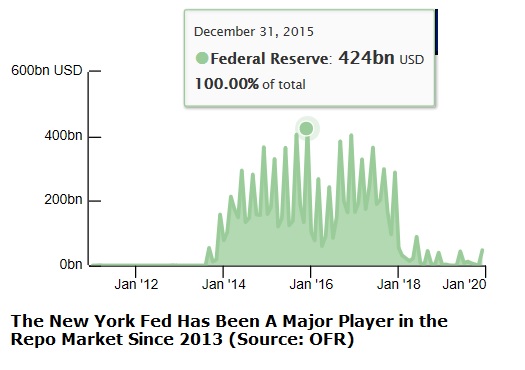

The well-promulgated notion that the Federal Reserve began heavily meddling in the repo loan market on September 17 of last year is a piece of fiction. According to the U.S. government’s own database, residing at the Office of Financial Research (OFR), from 2014 through December 31, 2017, the New York Fed was engaged in repo transactions with U.S. Money Market Funds with $200 to $400 billion changing hands on pivotal days. For example, on December 31, 2015, the Fed engaged in $424 billion in repo transactions; on December 31, 2016, $403 billion changed hands; and as recently as June 30, 2017, $354 billion changed hands between Money Market Funds and the New York Fed.

…