Well, it had to happen some time.

Well, it had to happen some time.

After serveral attempts to make some money shorting the Index Futures we hit the jackpot in yesterday Morning's PSW Report, when I said to our Members:

It doesn't matter what happens during the day, in the overnights, we rally to new highs. Oddly enough, we've been making our money on the short side (see last week's Webinar) by playing the indexes short when they peak and selling on the dips so this morning we're doing it again at 9,240 on the Nasdaq (/NQ) Futures, 3,335 on the S&P Futures (/ES) and 29,280 on the Dow (/YM) Futures.

Meanwhile, we're stubbornly long on Natural Gas (/NG), which is now at $1.90 but our average entry is $1.962 and we already have 4 long.

As you can see from the image above, we hit our goal this morning (as discussed in yesterday's Live Trading Webinar) so we're taking the money and running but we'll re-establish on a pullback. It's a nice $2,320 gain on the day, so we don't turn that away and we'll also cash out our Index Futures, now at 9,190 on /NQ for a $1,000 per contract gain, 3,313 on /ES for a $1,100 per contract gain and 29,050 on /YM for a $1,150 per contract gain. Now, wasn't yesterday's PSW Report worth your $3? If so, don't forget to SUBSCRIBE HERE!

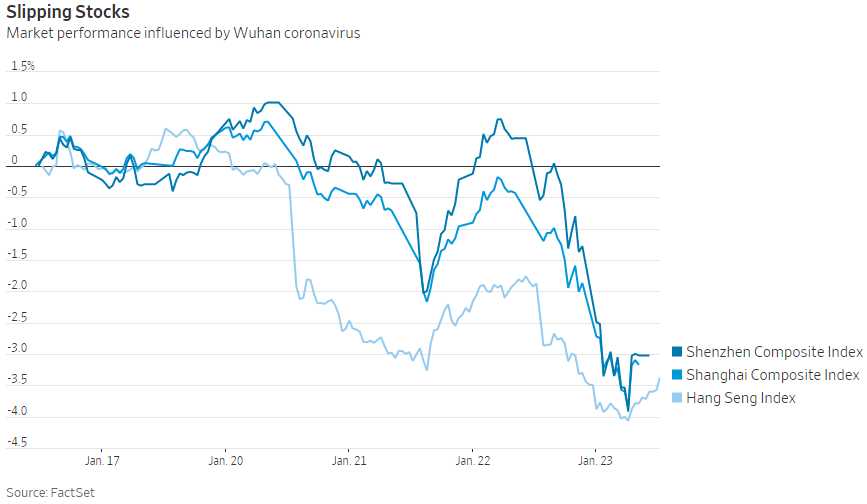

We played yesterday bearish because there was now NEW news that justified the move up and, this morning, there's no NEW news justifying the move down so we'll cash out and wait for something interesting to happen. The most interesting thing happening at the moment is the Chinese coronavirus that has sent the Chinese markets down 5% already this week and our 5% Rule™ says a weak bounce is 1% and a strong bounce would be 2% – so we'll see if the weak bounce fails tonight and, if so, we may be heading lower.

We played yesterday bearish because there was now NEW news that justified the move up and, this morning, there's no NEW news justifying the move down so we'll cash out and wait for something interesting to happen. The most interesting thing happening at the moment is the Chinese coronavirus that has sent the Chinese markets down 5% already this week and our 5% Rule™ says a weak bounce is 1% and a strong bounce would be 2% – so we'll see if the weak bounce fails tonight and, if so, we may be heading lower.

Two more Chinese cities were placed on lockdown as over 1,000 people are now infected, up from 300 on Tuesday and 500 yesterday. At Wuhan’s Hankou rail station, thousands of travelers hustled to catch trains, many booked or changed at the last minute, to get out of the city before the lockdown on public transportation. Inside the station, people wearing face masks and dragging luggage jogged to catch departing trains. Almost every seat on the trains was occupied.

In Hong Kong, health authorities on Thursday said they were investigating two patients who are suspected of having been infected with the new coronavirus, in what would be the Chinese territory’s first confirmed cases. Keep in mind they are "investigating" the disease in Hong Kong, AFTER the patients traveled from Whuan on trains and in stations where they had contact with thousands of other people and AFTER they spent days in Hong Kong before getting sick enough to seek medical attention.

In Hong Kong, health authorities on Thursday said they were investigating two patients who are suspected of having been infected with the new coronavirus, in what would be the Chinese territory’s first confirmed cases. Keep in mind they are "investigating" the disease in Hong Kong, AFTER the patients traveled from Whuan on trains and in stations where they had contact with thousands of other people and AFTER they spent days in Hong Kong before getting sick enough to seek medical attention.

There is still way too much market complacency here…

So why are we cashing out our Futures Shorts? Well this market tends to be very bouncy so we're just playing the odds and we also have index shorts (SQQQ) in our Member Portfolios and we will be looking at adding more of those if the market opens weak. The Futures are just a good way of giving us overnight protection ahead of something like this weekend's announcement that there are thousands of people infected right at the beginning of Chinese New Year – that could be good for a huge overnight drop.

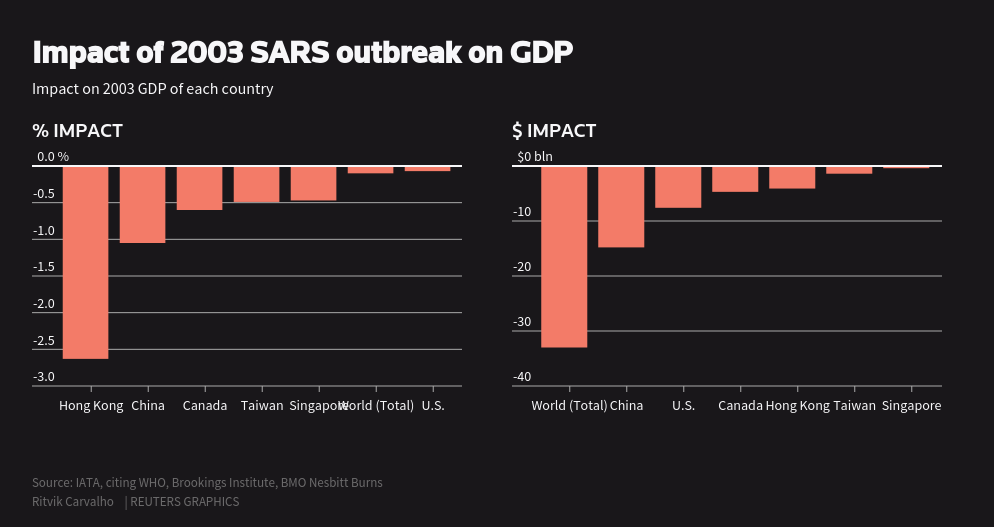

The 2003 SARS Outbreak also began in January and was a crisis by March and lasted until about July, when vaccines were developed. It's good that people are freaking out about this early as we certainly don't want a repeat of SARS as it knocked over 2.5% off Hong Kong's GDP and over 1% off the GDP of all of China – something like that could topple the Chinese banking system as they are in the middle of a bad loan crisis already.

We can hedge China's potential crisis with a long position on te China Ultra-Short (FXP), which should open this morning at $55 and just the straight stock should do well if Chna does poorly but I'd rather set up an options hedge as follows:

- Buy 20 FXP June $50 calls for $7 ($14,000)

- Sell 20 FXP June $65 calls for $2.50 ($5,000)

- Sell 5 FXP June $50 puts for $4.30 ($2,150)

- Sell 5 CHL Sept $45 puts for $4 ($2,000)

That's net $4,850 on the $30,000 spread so there's $25,150 of upside protection if FXP gets to $65 into June expirations. If China recovers and we get completely burned, we're promising to buy 500 shares of FXP for long-term protection at $50 (20% off) and 500 shares of China Mobile (CHL) at net $41 (10% off). I don't see why the flu would have a long-term impact on China Mobile and Chinese stocks are very stretched and people are pretending the Government will bail out the banks but it's doubtful that will go smoothly, so I like the idea of having some FXP in our Short-Term Portfolio for the long term.

Let's be careful out there!