Up and up the markets go (again).

Up and up the markets go (again).

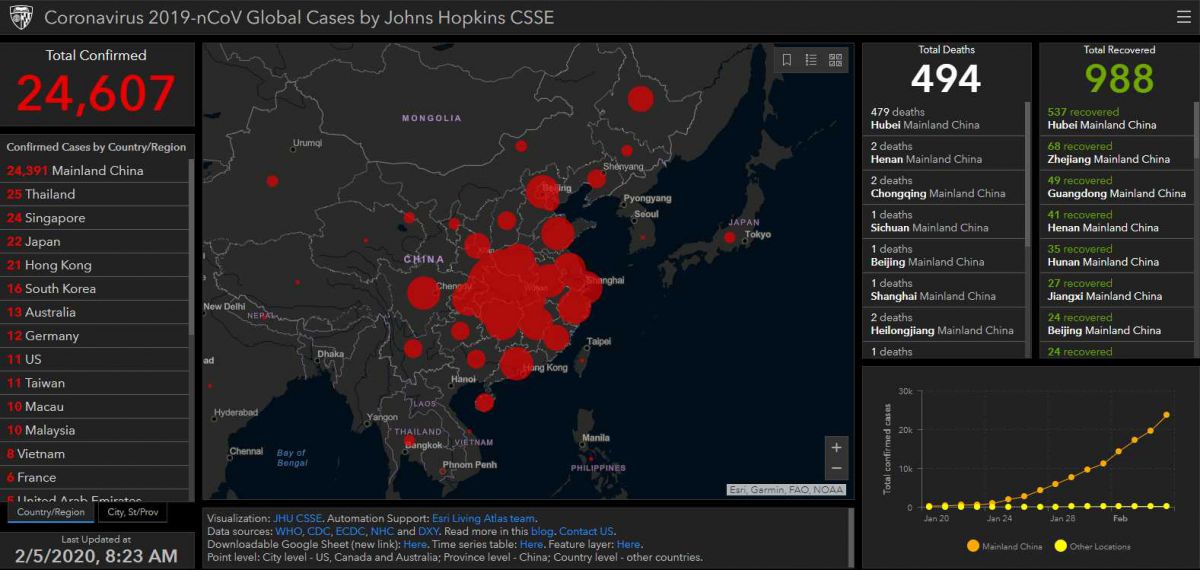

Only 25,000 infected (up 7,500 (42.8%) from Monday) and only 500 dead (up 140 (38.6%) from Monday) so far from the virus we're now completely ignoring though I'm kind of looking at what is now 216 infected outside of China vs 183 on Monday as only up 33 and that's just 18% outside of China. The good news this morning is China claims to be close to a treatment that seems to work for virus patients and we now have 988 people recovered – twice as many as have died so – progress!

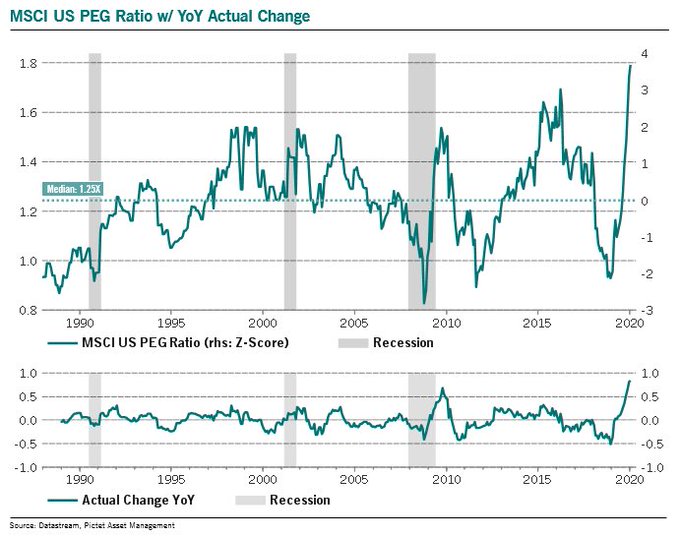

As we also noted on Monday, Gilead (GILD) is making progress on a vaccine, as are others so we should be happy with the progress but now we're back to our original problem which is that stocks are just too darned expensive in the first place. The US PEG Ratio (Price/Earning divided by Growth) has NEVER been higher than it is now and that means stocks have never been more expensive relative to their actual growth:

That's in general, of coruse, our job is to look for stocks that are specifically good buys, like GILD was on Monday and Freeport McMoRan (FCX) was yesterday. FCX was part of our overall call on a potential China recovery strengthening copper prices, which was good for our Copper Futures (/HG), which gained another $1,875 as of this morning and we should probably sell 1/2 (1) at $2.60 to lock in $2,000 in gains and put a stop at the other one at $1,000 so we're up at least $3,000 on the set.

That's in general, of coruse, our job is to look for stocks that are specifically good buys, like GILD was on Monday and Freeport McMoRan (FCX) was yesterday. FCX was part of our overall call on a potential China recovery strengthening copper prices, which was good for our Copper Futures (/HG), which gained another $1,875 as of this morning and we should probably sell 1/2 (1) at $2.60 to lock in $2,000 in gains and put a stop at the other one at $1,000 so we're up at least $3,000 on the set.

Speaking of new trade ideas, I'm going to be on BNN's Money Talk this evening at 7pm this evening and our brand new Money Talk weathered the market storm like a champ and is already up 8.7% after its first quarter, which is very good considering we have deployed NONE of our cash and only $8,000 in margin (out of $200,000) – so we're in excellent shape.

We have 3 solid positions that we're not worried about so it's definitely time to add a couple more and, fortunately, we're very pleased with 2 of the bargains we see so we're going to add new trade ideas on two of our favorite stocks this evening.

Trade #1 will be Freeport McMoRan (FCX) which is unfortunately $12.04 now (was $11.44 yesterday) but that's OK as we can adjust the trade just a bit and still make it work. As I noted yesterday morning: "FCX is a $16.5Bn stock and they are near break-even after spending Billions on expansion projects that don't finish until 2022 which they believe will drive cash flow to around $4Bn but even if it's $2Bn, that's a very attractive price for the stock but traders don't like to wait while I'm very happy to establish a long-term position."

That was for our Long-Term Portfolio and we'll do a smaller position for the MTP as follows:

- Sell 10 FCX 2022 $12 puts for $2.50 ($2,500)

- Buy 20 FCX 2022 $10 calls for $4 ($8,000)

- Sell 20 FCX 2022 $15 calls for $2 ($4,000)

We're staying conservative and our worst case would be owning 1,000 shares of FCX at $12 ($12,000) plus whatever cash we lose on the spread. The net cash outly is just $1,500 on the $10,000 spread and the upside potential at $15 or better is $8,500 (566%) if all goes well but even at $12, the trade returns $4,000 for a $2,500 (166%) profit – and that's our starting point! The ordinary margin requirement on the puts is just $770 – so it's a very margin-efficient trade as well.

Our 2nd new position for the MTP is one I am thrilled with and that's IMax (IMAX), who have been clobbered on the China shut-down and New Years is their big time of year but, as a long-term investment, this too shall pass and it's incredible that we get to jump into this stock this cheaply so our trade idea will be:

- Sell 10 IMAX Setp $18 puts at $2.50 ($2,500)

- Buy 20 IMAX Sept $15 calls at $3 ($6,000)

- Sell 20 IMAX Sept $20 calls at $1 ($2,000)

The only problem is that IMAX Sept $20 calls are currently 0.75 so, initially, we're going to have to lay out $3,500 and, hopefully, we'll be able to reduce our outlay to $1,500 when we are able to sell the short calls so it's a bit of a gamble but I have faith that this should be the bottom for IMAX and I really think it's silly to sell the short calls for $500 less than we need to. When all is said and done, this should be just like FCX as it's a net $1,500 investment on a $10,000 spread with $8,500 (566%) profit potential but we only have to wait until September 18th to collect if all goes well! The put sale is more aggressive so the margin is $1,437 but it's over a much shorter period of time – so I still like it.

That will leave us with 4 positions in the MTP and we started with $100,000 and we're up $8,738 after a bit less than 3 months but let's check our potential gains (you should ALWAYS check your potential gains) to make sure we're on track to make another 8% over the next quarter (as we don't touch this portfolio between appearances).

- Sunpower (SPWR) – I think we got a fantastic entry on this one and we're only up $515 on the short $8 puts and SPWR is already over $8 so we have $2,585 left to gain with high confidence.

- Barrick Gold (GOLD) – We were very conservative on this spread and it's already up $2,603 at net $3,277 but it's a potential $12,000 spread if GOLD manages to hold onto $17 into Jan 2022 and I feel confident we'll gain the other $8,723 (266%) by then so it's actually good for a new trade – even if you missed our net $675 original entry.

- IBM (IBM) – IBM was last year's stock of the year (GOLD is this year's) and our target was $150 by the end of this year and here we are (again), so we'll see if it sticks this time. We caught a great entry in November and the stock is up 10% since then and our $460 net credit on the spread is now net $5,160 so a net gain of $5,620 (1,222%) so far but it's a $16,000 spread so we still have $10,380 (185%) left to gain in a trade I'm extremely confident with – a keeper!

So that's net $21,688 left to gain on our original trade ideas and $17,500 from our two new trades means we have $39,188 expected and mostly over 7 more quarters so $5,998 (6%) gains per quarter means we'll be on track but the IMAX trade should make $1,000/month so yes, we'll make another $8,000 (8%) by June and, if we remain on track, we'll be able to add 2-3 more longs and kick this sucker into a higher gear!

Until then, back to our day jobs…