Yep, we're still talking about the virus.

Yep, we're still talking about the virus.

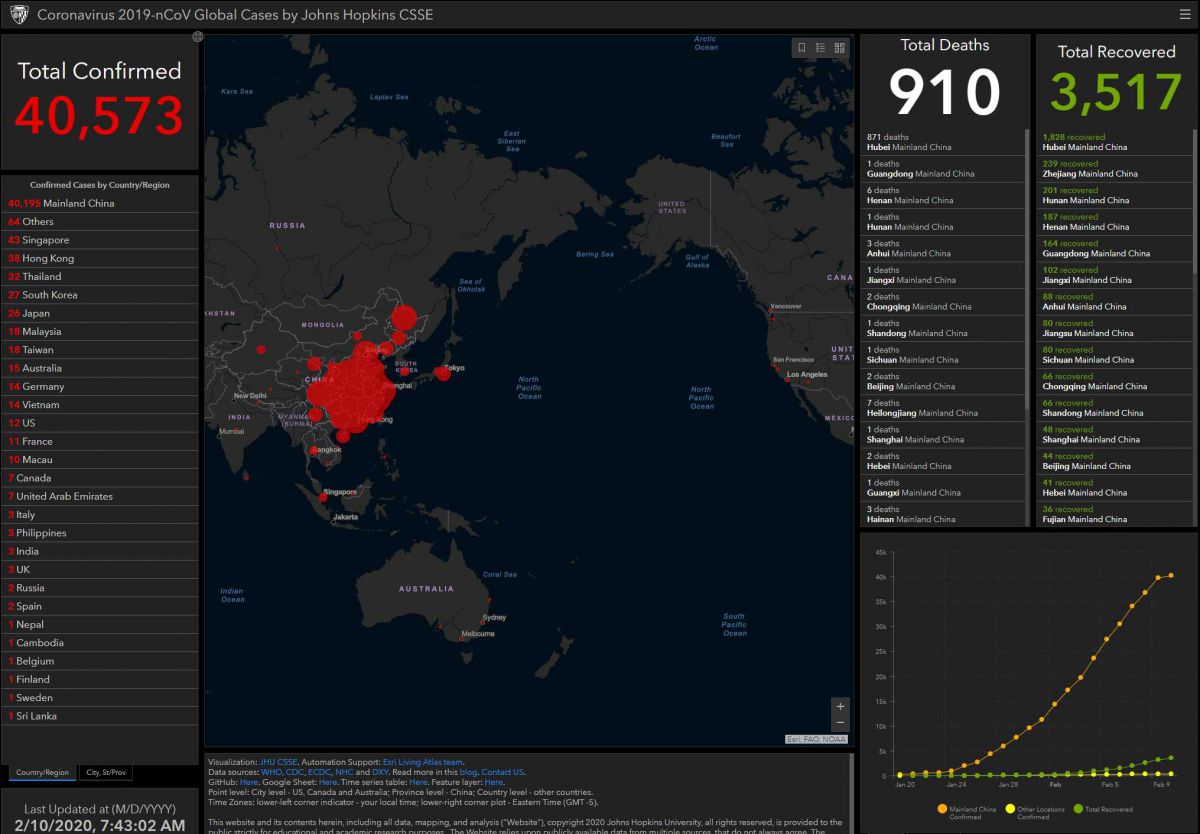

The good news is, 3,500 people have now recovered and "only" 37,000 people remain ill. Oops, 36,000 – the other 1,000 are dead but hey – why should that worry the US Stock Market, which has the ability to ignore everything, it seems… I HATE to be an alarmist but I am alarmed and not many other people seem to be so I'm going to bring it up – just to maintain awareness until it's really not a worry.

As you can see from the chart, China has hardly been completely covered over with virus hot-spots and I can still see most of the word "Tokyo" (because it's out in the ocean and no one is affected there yet) and only MAJOR cities in the US have the virus so far – why would anyone worry about that? Last Monday, there were 17,400 people infected and 364 people dead so one could argue that this is more and one could say that green line on the chart, representing Global Infections, has begun to take off – after being flat all month while we "got it under control" but not me – I'm NOT an alarmist….

The Monday before that (Jan 27th), we were at 3,000 people and hardly anyone was dead but I predicted fighting the virus would cost hundreds of Billions of Dollars and knock $400Bn (2.8%) off China's GDP which, of course, would bleed through and affect other economies – all that remains to be seen, of course.

Last week, the markets got a pop on word there was a "cure" (viruses are not cured) and a vaccine (vaccines take months to create and more months to manufacture) in China and both turned out to be BS but, as we have learned in the age of Trump, it doesn't matter if something is true or not – as long as it works. In fact, just this weekend, we got this cheery note:

Last week, the markets got a pop on word there was a "cure" (viruses are not cured) and a vaccine (vaccines take months to create and more months to manufacture) in China and both turned out to be BS but, as we have learned in the age of Trump, it doesn't matter if something is true or not – as long as it works. In fact, just this weekend, we got this cheery note:

A cluster of cases in France, Spain and the U.K. confirmed over the weekend all appear to have links to a French ski resort, where the infected people had contact with a British man who had just returned from the conference in Singapore. The meeting, which took place at the Grand Hyatt hotel, was organized by an unidentified company in January and attended by more than 90 foreigners.

The spreading pattern is reminiscent of the SARS outbreak in 2003, when a single infected doctor transmitted the disease to multiple people and it was then carried around the world. Malaysia and South Korea had already confirmed cases of the virus linked to the Singapore meeting last week, and the cluster of European cases indicates that the meeting has become a major seeding event.

Anyway, I don't want to dwell but I do suggest reading up a bit, to keep yourself aware of the risks:

- European Spread Brings Worry; Wuhan Cases May Peak: Virus Update.

- WHO Chief: Concern Over Virus Spread From People With No China Travel.

- Inundated With Flu Patients, U.S. Hospitals Brace for Coronavirus

- Death Toll Hits 904 as China Sets $10 Billion Plan: Virus Update.

- China’s Battered Banks Brace for Worst-Case Economic Scenario.

- Hong Kong Is Showing Symptoms of a Failed State.

- Powell to Confront ‘New Risk’ to U.S. Economy from China Virus.

- ‘I’m So Sorry’: Coronavirus Survivor’s Cross-China Travel Left Dozens Quarantined.

- Coronavirus updates: Amazon pulls out of Barcelona conference, 14 Americans test positive on cruise.

- Chinese Copper Buyers Cancel Orders Around The Globe As Economy Grinds To A Halt.

- Coronavirus 'Super-Spreader' Infects 57 In Hospital As China Continues To Refuse CDC Help.

- Where did they go? Millions left city before quarantine

- A Chinese citizen journalist who went viral for his reporting on coronavirus from Wuhan has gone missing, and his family says he's been forcibly quarantined.

- Expect "Cascading Global Impact" As Coronavirus Causes Massive Manufacturing Disruptions Worldwide.

- Coronavirus forces Foxconn to keep closed all iPhone assembly plants

So, you can see why I'm a bit concerned. Though really, that's nothing compared to my concern over this:

Temperatures on the continent range on average from 14 degrees Fahrenheit (minus 10 degrees Celsius) on the Antarctic coast, to minus 76 degrees Fahrenheit (minus 60 degrees Celsius) at higher elevations of the interior, the meteorological organization said.

Its ice sheet, which is nearly three miles thick, contains 90 percent of the world’s fresh water.

The Antarctic Peninsula, the northwest tip near South America, is among the fastest warming regions of the planet, the meteorological organization said. Antarctica is about the size of the United States and Mexico combined, according to NASA.

The high temperature is in keeping with the earth’s overall warming trend, which is in large part caused by emissions of greenhouse gases.

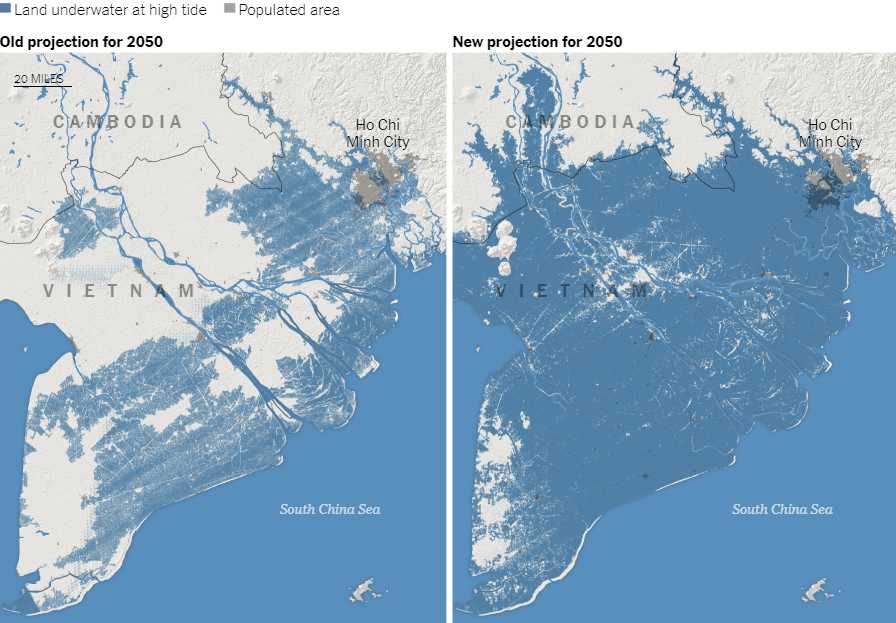

What, us worry? Florida looks pretty much the same as Vietnam, with most of the land below Orlando sinking into the Ocean over the next 30 years but, amazingly, we are ignorning that too! Literally people buying propery in Miami will need boats to access the 2nd floor before their mortgages are paid off…

What, us worry? Florida looks pretty much the same as Vietnam, with most of the land below Orlando sinking into the Ocean over the next 30 years but, amazingly, we are ignorning that too! Literally people buying propery in Miami will need boats to access the 2nd floor before their mortgages are paid off…

Of course the fishing is going to be fantastic – so there is a bright side with the World's largest artificial reef made up of millions of retirement homes, tailer parks and strip malls. I think, if we ignore it hard enough, it might just go away – right?

Trump's new $4.8Tn budget ($1Tn deficit – and that's optimistic) has a $740Bn Military Budget, creates a Space Force and has a Mission to Mars but allocates no money to either Climate Change or Infrastructure Spending. I guess we really are going to test that theory that, if we ignore it hard enough, it will all go away on its own.

There is a certain point at which the rest of the World may consider the actions of a rouge nation, who is playing with dangerous weapons of mass destruction that may threaten the existence of life on Earth, as the threat that needs to be dealt with by force. Greenhouse gases are becoming such a threat and Nicaragua, Syria and the United States of America are the only 3 countries in the World that haven't agreed to stop using these weapons of mass destruction under the Paris Agreement. What would you do if you were the learder of one of the other 186 countries?

No wonder Trump feels the need for a bigger and bigger Military – we may need them to defend our Carbon Criminal Corporations. These tariffs are nothing compared to the Global boycotts that will begin hitting them in a few years if the US continues to refuse to cut their emissions in-line with the rest of the World but by failing to budget for carbon-neutrality now – we make it impossible to comply down the line as well – we'll be too far behind to change our ways without massive economic upheaval.

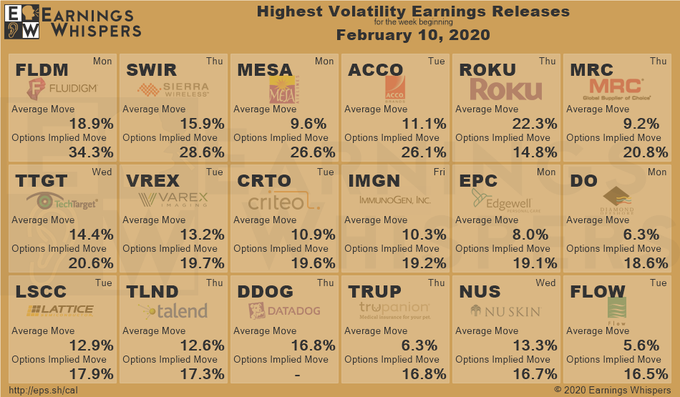

Not too much mention of the virus or global warming from the first half of earnings season. We're still very busy in the 2nd half and we'll see how things go – I'll be very interested to hear what Hilton has to say and Barrick (GOLD) reports on Wednesday and they are our Stock of the Year, so fingers crossed:

I'll put up the data chart but data doesn't really matter, does it? Earnings don't seem to matter either in this very silly market. I used to think reality was lurking just around the corner but now I'm not so sure it's even a thing anymore. We shorted the indexes on Friday (S&P Futures are up $1,500 per contract – you're welcome!) and they seem bouncy pre-market but that's even less real than the regular trading hours, so we're still waiting and seeing. If oil fails $50 things could get very ugly in energy and that would be a catalyst to drag things even lower:

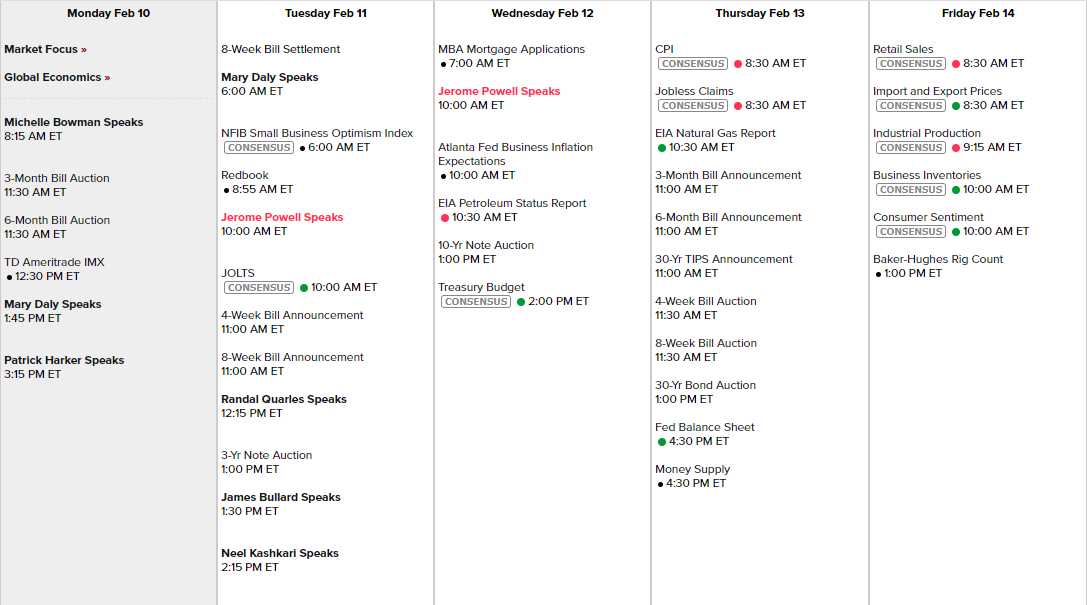

That's 7 Fed speeches and Powell testifying before Congress – should be an interesting week.