When You Were Born > Everything Else

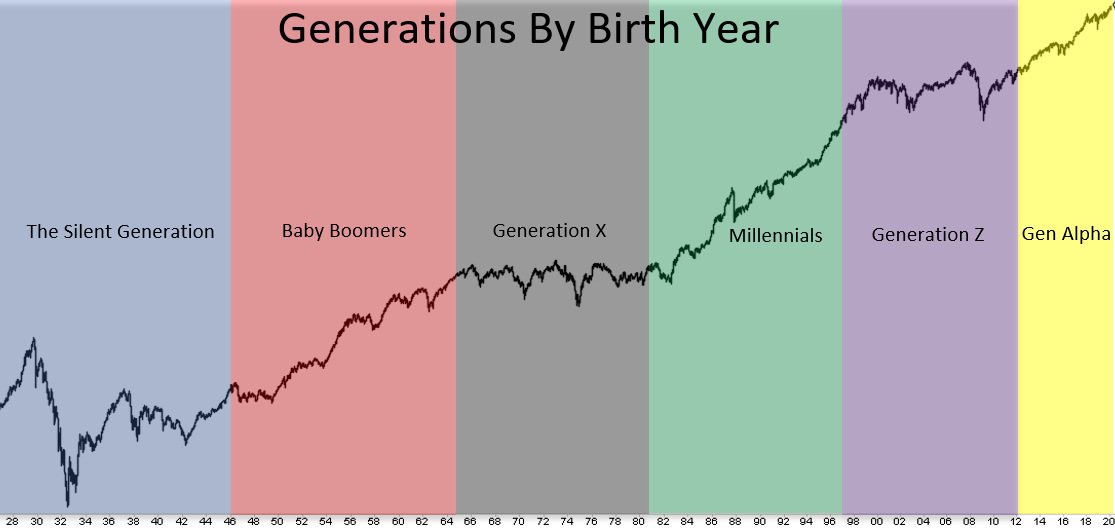

Courtesy of Michael Batnick

What is the most important factor behind one’s investing experience? Is it their ability to analyze a business, their temperament, or their network? It’s none of these things. For almost all investors, the most important driver of investment returns is the year you were born, and therefore how old you are when you began investing.

One of my favorite data points ever, courtesy of Nick Maggiulli, is that if you had invested from 1960-1980 and beaten the market by 5% each year, you would have made less money than if you had invested from 1980-2000 and underperformed the market by 5% a year.

I made this chart* that shows what the market was doing as different generations turned 22 years old, an age where people first start investing. Perhaps 30 would have been a better time to show the beginning of one’s investing journey, but the point remains that you have no control over the environment around you.

There are ways to make money in bad markets and ways to lose money in good ones, but by and large a rising tide lifts all boats and treacherous waters sink them. There’s no getting around the fact that for most investors, when you were born will trump everything else.

It’s unsettling to acknowledge that the experience we have in the market hinges on something that’s entirely out of our control, but hey, like De Niro told Pacino in The Irishman, “it’s what it is.” Plan accordingly.

*the chart below shows generations by birth year. It’s impossible not to notice that these just so happen to line up almost perfectly with different regimes, alternating from bearish to bullish. I say “just so happen” because I don’t believe there is any causality here.