Wheeee, this is fun!

Wheeee, this is fun!

We talked about how manipulated the market is yesterday morning and, in our Live Trading Webinar in the afternoon (1-3pm Wednesdays) we decided on the following Futures positions:

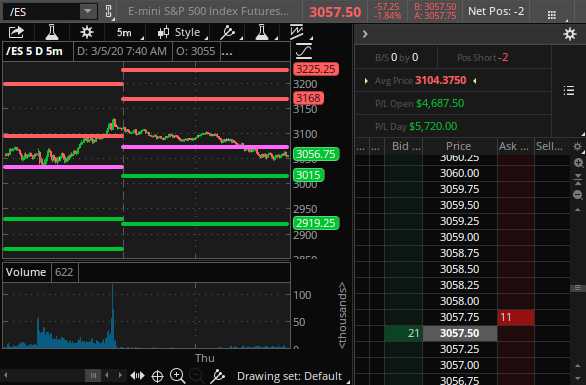

Shorting /ES at 3,100 and long /CL at $46.90.

3,100 is, of course, the strong bounce line on the S&P 500 (/ES) Futures that we drew for you in our Morning Report and we did go a bit over but we decided to stick with it because yesterday's rapid move higher was just silly as nothing has really changed. On the other hand, we went long on Oil (/CL) Futures because something was about to change as we expected OPEC to announce production cuts. And why did we think that? BECAUSE WE KNOW HOW TO READ THE NEWS! Trading is not that hard folks – we just read, think and trade…

As you can see from our /ES position, we're already up $5,720 on 2 contracts and we'll put a stop at $5,000 to lock in those gains or, once we fall below 3,050 on /ES – that becomes the stop with a goal of 3,020. That's over $30,000 in Futures gains since the market began turning down, making a lovely bonus hedge to our portfolios. That's why we keep shorting the market – it's not so much we are uber-bearish – it's just that we have plenty of long positions so, to BALANCE the portfolio, we prefer to look for things that profit when the market turns down. OIl (/CL) is an exception as it's a news-driven trade.

Oil is surprisingly still at $46.90, I suppose because virus fears are back this morning (yes, it's getting worse but I'm bored talking about it now that everyone else is) DESPITE the FACT that OPEC just annnounced a MASSIVE 1.5Mb/d production cut, so there's still time to join us in the most obvious bet of the week!

"We now convene at a time when the outbreak of COVID-19 has had a **pronounced** adverse impact on economic and oil demand forecasts in 2020, particularly in the first and second quarters" – OPEC President Manuel Fernandez

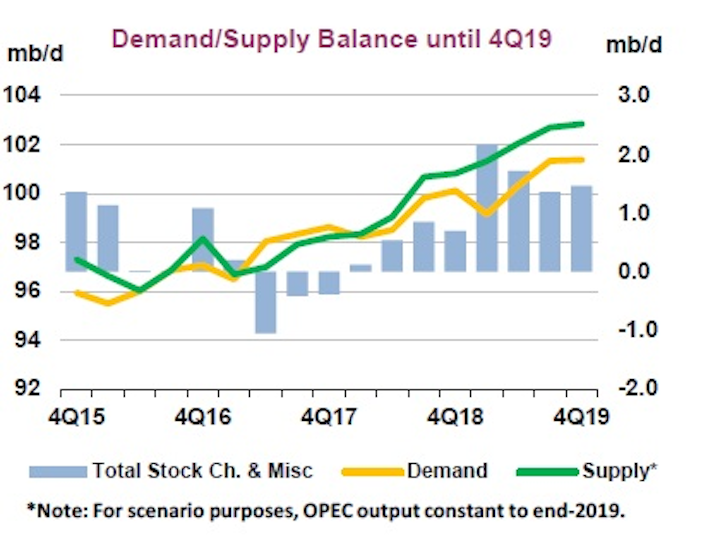

This will not help oil much but we should get to $48.50 (not necessarily today), which would be gains of $1,500 per contract – so we'll take that, right? The problem is OPEC has already cut 2.1Mb/d in the past few years and now they are cutting 1.5Mb/d because there is still a glut but that means now there is 3.6Mb/d of spare capacity, so much so that it takes the supply risk factor off the table and that is what generally drives Futures prices higher, not so much demand.

This will not help oil much but we should get to $48.50 (not necessarily today), which would be gains of $1,500 per contract – so we'll take that, right? The problem is OPEC has already cut 2.1Mb/d in the past few years and now they are cutting 1.5Mb/d because there is still a glut but that means now there is 3.6Mb/d of spare capacity, so much so that it takes the supply risk factor off the table and that is what generally drives Futures prices higher, not so much demand.

Unless the US joins OPEC and agrees to limit their supply of oil, prices will remain generally under pressure above $55 as the constant grind of electric cars, fuel efficiency and other manfufacturing efficiencies take their toll on oil demand – including the cutbacks in plastic use, which is about 10% of the World's Oil Consumption (10Mb/d) and plastic water bottles are litterally an act of environmental terrorism:

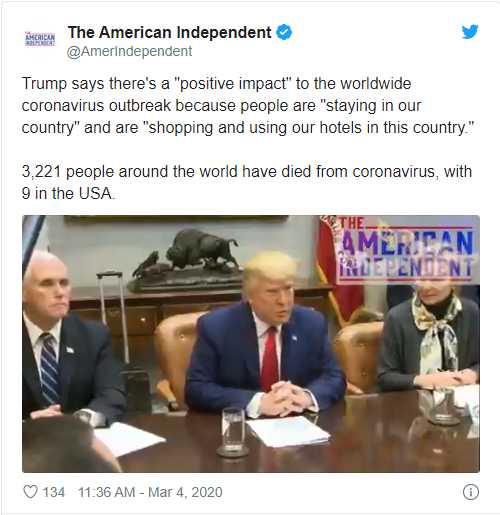

And yes, I have a big bottle of Fiji right next to me as I write this because I'm not better than you are – I just think it's important to be aware of the damage we're doing but, clearly, we have bigger fish to fry this week as civilization is crumbling around us but at least Nero is pleased:

Yes, it's not The Daily Show or Our Cartoon President – this is our actual Commander in Chief talking about the positive impact of the virus that he clearly has no real plan to control. The Fed did what they did and other Central Banks are promising action and Congress just pledged $8.5Bn to fight the virus while the ECB is putting $50Bn to work but this is likely a drop in the bucket to what it's going to cost to contain this thing and that too is a drop in the bucket compared to the staggering economic damage this virus is doing.

Yes, it's not The Daily Show or Our Cartoon President – this is our actual Commander in Chief talking about the positive impact of the virus that he clearly has no real plan to control. The Fed did what they did and other Central Banks are promising action and Congress just pledged $8.5Bn to fight the virus while the ECB is putting $50Bn to work but this is likely a drop in the bucket to what it's going to cost to contain this thing and that too is a drop in the bucket compared to the staggering economic damage this virus is doing.

On the bright side, I can fly to California and stop off to see my daughter in Philadelphia for $350 round trip from Fort Lauderdale and I'll probably have the plane to myself and a good chance of getting an upgrade in a half-empty hotel because people are indeed "staying home" – but not in the good way Trump envisions. The question is, do I want to risk the trip? I live in a tourist town so silly of me to avoid travel but, despite my generally pragmatic outlook on these things – I still have some doubts as we simply don't know enough to make good decisions in this regard.

“In a dying civilization, political prestige is the reward not of the shrewdest politician, but of the man with the best bedside manner. It is the decoration conferred on mediocrity by ignorance.” – A Coffin for Dimitrios