Don’t Catch a Falling Knife

Courtesy of Michael Batnick

Courtesy of Michael Batnick

What do you call a group of stocks that fell 10%, then another 20%, then another 30%, then another 40%, and then got cut in half? Oil services. This group of stocks, think Halliburton, Schlumberger et al., are collectively down 86% from their peak in 2014.

If you know absolutely nothing about investing, you know the phrase “buy low sell high.” This idea makes sense in theory, but in reality these four words have been responsible for more wealth destruction than any other quote in the investor’s tool box.

Drew Dickson shared an insane story today about an e-commerce software company that he covered during the dotcom bubble. It had a market cap of over $70 billion at its peak, and today it’s down to $30 million. Drew said:

That means it fell by 75%, then another 75%, then another 75%, and then another 75%. And then another 90%.

Stocks can fall a lot lower than you think is possible, and when they’re crashing, there’s almost always a good reason why.

Which brings us to today.

The Coronavirus has slowed down travel and decimated these stocks like they’re banks in the financial crisis. The airline index fell more than 3% every single day last week. They fell nearly 4% on Monday, and another 9.3% today [3-6-20].

Royal Caribbean went from $135 on January 17th to $65 today. Four years wiped out in 32 days.

I understand the temptation to step in and buy, but catching a falling knife doesn’t usually work out well.

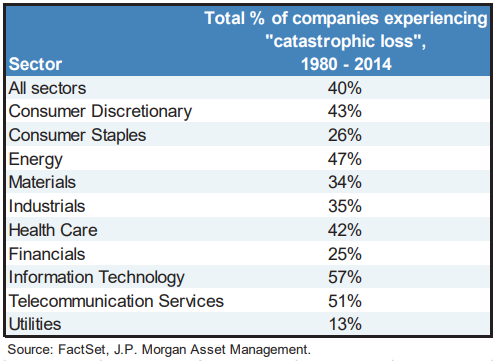

According to a great study by J.P. Morgan, 40% of all stocks experience a catastrophic decline from which they never recover.

If you’re going to try and be a hero, it’s critical that you have a game plan. First of all, you need to determine what you’re really trying to accomplish. Are you trying to call the bottom for a quick trade? If so, maybe wait for these things to stop crashing.

If you’re trying to build a position because you think they’ll be higher in a few years, then you have plenty of time to accumulate the stock. For example, if you want to risk $1,000 in one of these names, you don’t need to buy the whole thing in one shot, you can buy in increments. $250 at $50, another $250 at $45, etc. Or you can buy $500 today another $500 two weeks from now. Whatever you decide, the key here is that you have a system in place that you commit to paper. These things are moving way too fast to make decisions during market hours.

It’s also critical that you have an exit plan, especially if you’re just looking for a quick bounce. If you get lucky and catch the bottom, make sure you don’t turn a trade into an investment.

Buy low sell high sounds great, but usually knife catchers buy low and sell lower. If you’re going to play this game, make sure you do it responsibly.

Source: