After finishing down 2,000 (10%) points on the Dow and 260 (9.55%) on the S&P, this morning the Futures are limit up.

After finishing down 2,000 (10%) points on the Dow and 260 (9.55%) on the S&P, this morning the Futures are limit up.

While that's exasperatiing – it can also be very profitable, especially as we played the 2,500 line bullish on the S&P 500 Futures (/ES) and they are now up over $4,000 per contract (you're welcome!) as /ES gains over 100 points in the Futures, hitting the 5% circuit breakers pre-market but there are no upside breakers in regular trading so we'll see how much of that 10% we can recovery now that stimulus talk is beginning to overwhelm virus talk – for today, at least.

We also have our long position on Oil (/CL) which is up another $1,600 per contract this morning as Oil crosses back over $33 and we've been playing those since $30 and already took half off at $32.50 so we're very comfortable letting those ride a bit further with stops back at $32.50 for now.

While $1.5Tn is nice, it may not be enough to keep things going as we're waiting to see what kind of other measures the Government is going to take and it needs to be something good into the weekend or we might sell back off into the close. We expected this, that's why we went long on 10 new positions during yesterday's carnage (see yesterday morning's PSW Report) and why we took the Futures longs but nothing has really changed and what we really need is a well-coordinated response to the virus that restores long-term confidence – that is worth more than any rate cut but, for this Government – it's a very tall order indeed.

Still, it's nice to take a break from all the down days and we've dropped 30% from the top which means, just to get a weak bounce, we need a 6% gain so 5% in the Futures is certainly not enough to get excited about – keep that in mind when people are talking about a 1,100-point (5%) rally in the Dow with bated breath.

Pouring more money on the fire is not going to make the virus go away and won't dampen the economic impact of the virus. It's like giving everyone on the Titanic one Million Dollars and a bucket and claiming you "saved" them. It's what people who aren't actually able to fix things do to buy time (and votes) but it accomplishes nothing in the end – we need to do better!

Pouring more money on the fire is not going to make the virus go away and won't dampen the economic impact of the virus. It's like giving everyone on the Titanic one Million Dollars and a bucket and claiming you "saved" them. It's what people who aren't actually able to fix things do to buy time (and votes) but it accomplishes nothing in the end – we need to do better!

So we will sit back today and see what kind of bounce we get from the Fed's action and whatever BS the Government spins out today but none of it matters – even if we move up over 10% to the Strong Bounce line because that then brings us into the weekend, where things could get worse or better – it's a coin flip. So we'll have to maintain our hedges, no matter how great the rally is going but, fortunately, we added $70,000 worth of longs yesterday that should be in very nice shape, which will offset the losses on our hedges (so we sort of hedged our hedges).

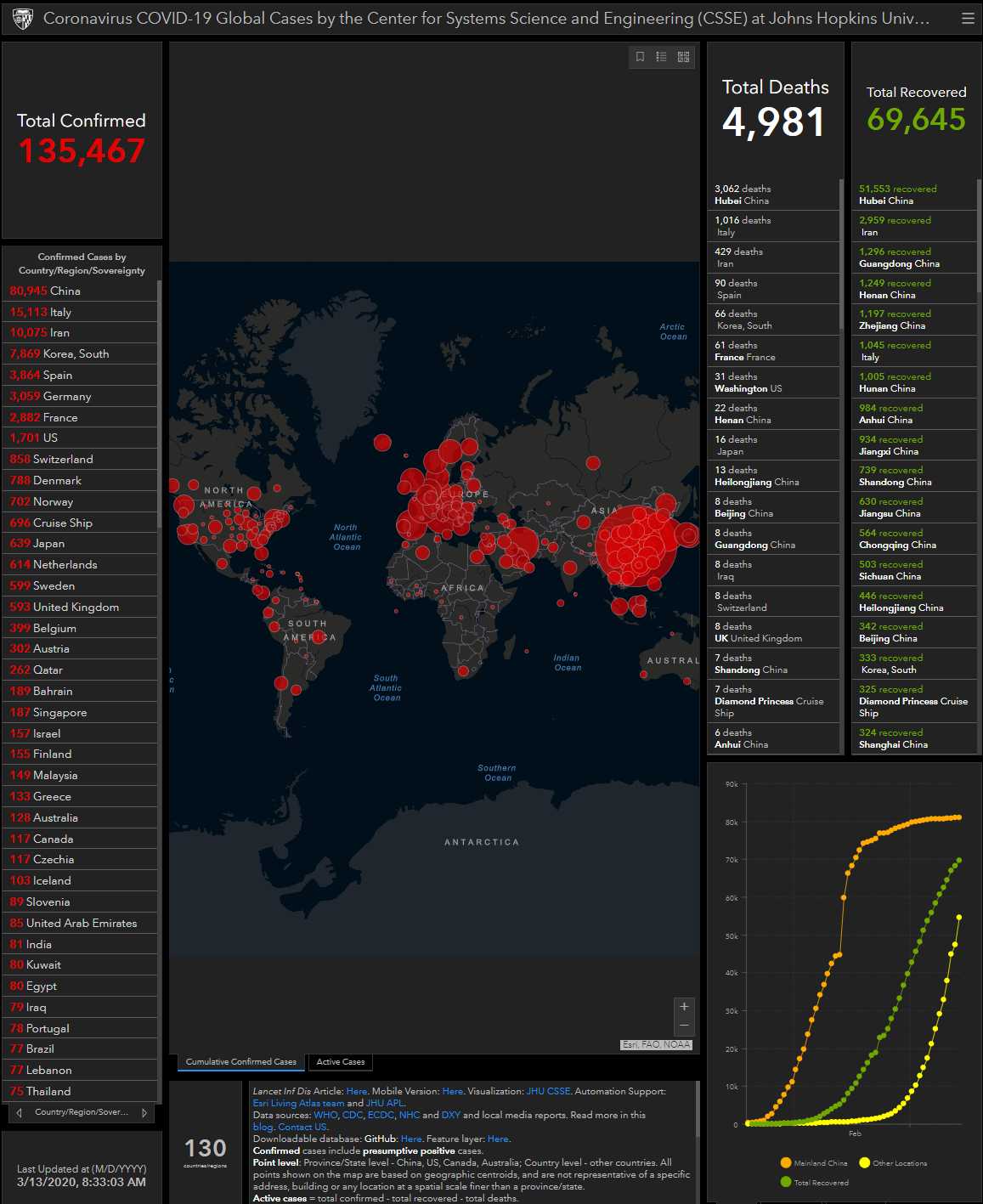

On the virus front, Global infections have jumped overnight by 7,000, which is more than there were in the World TOTAL at the end of January. Even worse, that's out of 48,000 that were outside of China so a 14.5% jump in less than 24 hours indicates we're nowhere near under control and THAT is what the underlying problem is – not whether the Fed Funds Rate is 0.75% or 0.25% – has it impacted your life since they dropped it last week? No? Well – then you see the problem…

We're going to cross 5,000 deaths over the weekend too and possibly 2,000 infections in the US – more numbers that can put people into a panic.

It's going to be another interesting day in the markets.

Have a great weekend,

– Phil