MORE FREE MONEY!!!

MORE FREE MONEY!!!

We're closer to it today than yesterday so the markets have gotten over their temper tantrum about yesterday's delay and now counting the uncountable riches that are about to be thrown around by our Government and our Federal Reserve as well as all the other Central Banksters around the World and we're even having an emergency G20 meeting to discuss even more bailouts for our Top 1% Corporate Citizens because they should never ever suffer the consequences of their bad decisions – like letting the Oligarchs run the World, leaving us totally unprepared to handle a Humanitarian crisis (I know, so many big words to look up!).

“Sentiment has improved, but to call it a turning point is too strong a word for now,” said James McCormick, global head of desk strategy at NatWest Markets. “It is more of a tug-of-war. Policy bazooka is in place, but will be fighting against very weak data and still worrying trends on Covid-19 data. We are more neutral on risk assets now.”

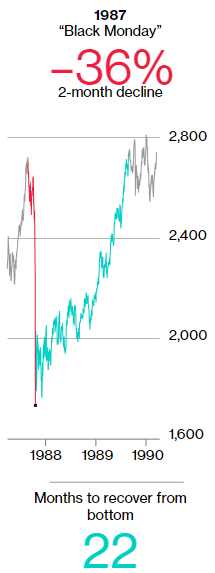

There's a great article in Bloomberg comparing this sell-off to other market sell-offs but the primary take-away on this thing is IT'S ONLY BEEN 6 WEEKS SINCE THE TOP OF THE MARKET!!! In that way, the market collapse is most like 1987, when we were in the middle of a rally that had the Dow going from 2,250 in May to 2,750 (22%) in August after already rallying from 1,300 in 1985 and it was all based on Reagan's tax cuts and trickle down BS that masked the "sudden" S&L crisis that exploded and finally popped the bubble and we tested the lows in early October, about 60 days after the top, firmed up around 1,750-2,000 and didn't really get back on track until Aug 1988 and it was a year after that before we were back at our highs.

There's a great article in Bloomberg comparing this sell-off to other market sell-offs but the primary take-away on this thing is IT'S ONLY BEEN 6 WEEKS SINCE THE TOP OF THE MARKET!!! In that way, the market collapse is most like 1987, when we were in the middle of a rally that had the Dow going from 2,250 in May to 2,750 (22%) in August after already rallying from 1,300 in 1985 and it was all based on Reagan's tax cuts and trickle down BS that masked the "sudden" S&L crisis that exploded and finally popped the bubble and we tested the lows in early October, about 60 days after the top, firmed up around 1,750-2,000 and didn't really get back on track until Aug 1988 and it was a year after that before we were back at our highs.

That's was with MASSIVE intervention by the Government as well. Government intervention is not a magic wand that will fix everything tomorrow or next month or even next year so those of your sitting around starting at your portfolios with your fingers crossed are NOT likely to be very happy about the outcome in the foreseeable future.

These things play out over time but, what we can do – is QUANTIFY the known elements (which we discussed yesterday) and REPOSITION ourselves to take advantage of the eventual bounce. And we will bounce – this is the Dow we are looking at from 1987 – it's at 19,260 now – even after the massive sell-off it's still up 1,000% from where it was 33 years ago – that's 30% average growth per year!

The reason it's 30% per year is because of compounding and the worst thing you can do to miss out on compounding returns is skip a year and that is what you will be doing if you don't adjust your positions. We don't call a bottom because of a chart – we call a bottom because this virus is like a neutron bomb – it doesn't destroy the buildings or the factories – just the people and, as soon as the danger has passed – the people who are left can go right back to work and right back to the movies and shopping malls, etc. This is a temporary problem yet the market is trading like it's a permanent one.

Also, since it's not specific to the US, the World is all in this together so it doesn't really matter how much we spend to fix it as we're all in the same boat and all countries will have more relative debt on their books and the same relative deficits – that does not advantage or disadvantage the US so it's not a major factor in our decision-making.

What matters is whether or not we have an appropriate response. As I have pointed out to our Members, Europe routinely shuts down for the month of August every year and somehow they survive. The US hasn't even been shut down for 2 weeks and people act like the World is ending. Even the President is freaking out and saying this nightmare has to end on day 10 the "lockdown" – which is barely being obeyed.

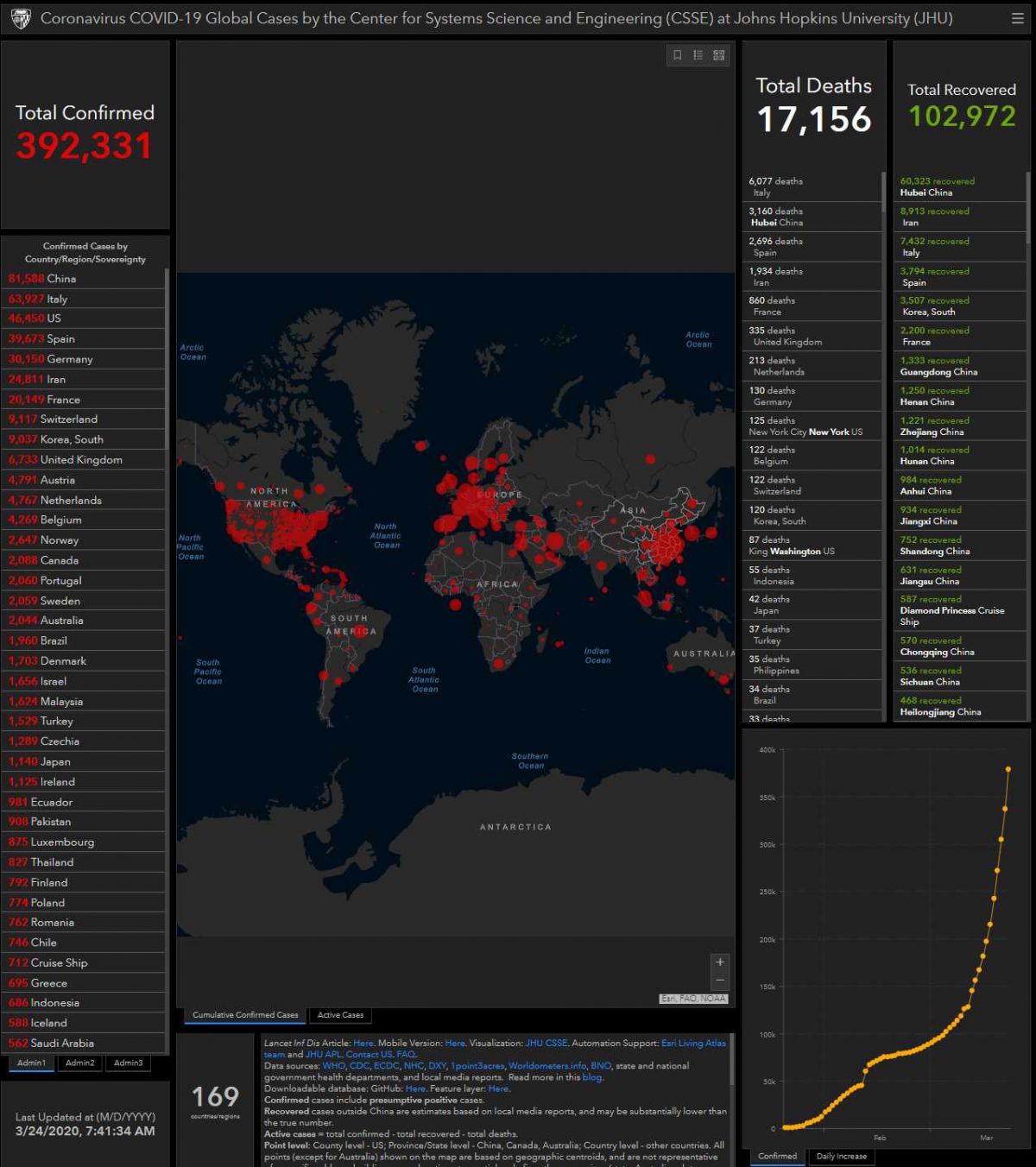

Almost 400,000 people around the World have now contracted COVID-19 with the US rocketing up to 3rd place thanks to our completely inept "leadership" and Italy is about to pass China in number of cases and has already passed China in deaths, with 6,077 people dead from Coronavirus – and China had a 60-day head start!

In order not to freak out Americans, you'll notice that US deaths are broken down by cities – so we don't hit the top of that chart and alarm the voters. They did that with China too but not Japan or India or even Greenland, where all 4 people who have the virus are grouped together and the other 6 people are avoiding them.

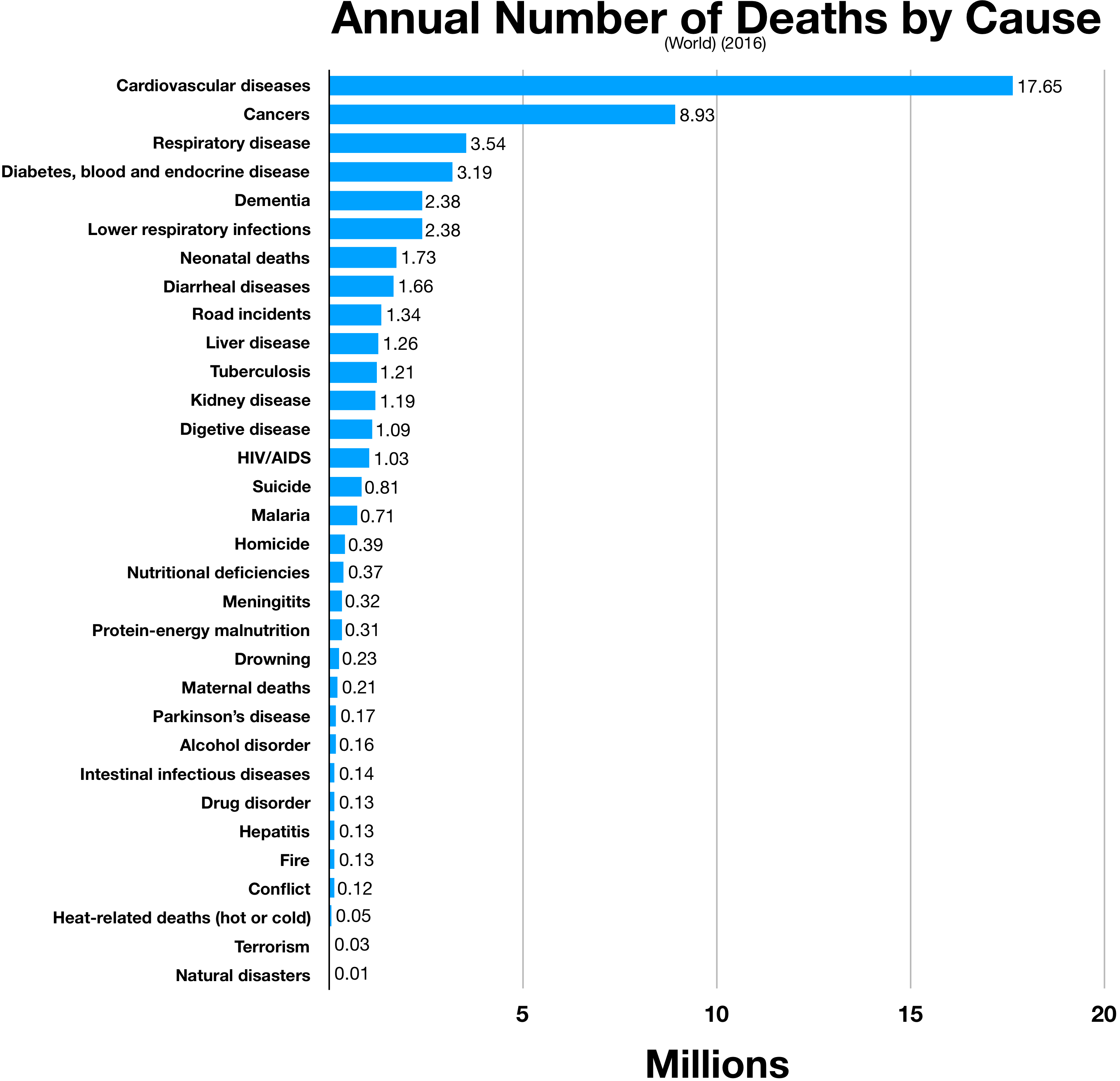

So yes, people have the virus and people are going to die, perhaps 2M people in the US if this thing gets out of control but 2M people die of Dementia each year and 3M from Diabetes and 9M from Cancer and 17M from Heart Conditions… 1M people die of Aids, 400,000 are murdered, 800,000 kill themselves 1.3M are killed while driving.

So yes, people have the virus and people are going to die, perhaps 2M people in the US if this thing gets out of control but 2M people die of Dementia each year and 3M from Diabetes and 9M from Cancer and 17M from Heart Conditions… 1M people die of Aids, 400,000 are murdered, 800,000 kill themselves 1.3M are killed while driving.

These are all horrible numbers but it happens every year and we all get up and go to work the next day and the economy doesn't fall apart because, each year 96M babies are born and we have 8Bn people on this planet and the poorest countries in this World like Burundi, Niger, Liberia, Malawi, Congo STILL have GDP per capitas of $1,000 per person and they don't have internet, electricity or even running water and they don't drive to work or stream videos or cry about how bored they are at home while waiting for McDonalds to deliver dinner and EVEN THEY have a GDP that would place the World GDP at $8Tn.

So, assuming we don't all become ox herders who have to carry well water with jugs on our heads (no offense, poor countries – just illustrating a point), what GDP level do you think the Virus will brink us down to? The current per capital GDP of the US is $65,111 and that sucks compared to Luxembourg at $113,196 or even Switzerland at $83,716 or Macau at $81,151 or Norway at $77,975 or Ireland at $77,771 but we've almost caught up to Iceland at $67,037 – so we have that to look forward to when we are great again...

Anyway, past economic policy failures aside (and every one of those coutnries is Socialist with Universal Health Care), lets say we lose 50M jobs (1/3) and stores and businesses go bankrutpt and it takes us years to recover. What economy would we be like? Will we be like Puero Rico ($31,538), which was devastated by a hurricane? Will we be like Slovenia ($26,234), where our First Lady is from? Will we be like the Bahamas ($33,749) where they always have 30% unemployment?

The average Per Capita GDP for the planet Earth is $11,297 x 8Bn people = $90Tn. Having 1-2Bn people from developed nations drop half of their economic activity would only lower the bar about 10% overall because it's 25% of the people (not even) dropping 50% of their economic activity (not even) = 12.5% total effect. If, on the other hand, you fill up your tank with gas to go hunt and gather food at the supermarket – you have already blown right past the economic output of Melania's family in Slovenia.

The average Per Capita GDP for the planet Earth is $11,297 x 8Bn people = $90Tn. Having 1-2Bn people from developed nations drop half of their economic activity would only lower the bar about 10% overall because it's 25% of the people (not even) dropping 50% of their economic activity (not even) = 12.5% total effect. If, on the other hand, you fill up your tank with gas to go hunt and gather food at the supermarket – you have already blown right past the economic output of Melania's family in Slovenia.

Why then, would you be selling Global Stocks down below 50% of their typical prices when Global GDP is not likely to fall more than 12.5%? That seems like pretty irrational investing yet we're seeing it all over the world because traders trade on fear – not logic and those of us who can remain logical in a crisis have a World of opportunities available to us.

But you won't be able to take advantage of those opportunities by remaining passive. AT&T, for example, fell from $39 in Janauary to $26.77 at yesterday's close (-31%) and they probably won't cut the dividend because it's not like you are cutting off your phone or cable due to the crisis, is it? So $26.77 is probably irrationally low. It's $192Bn in market cap and T made $20Bn in 2018 and $15Bn last year as they merged with Time Warner – and you are not cancelling your HBO subscription either – are you?

So $26.77 is too low as it's only 10x probable earnings but $39 is too much for this environment so, if you are sitting on $39,000 of T stock (1,000 shares) that is now worth $26,770 – what can you do to fix it? Surprisingly, the answer is to selll it and switch to options:

Your premise is T goes back to $39, right? Well we can cash the stock for $26,770 and your plan was to make $13,000 and it might take 2 years to make it back. You were going to hold onto the stock so there's no harm in promising to buy 500 shares at $25 by selling 10 2022 $25 puts for $5.30 ($5,300), that obligates us to buy 1,000 shares of T for $25 – about the price you have them for now.

You can then use that money to buy 20 of the 2022 $23 ($5.50)/30 ($2.85) bull call spreads for $2.65 ($5,300) so now you've spent net $0 to be in the $14,000 spread that pays off if T is just over $30, not $39 in Jan, 2022. Meanwhile, you still have the $26,770 you cashed out and once T is back on track, you can put that money to work on other opportunities rather than having it all tied up in one trade or, if T falls further, now you have plenty of money on the sidelines to adjust your options spread with.

That is the kind of adjustments we did in our Long-Term Portfolio and Butterfly Portfolio yesterday for our Members as well as our 6 other Member Portfolios last week. If you are not going to add to your positions when stocks are 50% off their usual price (not the peak price – the NORMAL price!), when the Hell are you going to buy?

There WILL be stimulus and it will be enough to push our GDP back to normal (ish) in the very near future as long as the virus doesn't plague us for more than 90 days. After that – we'll need more stimulus and a long-term Recession becomes a bigger concern but, as of this moment – if they sounded the "all clear" – you would get up, get dressed and go to the office and all your papers would still be there to shuffle so no lasting damage has yet been done.

You will KNOW when that changes – and that's why we still have our hedges – just in case.