“It’s a make-or-break moment.”

“It’s a make-or-break moment.”

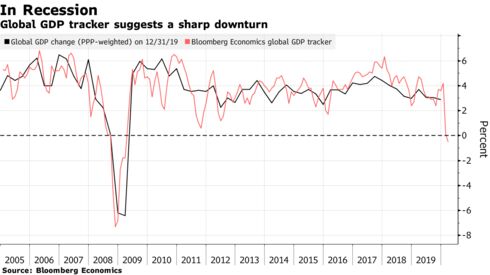

That is according to former IMF chief economist Maury Obstfeld who went on to say: “This may be the greatest global crisis we’ve faced in the postwar period.” Having all taken steps to support their individual economies, failure by the leading Group of 20 countries to now act together could consign the world to “reservoirs of disease” and trigger outward migration from poor countries on “a biblical scale,” said Obstfeld, now a professor at the University of California, Berkeley.

Social distancing and hand-washing are not options in countries where having your own room and running water are luxuries few can afford. The IMF says emerging markets will need Trillions of Dollars worth of aid from developed nations or they will simply become long-standing viral hot-spots that could re-infect the rest of the World at any moment. We are, indeed, all in this together!

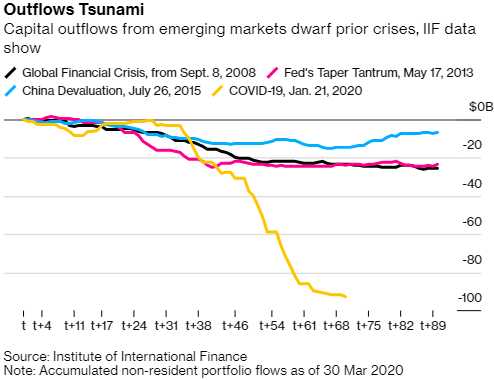

We'll hear more about this at the IMF's annual meeting, which starts tomorrow. At the same time, emerging markets are facing a massive liquidity crisis as they don't have Central Banks that can simply crank up the printing presses when they need to throw money around. Capital has simply flown out of Emerging Markets and is continuing to do so and those are the people who supply a lot of the parts and materials that make American factories run.

We'll hear more about this at the IMF's annual meeting, which starts tomorrow. At the same time, emerging markets are facing a massive liquidity crisis as they don't have Central Banks that can simply crank up the printing presses when they need to throw money around. Capital has simply flown out of Emerging Markets and is continuing to do so and those are the people who supply a lot of the parts and materials that make American factories run.

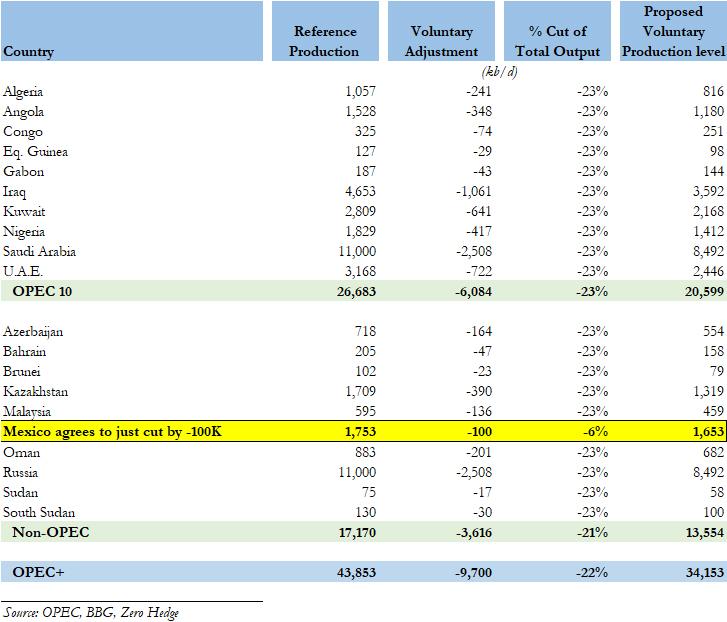

While I could write a whole article on that crisis and it's implications – we don't have time because we need to talk about the Oil Crisis, which also affects Emerging Markets. This weekend, OPEC finally agreed to cut production by 10M barrels/day (9.7 actually) but the US had a 30M/b net build last week and generally we use about 130Mb/week so that's a 19% overall build and, as I said to our Members over the weekend:

Meanwhile, we had a net 30M build this week and that's out of 130Mb production so 19% too much oil being produced gives us an idea of the extent of the pullback in the economy. I know I last filled up about a month ago. In fact, I should go start my car just to make sure the battery is good. Anyway, so OPEC cut 10Mb out of 100Mb/d production is nowhere near enough and we're going to drown in oil soon as we overflow every possible storage space.

Oil back to $22.65 as there's NO DEAL – /RB 0.682, /NG $1.75 – all very tempting but, as I said, 10Mb is never going to be enough though it really is as they are looking ahead to the virus ending and traders are not. In other words, 10Mb/d does nothing to address the current surplus because, if the US has a 30Mb build out of 200Mb, then we're 15% too much and that's 15Mb/d globally but that's not realistic to continue all year and OPEC is looking at a long-term cut and they feel 10Mb for 6 months (1.8Bn barrels) will address the 15Mb/d build for 3 months (1.35Bn barrels) and then some – it's just that they are communicating it poorly and again – people simply don't understand math.

Even though there is a deal this morning, the math on the 10Mb cut simply doesn't work out for the short-term traders and that allows Banksters like Goldman Sachs (GS) (see: "Goldman’s Global Oil Scam Passes the 50 Madoff Mark!") to stir up dissent, saying this historic cut is not enough and putting up very confusing table and claim the actual cut will be much less because, for one thing, non-OPEC nations won't actually cut 21% to fall in-line with OPEC.

THEREFORE, concludes Goldman's analyst, it's really only a 5Mb/d cut when you look at it his way and therefore you, the Retail Investor, should not go long on oil (not until GS's clients are done loading up on it near $20, of course) and then, when oil is back over $40, Goldman will tell you how you'd better get in fast or you will miss an historic rally – while their clients are cashing out their 100% gains. That's how the market works and we are being treated in this cycle to seeing all these manipluation games play out at hyper-speed – which makes them much more obvious if you pay attention.

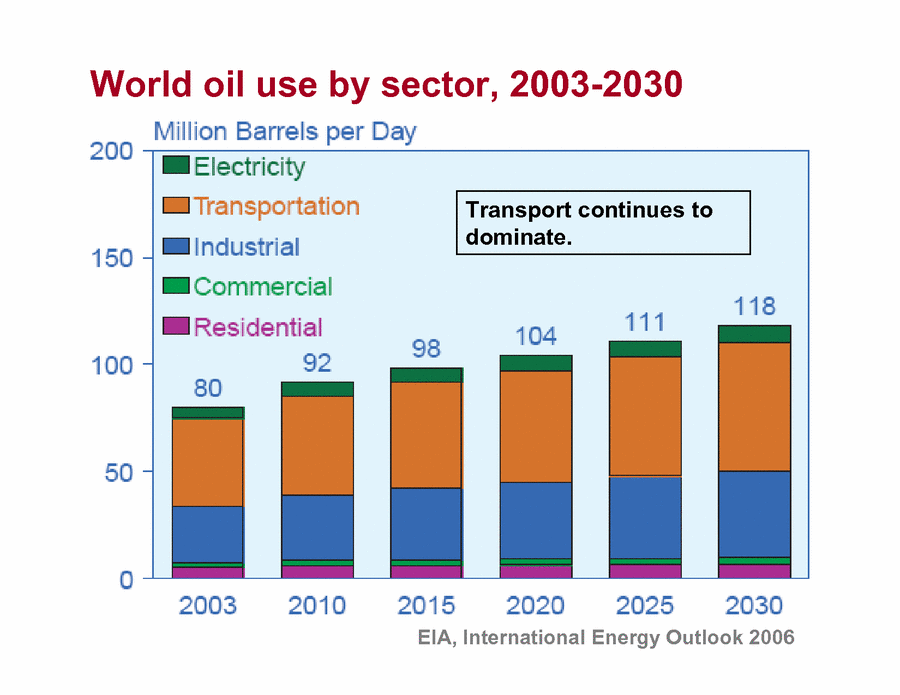

Speaking of storage, by the way, storage tanks in the UAE and around the World are filled to capacity as all those empty roads you've been seeing for the past month begin to take their toll. As you can see from the chart, 50% of the World's oil is used for transportation and 60% of that is used by "Light-Duty Vehicles" or passenger cars.

Speaking of storage, by the way, storage tanks in the UAE and around the World are filled to capacity as all those empty roads you've been seeing for the past month begin to take their toll. As you can see from the chart, 50% of the World's oil is used for transportation and 60% of that is used by "Light-Duty Vehicles" or passenger cars.

So almost no cars are on the road and that means 60% of 50% or 30% (at most) of the oil is not being used. Thiss is very simple math. So if we usually consume 100Mb/day of oil then up to 30Mb/d of oil is not being used but, as I said above, more like 20Mb/d and then for how long? So far, 30 days = 600Mb and let's assume 3 months and we're at 1.8Mb and that means OPEC would have to cut oil production 10Mb/d for 6 months to make up the difference and they feel they've accomplished that.

The problem is that storage is getting full now but the US has 70Mb of spare capacity in the Strategic Petroleum Reserve and other countries do too, so some of the surplus will go there. So I do think this ($22.50) is a good bottom for Oil and we can play the /CL Futures bullish here with a tight stop below the line (and we'd try again at $20 if this fails or any time we're back over $22.50) or we can play the oil ETF (USO) at $4.90 and, while that's fun, we can put last week's lessons to use with the following trade idea:

- Sell 5 XOM Jan 2022 $30 puts for $4.30 ($2,150)

- Buy 30 USO Jan 2021 $3 calls for $2.30 ($6,900)

- Sell 30 USO Jan 2021 $5 calls for $1.10 ($3,300)

That's net $1,450 on the $6,000 spread so the upside potential is $4,550 (313%) in 9 months, which is a pretty good rate of return and you risk owning 500 shares of Exxon (XOM) at net $32.90, which is 25% below the current price. The ordinary margin requirement is just $657 but that's not the point, the point is, if you have $16,450 sitting around and you don't want to take big risks but you wouldn't mind owning 500 shares of XOM as your worst case, either you'll get the stock or you'll get $4,550, which is a 27.6% return on $16,450 anyway.

Lots of people are THRILLED to make 27.6% in less than a year, not our Members at PSW, of course – this is not a trade we'd usually bother with but it's exactly the kind of trade we will be making in our new Hedge Fund, which aims to make nice, steady returns off of very conservative positions with the aim of paying our quarterly "dividends" (not really dividends) by selling puts and calls against our long positions.

For instance, XOM July $52.50 calls are $1 and July $30 puts are $1.20 so we could sell just two of each and collect $440. $440 may not seem like a lot but it's 2.6% of $16,450 so our money is safely on the sidelines, we have committed to buying XOM very cheaply in 2022 and we make $4,550 (27.6%) if oil is over $25 at the end of the year AND, while we wait, we collect 2.6% per quarter – which beats the Hell out of most income funds.

We don't have to manage your money – you can certainly learn to do it yourself and we'll be happy to teach you how. The main trick is to stay well-diversified and well-hedged and to NOT BE GREEDY!!! Most people who blow up their trading accounts in markets like these do so due to over-leveraging and lack of diversity – even more so than lack of hedging. 27.6% is PLENTY of money to make in a year – even without the bonus 10% quarterly pay-outs. Especially in a volatile market – SAFETY FIRST should be your watch-word.

And that brings us to this morning's final topic – Virus Counts. It's depressing but we have to talk about it as the US now has 557,663 out of the World's 1,863,406 confirmed cases and, so far, we also are in last place for testing with just 2.8M tests administered – not even 1% of our population. So the short story is we have no idea how many people are infected and Johns Hopkins has begun to monitor US testing to cut through Trump's BS on the subject. 600,000 infected is 1/500 Americans and we're on a path to be over 1M Americans (1/250) infected by the end of the month – that same time that Trump wants to lift restrictions.

Do you want to go back outside in May, when 1/125 people MAY be infected – perhaps 1/67 by the end of May (5M Americans) if we don't do something to slow the spread NOW? Later is too late and waiting until November is far, far too late – if we are even able to hold an election at that point.

That's why we're still very cautious and we added hedges into the weekend for our Member Portfolios – this is no time to throw caution to the wind. Earnings season begins this week and it's not the earnings that matter but the guidance, or whatever the CEOs say in lieu of guidance – that will mostly be pulled:

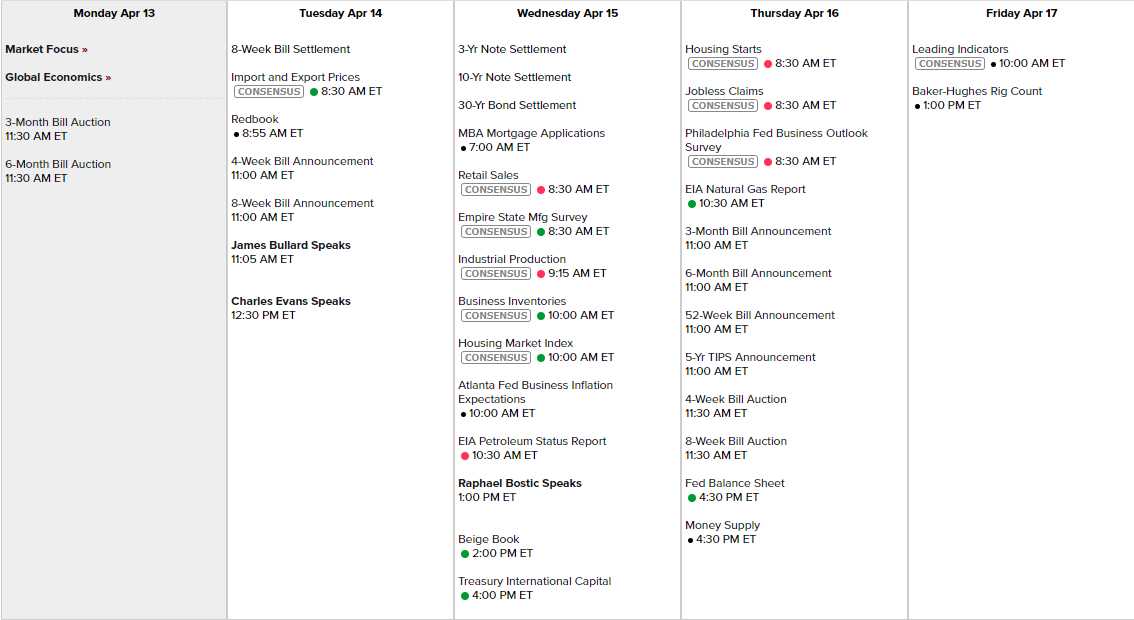

The Retail Sales Report is Wednesday alonw with Empire State Manufacturing and the Atlanta Fed Report and the Fed's Beige Book – which may not be up to date enough to get a real idea of what's happening but clearly the Fed is already terrified and doing whatever it takes to prop up the economy. Philly Fed is on Thursday and Leading Economic Indicators on Friday but it's all about earnings, starting tomorrow.

Be careful out there!