Well this is no surprise.

Well this is no surprise.

Back on April 15th, in our Live Chat Room, I said to our Members:

"What we really care about is the bigger picture and we know 2,850 is our old Must Hold and 2,300 (2,280) is our -20% line and 2,550 (2,565) is our -10% line and that's the range we expect to be in.

Once things calm down, we should range up or down 10% around 2,850 for the 2nd half of the year but I think for the next few months, it's more likely we stay between 2,550 and 2,850 and consolidation there would be nice and healthy for a good move back to the top of the range that's more likely to stick."

For more details on our trading range and how we took advantage of the move, see March 17th's: "2,400 Tuesday – S&P Tests the Bottom of our Target Range"

We expected the top of the range to be a barrier and we lightened up on our longs and added more hedges at the top and, since then, we're pretty much right where we were at the time but this morning we're down yet again on the Futures, down 5% in the last 3 sessions as the Adminstrations "Blame China for Everything" strategy is not really inspiring investor confidence.

Warren Buffett isn't buying this dip and that's kind of disturbing. My long-time readers know how much I love Buffett but I don't always agree with hm these days as he's losing a few steps from what he was so, just because he says something doesn't mean it's true – as evidenced by his sudden love of airlines, now ended as he dumped them all – since he's not confident that industry will recover from the virus any time soon (and "soon" to Warren Buffett is years, not months!).

Buffett said his $137Bn cash on hand "isn't that huge when you think about worst-case possibilities… We don't prepare ourselves for a single problem, we prepare ourselves for problems that sometimes create their own momentum." You can understand why Buffett is upset – Berkshire Hathaway (BRK.B) is down 20% at the moment and probably headed back to down 30% after reporting a $54.5Bn loss in their stock holdings that netted them a $30.6Bn loss for the quarter.

Berkshire is a wonderful proxy for the S&P as it's a selection of well-run companies that are privately held by Buffett as well as his hand-picked selection of stocks. Now that he's gotten rid of those airlnes, I think it might be an interesting play for us again – especially if they re-test the -30% line at $160. The airlines will be interesting to watch today as Buffett announced they had dumped ALL of their airline holding, roughly 10% of UAL, AAL, LUV and DAL and those stocks are all down 10% this morning but that's a bit silly since Berkshire already sold their stake – which is why they are so low in the first place!

Berkshire is a wonderful proxy for the S&P as it's a selection of well-run companies that are privately held by Buffett as well as his hand-picked selection of stocks. Now that he's gotten rid of those airlnes, I think it might be an interesting play for us again – especially if they re-test the -30% line at $160. The airlines will be interesting to watch today as Buffett announced they had dumped ALL of their airline holding, roughly 10% of UAL, AAL, LUV and DAL and those stocks are all down 10% this morning but that's a bit silly since Berkshire already sold their stake – which is why they are so low in the first place!

The airlines are tempting down here but a lot of things are tempting down here and, like Buffett, we have resisted temptation and kept plenty of our CASH!!! on the sidelines. As I said back on April 7th, when the market began to bounce in our Earnings Portfolio Review:

"Smart Portfolio Management is all about BALANCE and we need to be aware of when we are making too much money as acutely as when we are losing too much money. We did not expect a V-shaped recovery but we're getting the start of one with the S&P 500 back over 2,700 already this morning. We are generally expecting 2,850 to be the top of our range so we need to now look at each of our positions and make sure we are comfortable and for sure we will be adjusting our SQQQ hedges to lock in these gains."

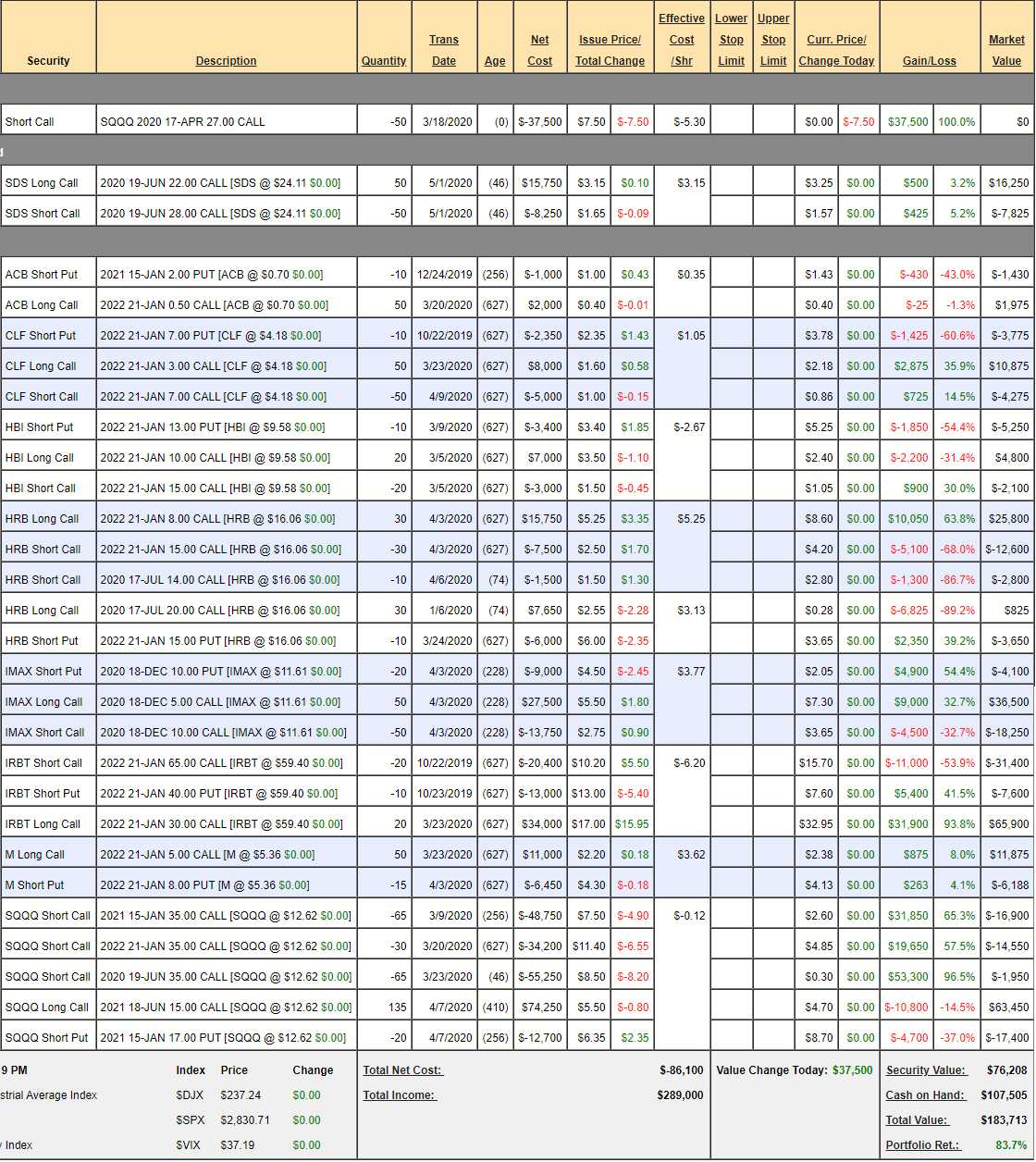

That balance took the portfolio from $155,140 to $183,713 as of Friday's close, now up 83.7% for the year thanks mainly to our hedges, which paid us very well and continue to do so (we unwound the first set at the botttom – this is our second set). This time, to get more bearish, all we need to do is cash in our short SQQQ calls, which is going to happen if 8,600 fails on /NQ!

So far, everything is proceeding as we have foreseen so there's no need to do anything drastic. We are still looking for opportunities but, like Buffett – I'd rather sit on the sidelines for another quarter and see how things shake out as NOBODY knows which way this virus will break as many cities around the World open back up.

"Oh oh people of the earth

Listen to the warning

The Seer he said

Beware the storm that gathers here

Listen to the wise manI watched as fear took the old men's gaze

Hopes of the young in troubled graves

I see no day, I heard him say

So grey is the face of every mortal" – Queen