Oil price: futures markets warn it won't recover after coronavirus

Courtesy of Mark Shackleton, Lancaster University

West Texas Intermediate (WTI) crude went negative for the first time in history this month as oil traders got stuck between a mammoth oversupply and lack of places to store it. The international price of “black gold” remains at the bottom of the barrel.

Oil producers are struggling to shut down their units or to find environmentally acceptable alternatives to dumping product. Sea tankers are finding it difficult to offload and are readjusting routes in their hunt for potential takers, but it’s not easy: COVID-19 has killed demand for oil everywhere.

WTI is trading at about US$17, while the Brent equivalent is around US$25, still the sort of levels where much global oil production is not profitable. Brent and WTI are the two main grades of oil that are used to benchmark prices around the world, with Brent found offshore and being of slightly higher quality than its onshore American counterpart.

More tolerable prices may return soon if the oversupply levels off and then global demand rises as lockdown restrictions are relaxed. But what are the longer term prospects for the price of oil, and how have they been affected by COVID-19?

Energy prices and time periods

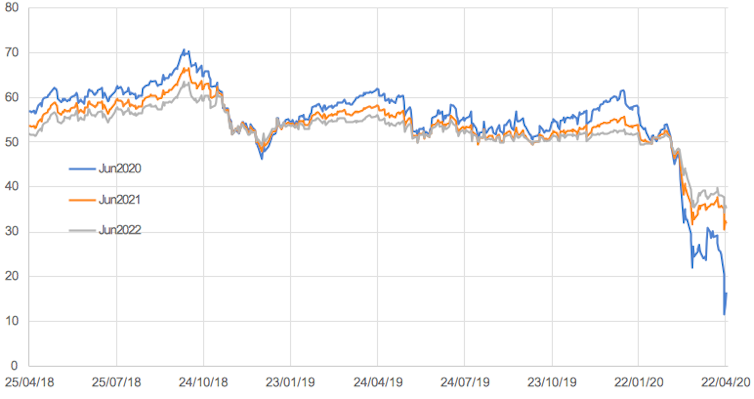

The future price of oil is normally cheaper than the current, or “spot”, price. This reflects the fact that those willing to underpin future oil production with early orders usually get a discount. This can be seen in the graph below, which shows the prices of trading contracts over the past couple of years for oil for delivery in June 2021 (orange) and 2022 (grey) compared to the “spot” price, which is currently June 2020. This year, the normal order from least to most expensive has reversed.

WTI price in US$ for delivery, June 2020-22

Contango and cash. Intercontinental Exchange

This crossover of spot and future prices is known as a contango, or short-term glut. This is certainly not the first contango in energy trading – electricity markets have periods of overgeneration in which producers pay consumers to take power that would damage the generating station otherwise.

Indeed, these events are becoming more common because of the world’s transition from types of energy that can be stored, such as oil, to those that cannot, such as wind and solar power. We’re seeing these events not just in the UK but across the world.

In the present case, the reason for the oil contango is basically that investors think that prices will improve in future as economies recover. The contango is greater than during the financial crisis of 2007-09. Incidentally, there’s no equivalent shift in the price of gas (LNG). The gas price has been supported by the fact that electricity demand has been higher because of everyone being at home during lockdown.

After COVID-19

The previous graph also tells us that investors don’t think the price of oil is going to recover to anywhere near pre-coronavirus levels by June 2022. Two years from now, they think the price will be somewhere between US$30 and US$40.

Even when we look at data for the mid-2020s, the sort of timescale in which you would hope COVID-19 has ceased to be a problem, the markets still don’t foresee a return to previous levels. Contracts for WTI oil in December 2026 are currently trading at slightly under US$46, compared to US$50 to US$55 historically. This time last year, they were trading at US$54.

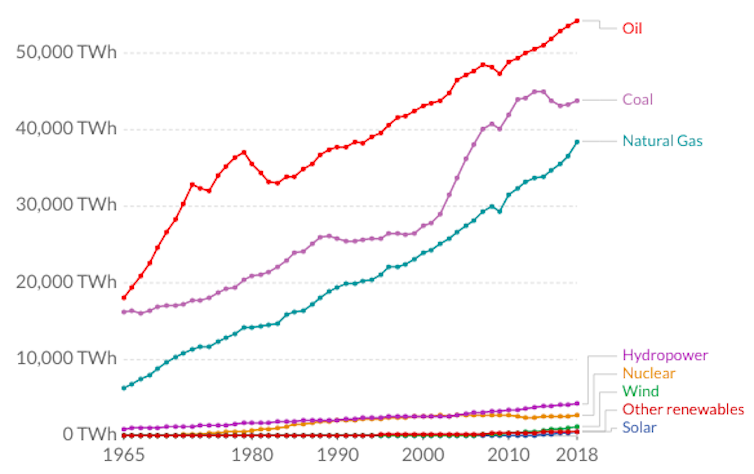

It was already likely to be the case that demand for fossil fuels would decline in the coming years as they face increasing competition from renewable electricity powering everything from home central heating to cars and buses. Coal consumption has peaked, though oil has had at least one advantage. Its high energy density and portability make it hard to replace in aviation, assuming the airline industry becomes viable again. On the other hand, increased tele-working during the pandemic may spur the decline of the daily commute and possibly business trips too.

World energy consumption (TWh) 1965-2018

Our World in Data

This change is reflected in the share prices of the oil majors. Operators such as Exxon and Shell, which have historically been seen as very safe investments, are down 40% since January compared to an overall stock market decline of about 15%.

These are traditionally high dividend payers, though Shell just cut its dividend for the first time since the second world war. Yet even if the current supply glut costs these companies one or two years of reduced earnings and lost dividends, this can’t account for the magnitude of their declines.

Share prices of top five oil majors vs S&P500

S&P500 = blue; Shell = pink; BP = yellow; Chevron = green; Total = purple; Exxon = red. Trading View

The fact that Saudi Arabia has been trying to sell part of its assets by listing Saudi Aramco, the world’s largest oil owner, on the stock market, was itself a signal that they may think the most lucrative years are behind this industry. It had been hoping for a US$2 trillion listing on one of the world’s leading stock markets, but this is now looking less likely. Aramco has scaled down to the local Riyadh Tawadul exchange, with an implied valuation of US$1.5 billion.

The firm had promised to pay total dividends of US$75 billion this year, but this looks a tall order from company cash flows at the current oil price. The signals about future prices will be doing little to reassure investors about buying shares, since they had been holding these stocks for their high dividend yield and now that is getting cut.

So while the transition from oil was already underway, the global COVID-19 lockdown appears to have accelerated it. Oil remains essential for transport, but not as much as before – and gas and renewables continue to increase their share of energy generation. It could well be that COVID-19 has done more for the green revolution than any climate summit.

Mark Shackleton, Professor of Finance, Lancaster University

![]()

This article is republished from The Conversation under a Creative Commons license. Read the original article.