S&P 2,850.

S&P 2,850.

That line is like a magnet and, halfway through the month of May, right where I predicted we'd be when I was on Bloomberg on March 11th (see: "Thursday Failure – Trump Shuts Travel, Provides No Solutions, No Stimulus – Market Tanks (again)" for the recap). That prediction was not for political reasons – it was based on our assessment of the VALUE of the S&P 500 based on what we knew regarding the virus, the stimulus, the political and social environment. You know – Macro Analysis.

There's been a ton of BS thrown around as the virus and our Government's response to the virus, has become such a political issue that I can't even say the President is doing a bad job without getting death threats. My job as an analyst is to tell you what's really going on – whether you want to hear it or not – anything less than that wouldn't just make me bad at my job, it would make me dishonest.

If you want an honest, balanced assessment of where we are now – here's the Mayor of Los Angeles – one of the smartest guys I ever met – giving his assessment of how we stand as cities struggle to re-open:

Also on Wednesday, Garcetti said on ABC: "I think we have to all recognize that we’re not moving beyond COVID-19. We’re learning to live with it." “We’ve never been fully closed, we’ll never be completely open until we have cure,” he added. That's why we got more aggressive with our hedges on Tuesday (ahead of Garcetti) as the S&P approached 3,000 and we did the math and decided that would be a p/e of over 35 on the S&P – a bridge I did not feel even irrational investors and trade bots were willing to cross.

That post became part 7 of our Portfolio Protection Workshop and I strongly urge you to re-read that series over the weekend as we may be approaching another major down leg as the World will hit 5M infections next week and the US alone will pass 1.5M infected as we are still getting 25,000 new cases each day – even as the Government rushes to declare victory and open up the cities.

- Portfolio Repair Workshop Part 1 – Damage Assessment

- Portfolio Repair Workshop Part 2 – Resetting Your Positions

- Portfolio Repair Workshop Part 3 – Adjusting Our Hedges

- Portfolio Repair Workshop Part 4 – Adjusting Our Goals To Reflect Reality

- Strategy For Buying Stocks At A 15-20% Discount

- Portfolio Protection Workshop Part 5 – Don't Get Excited!

- Portfolio Protection Workshop Part 6 – 20 Crisis Trades And Adjustments

- Portfolio Repair Workshop Part 7 – Pressing our Hedges (Just in Case)

As I noted on Tuesday, we take a portion of our unrealized gains (even if they are recovery gains) from our long portfolios and put them to work in our short, hedging portfolio to maintain BALANCE as you never want to be too bullish or too bearish in any market. You may end up being right – but is it really worth the risk?

Back on March 20th, we reviewed our Future is Now Portfolio, which had taken a 10.8% hit as the market headed lower. Our positions were down 30, 40 and 60% but, fortunately, we hadn't bought much yet since all the stocks on our Watch List were too expensive so we were waiting patiently for a correction, which finally came.

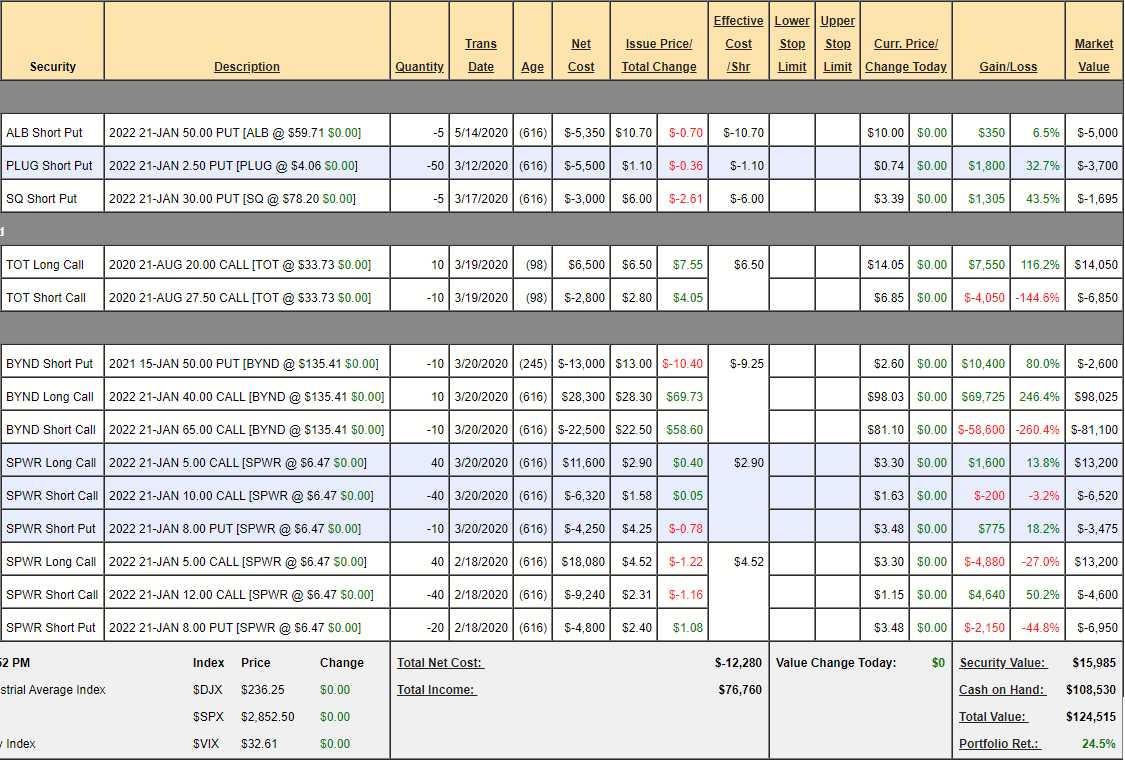

We went through our adjustment steps, getting more aggressive on SPWR and BYND and TOT was brand new, so no adjustment needed. Now, just two months later, we're at $124,515 – up $35,280 (39.5%) off the bottom but only up 24.5% from our $100 start. We just added ALB short puts Tuesday and the rest of the commentary is as follows:

- ALB – Still has that new trade smell!

- PLUG – On track

- SQ – Doing too well, we almost can't keep it up 60% already with 18 months to go. Still, there's a safety factor as it's not just that we can "only" make $1,258 more but that we're fairly positive we will and there's pretty much no way this will be in trouble and the margin is only $423 – so there's no reason not to keep it.

Again, this is why we have Watch Lists. That way, when there's a huge dip in the market, we have a list of stocks we already know we'd like to buy and all we need to do is double-check our premises and see which ones are giving us the best deals and then we're ready to pull the trigger. I guess it's just doing your homework BEFORE it's due – something I struggle to get my kids to appreciate…

- TOT – We were too nervous to sell puts but I think we can be confident $25 was a good bottom so let's sell 5 Nov $30 puts for $3.25 ($1,625) to round out the spread.

- BYND – Got a boost from the meat shortage. People were saying BYND was the only meat left in the supermarket as if that was an indicator that no one wanted it but, to me, it meant a lot of new people were going to try it. We are jokingly in the money on this one at net $15,130 on the $25,000 spread that's over 200% in the money. Although a 40% return is not very exciting for PSW Members – this is certainly good for a new trade with that kind of return.

- SPWR – We liked it so much we played it twice. Both long-term and both with $5 calls and $8 puts – just different upside targets. Potential is net $48,000 for the 2 and currently net $1,350 so there's $46,650 (3,455%) upside potential – so I'd say that's good for a new trade!

So we have about $65,000 worth of upside potential, mostly SPWR, over the next 18 months and we have plenty of buying power so we'll keep our eyes open for positive trends so we can go Back to the FUTURE!!!

Notice we followed the steps of our Portfolio Protection Program (hedges are in our Short-Term Portfolio, which we updated on Tuesday) and we are left with very conservative targets that will make a conservative $65,000 (55%) in 18 months and we still have $108,530 in CASH!!! to deploy

The market doesn't have to go anywhere for you to make money when you trade options SENSIBLY. By sensibly I mean BEING the House – NOT the Gambler!

Have a great weekend,

– Phil