I get it.

I get it.

It's hard to get back over the 200-day moving average so we're not going to read too much into this early failure but it is worrying that we're heading into a 3-day weekend as tensions with China rise and the virus is raging in countries that have re-opened so that MIGHT be considered a set-back on 2 fronts that have moved the market up this year.

If we were to zoom out to a monthly chart of the S&P 500, we could throw out the spike down to 2,200 – as it quickly reversed – but that would leave us with a 3-month, 20% move down to our Must Hold Line that, so far, has only resulted in a weak (4%) bounce with repeated failures at the 5% line.

According to our 5% Rule™, which is NOT TA but just math, consolidating below the weak bounce line means we are more likely consolidating for a move down than up. That would be a move down below our Must Hold Level at 2,850 and back down to test the -10% line at 2,565. It's the same kind of bounce and weakovery that we had back in late 2018 – and we didn't need a virus then to plung 15% in 3 weeks in the second leg down.

All we've done in 2020 is double the scale but the computers are running the same algos they ran then. A one-month drop, a 2-month recovery and then they pull the rug out again (Thanksgiving weekend) and now we're heading into Memorial Day weekend all complacent again. I spent a lot of the Webinar yesterday warning about this so I won't re-hash it all – let's instead look at a good hedge to cover it.

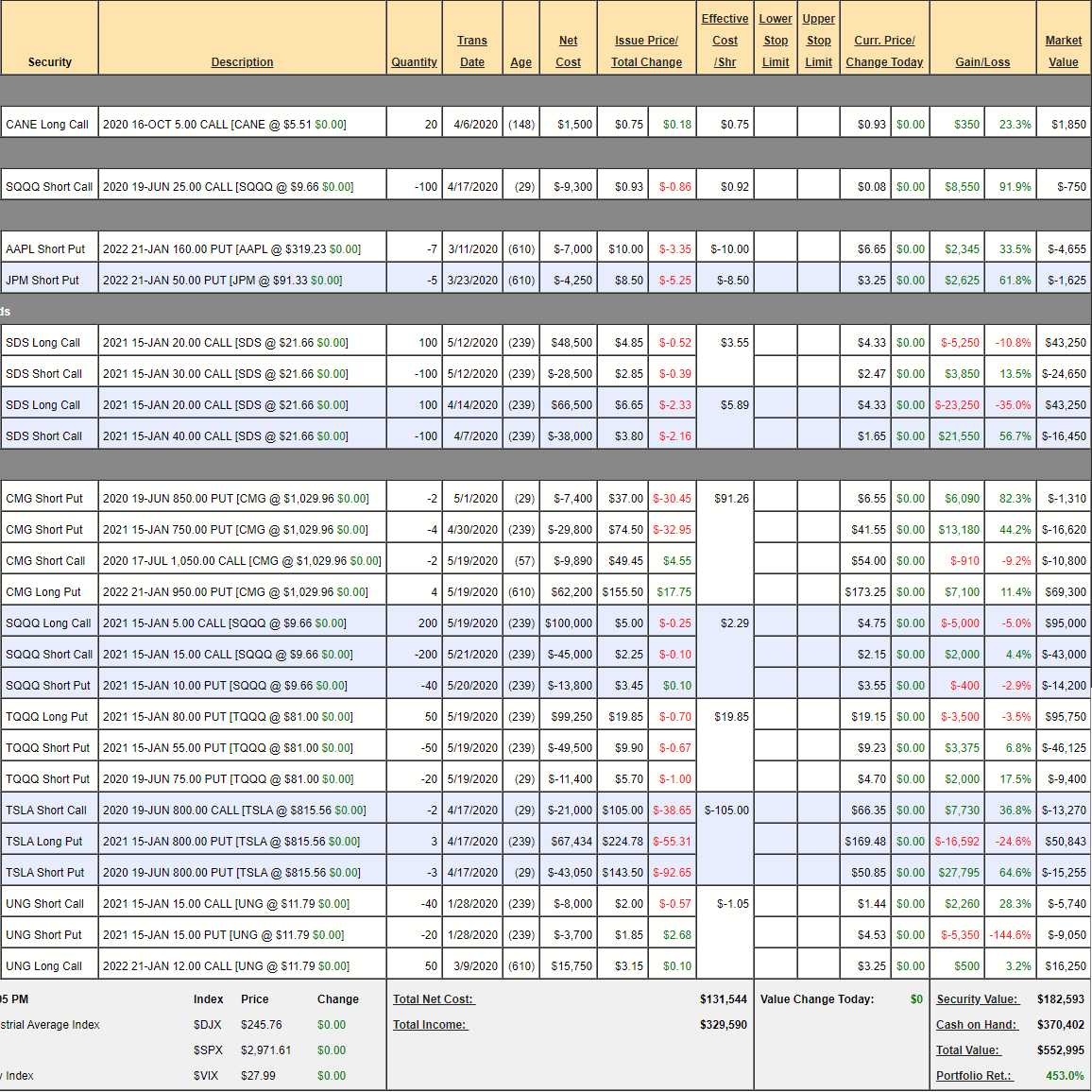

In our Short-Term Portfolio, we added a TQQQ on Tuesday and it's up a bit but still playable. We also have our Jan SQQQ spread which, at net $42,000 (even cheaper now), pays $200,000 (376%) if SQQQ is over $20 in January – which is only 8 months away as this year rushes by. These are the sorts of plays that gave us our tremendous profits during the recent downturn, so of course we're going to use them again as they are proven, great hedges!

The flaw in our set-up is we don't have anything we can quickly cash out on a dip as they are all fully-covered spreads (the index ones) and that will mean we won't have a lot of flexibility if we get a nice sell-off next week so let's fix that and tilt ourselves more bearish into the long weekend by simply buying back the already profitable (up 56.7%) short SDS Jan $40 calls at $1.65. We're spending $16,500 to uncover the 100 long $20 calls and that means, if they pop to $6 on Monday, we can quickly cash them out for $60,000, bringing out CASH!!! balance well over $400,000.

Also, we noticed how great the Micron (MU) put pricing was yesterday so let's go ahead and sell 20 of the 2022 $35 puts for $6 ($12,000) to help pay for the roll of our 50 TQQQ Jan $80 puts at $19 ($95,000) to 50 of the Jan $90 puts at $24.50 ($122,500). That roll costs $27,500 less the $12,000 is net $15,500 to push the hedge $50,000 deeper into the money and now it's a $175,000 spread we bought for net $53,850 but we'll sell more short puts to drive that cost lower over time.

That's what you are able to do when you have a balanced portfolio – just a few adjustments here or there can steer your entire portfolio more bullish or, in this case, more bearish when you are concerned about what lies ahead. Though the market doesn't seem very concerned – this has been a "no news is good news week" and It think that's going to change a bit in June as we begin to get statistics from cities and countries that have re-opened and, of course, economic data like the looming Non-Farm Payroll Report on June 5th.

Next week (which starts on Tuesday) we have Housing Data, Consumer Confidence, Durable Goods, Q1 GDP (2nd Estimate), Personal Income and Spending, PCE Prices, Chicago PMI and Consumer Confidence – which of those do you think you don't need hedges for?

Be careful out there!