How Sectors are Driving Value and Growth

Courtesy of Michael Batnick

7% a year for ten years sounds like a pretty decent return, and yet everybody has been complaining about it.

This 7% represents the return of large value stocks the last decade, which is pretty good. That is until you consider that few things are more relative in this world than investing, where people compare their returns to what they could have earned elsewhere. 7% isn’t bad, but compared to 14%, which is what large growth did over the same time, it’s downright awful.

The debate about the future of value versus growth has been under a microscope recently. One area of the discussion that sometime gets overlooked are the differences in sector weights, which can be a significant driver of returns.

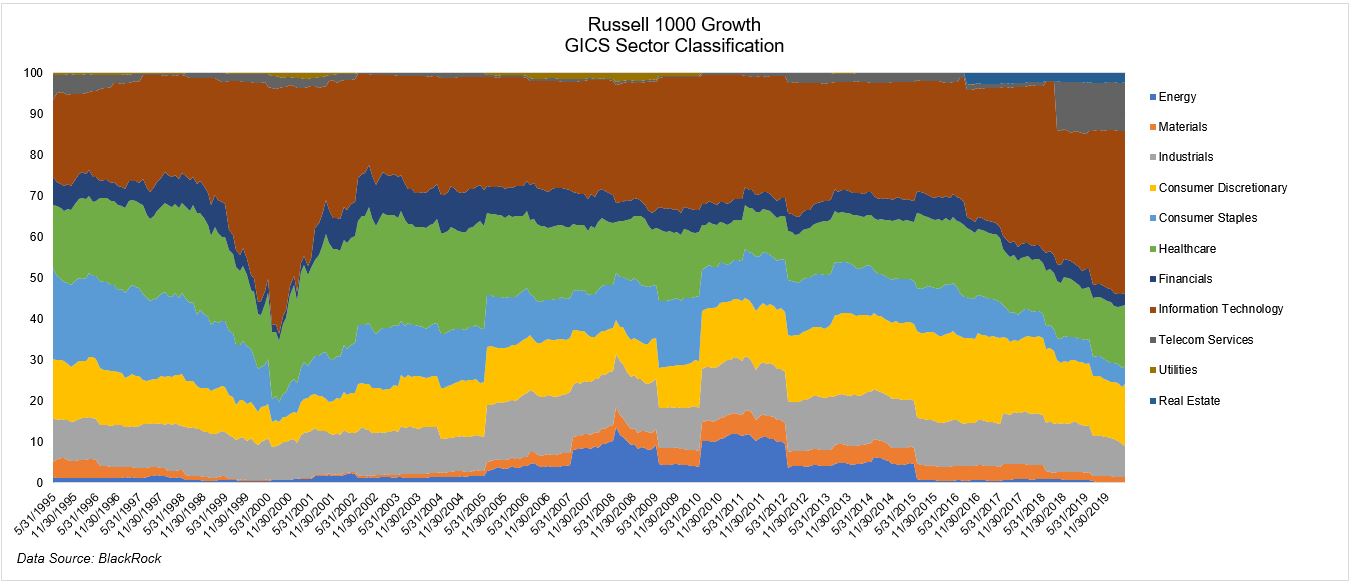

The chart below shows the makeup of the Russell 1000 growth index over time…

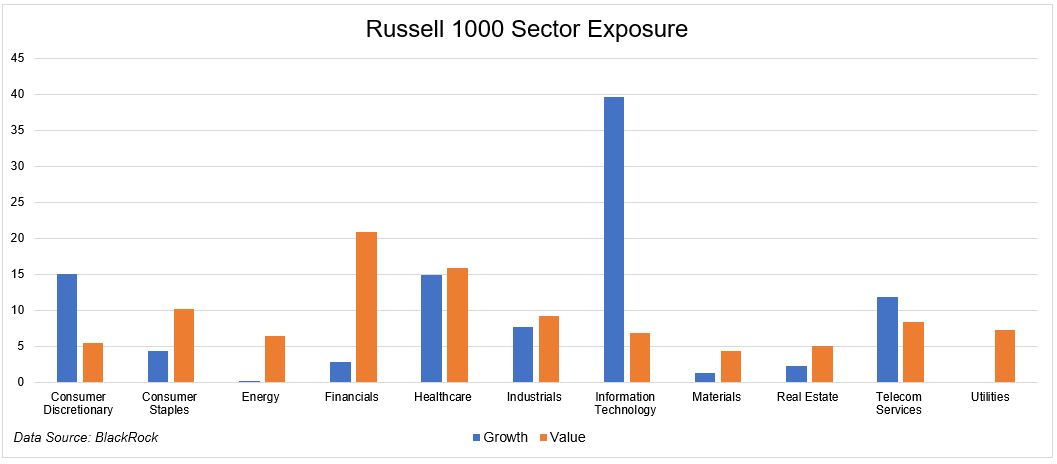

…Which looks markedly different than the Russell 1000 value index.

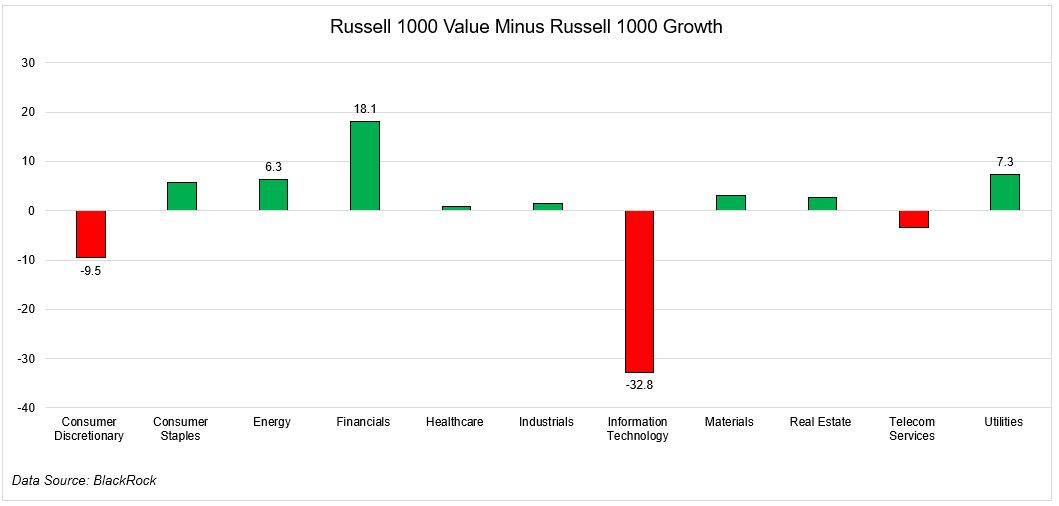

The 24% overweight that value has to energy and financials and the 33% underweight to tech tells you all you need to know about how the last ten years have played out.

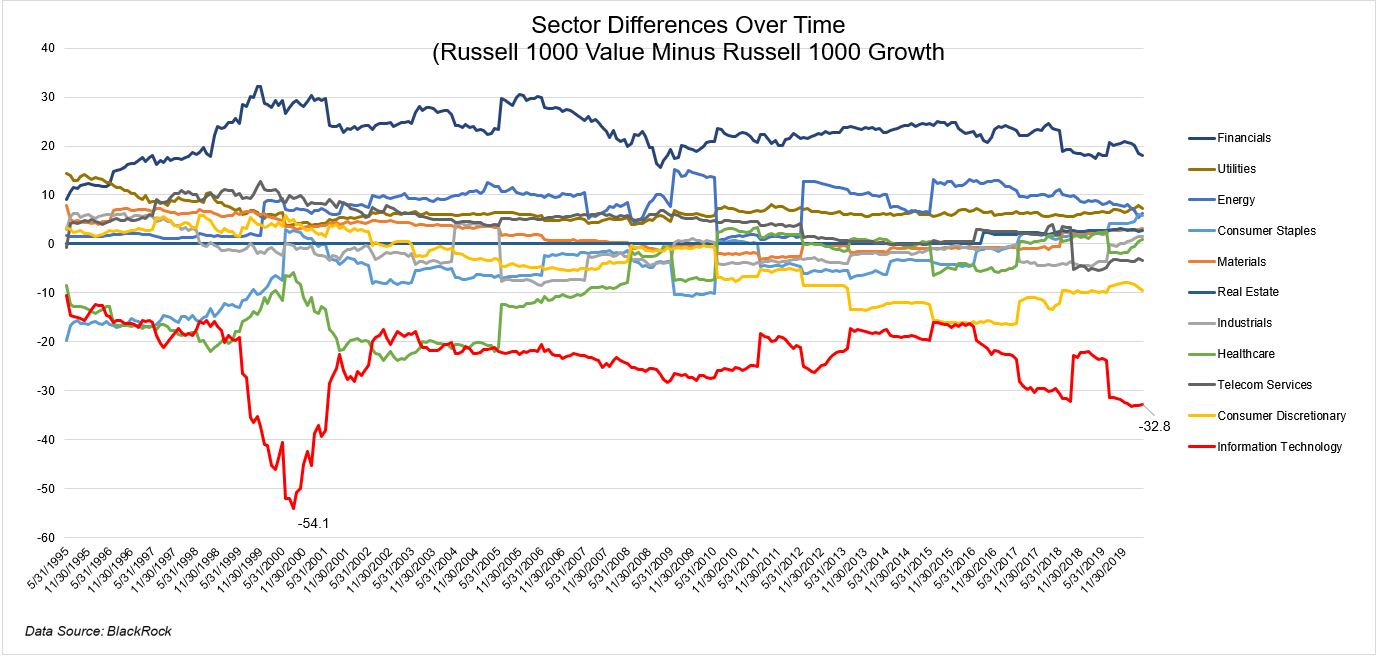

The chart below shows how the over and underweight of value relative to growth have changed over time. While this feels like a repeat of 1999, this shows just how crazy that period was.

It’s been nearly ten years since Marc Andreesen said software is eating the world and boy was he right. But now we have to ask ourselves the question, will the future look more like the recent past or will it return to the way things once were.

By this I don’t mean the return of brick and mortar, but more of the fact that investors have historically overpaid for the future (growth) and underpaid for the past (value). Whether or not this returns to the way things once were is the trillion dollar question.

On the one hand, the future looks bright for Spotify and Shopify and so many others, and on the other hand, Zoom has a higher market capitalization than the five major airlines put together.

And this is why this game is so hard. We have to balance the knowledge of what worked in the past with the uncertainty of what’s going to work tomorrow.