Wheeeeee!

Wheeeeee!

What a ride we had yesterday with the Dow Jones Industrial Average falling 1,861.82 – just a bit under 7% in a single day, erasing all of June's "incredible" gains in a single day. Of course, keep in mind that "incredible" means "impossible to believe" and we made it very, very clear this week that we did NOT believe this rally at all.

Monday Market Momentum – Up into the Fed Meeting

Of course, we're up today because Europe and Asia are up and they are up because we were up 2.5% on Friday and they are just catching up but that doesn't stop our pre-market traders from seeing a rally in Europe and trying to catch up to that – even though their rally was a reaction to our rally and yes – it's all total BS but that's the way the market works, so don't whine about it…

…See, it doesn't matter if it's FAKE!!!, as long as you WANT to believe it then you are happy to hear the BS – even if you know it can't possibly be true. Trump had his usual slew of lies in that press conference but the most insulting was the one about Black Unemployment, which was the only category of Unemployment that went up in May – even with the FAKE!!! numbers.

I do realize, by the way that every time I criticize the President or the Administration it sounds like some kind of Liberal rant and I do apologize to our Conservative readers who would rather not hear that sort of thing but this President, his policies and the blood-sucking corporate jackals he surrounds himself with really do SUCK and they are destroying this country through their policies and inactions so I say these things as both a Patriot and as an Analyst, more so than a Liberal (which I also happen to be.

Testy Tuesday – Infections Up, Markets Down Ahead of the Fed

Testy Tuesday – Infections Up, Markets Down Ahead of the Fed

I don't want to be your Cassandra, my "gloomy" outlook costs us the subscribers who like to hear BUYBUYBUY to confirm their bullish bias and, these days – there's a lot of them! Still, like the prophet, I am cursed to utter truths, yet I am rarely believed.

…Instead, we squandered $6.7Tn, didn't fix anything or cure anything and now we are recklessly re-exposing ourselves in an economy that is only 1/2 open BECAUSE WE DIDN'T REALLY FIX ANYTHING and, at some point, the death toll will become so great that we'll have to shut everything down again. Yes, I'm pissed off!!!

Without the PPE and without simply saying to certain businesses like Amusement Parks, Movies, Sporting Events, ect (sorry DIS) – we are NOT going to get on top of this virus and, ultimately, that is NOT going to be good for our economy.

Did you know I am my own favorite author? I have a terrible memory so I'm as surprised as you are to go back and see what I said about things and I'm just as surprised as anyone when I get it right! Or, in this case, just as sad…

Which Way Wednesday – Nasdaq 10,000 Edition

You've got to short the Nasdaq at the 10,000 line!

The first time we hit 5,000 on the Nasdaq was back in 2,000 – and we all know what happened then! It took us 17 years to get back to 5,000 and that was good consolidation and we popped right over it and stayed there. Well, we didn't stay there – the Nasdaq took off like a banshee and gained another 50% in 18 months and now, another 18 months later, another 33% move higher and we're at 10,000.

Even a small retracement from here can spell big money shorting the /NQ Futures, which pay $20 per point, per contract.

Sometimes the things I say can make you a lot of money!

Now skipping back to last Thursday:

3,100 Thursday – S&P 500 Tests Our 10% Line

So TECHNICALLY, the markets are in good shape but let's keep in mind that it cost us $6.7Tn to buy this technical rally and it's likely to cost another $2.3Tn to keep it going and that will put the National Debt around $28Tn more than 3 TIMES the $9Tn of debt we had in 2007 – before the Financial Crisis. $10Tn was added during Obama's 8 years in office and now another $10Tn is being added during just 4 years of Trump (so far) – that's a much faster pace than Covid was spreading back when Trump said we shouldn't worry because we only had 5 cases in the US!

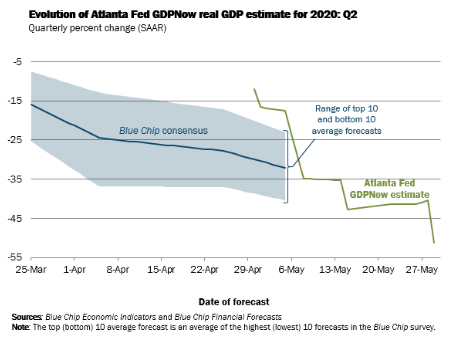

So the running cost of papering over a Recession seems to be about $10Tn but I'm not sure we're papering over this Recession – so far we're just boosting the market DESPITE the terrible economy. The Atlanta Fed's GDP Now Forecast shows a projected 52% drop in Q2 GDP while the range of private forecasts projects only a 25% decline.

That's a huge discrepancy – usually they are off by no more than 1% but it will take until July 30th before we get our first official estimate of Q2 GDP so, until then – let the speculators have their fun.

We made some aggressive adjustments to our Short-Term Portfolio, which hedges our Long-Term Portfolios and, so far, it seems to be holding up. The key to having good hedges is that, on a day like yesterday – we were even – with the STP gaining pretty much the same as the LTP lost. Having that balance means we don't have to panic out of our perfectly good long-term longs just because traders start getting nervous.

We will do full reviews of all or our Member Portfolios next week.

Have a great weekend,

– Phil