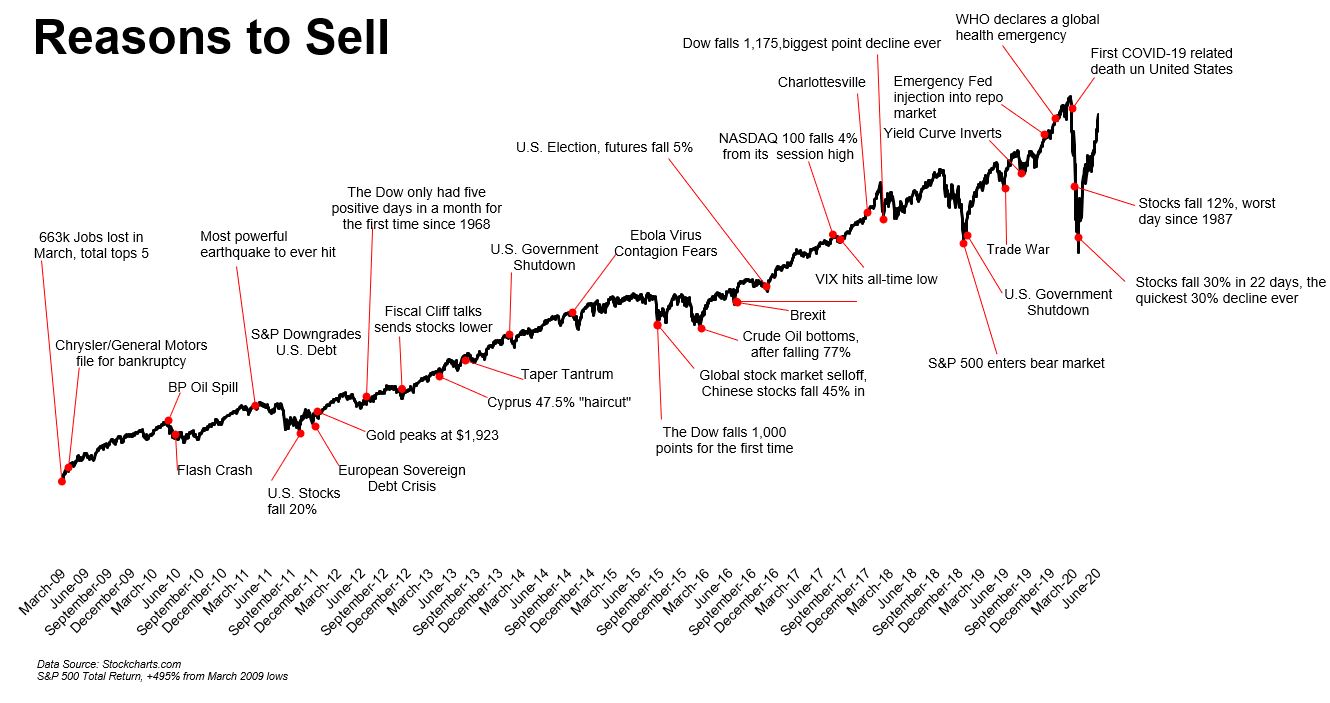

There Are Always Reasons to Sell

Courtesy of Michael Batnick

When things are good you worry they’re going to turn bad. And when things are bad you worry they’re going to get worse. This is why bears sound insightful and bulls sound oblivious.

If I asked you to list all the reasons to sell, they would be as long as a CVS receipt. For example:

- A second wave of COVID-19

- Stocks have come too far too fast

- Supply chains struggle to come back

- Too much corporate debt

- Too much sovereign debt

- High valuations

- Unsustainable profit margins

- Euphoria

- Day traders acting like this is easy

- Fiscal stimulus dries up

- Corporate real estate goes bust

- Student debt

- Pension shortfalls

- Municipalities hit by COVID-19 hurting revenue

- The Fed takes away the punch bowl

If I asked you to list all the reasons to buy, you’d be hard pressed to come up with much of anything:

- Umm. Hmm. Stocks are going up so I hope this will continue?

No, really, what’s the bull case? I don’t know, but this is my point. Struggling to come up with reasons to buy is not unique to 2020.

We feel losses harder than the we feel joy from an equivalent gain, so in order to protect ourselves from pain, we want to know all the things that can go wrong. “Oh, the world is going to end? Please tell me more.”

I was looking forward to updating this chart, but never in a million years did I think I would do it this quickly.

Who knows where stocks go from here? This chart might look very different in six months, because ____________. After all, there are always reasons to sell.