Wheeee, what a ride!

Wheeee, what a ride!

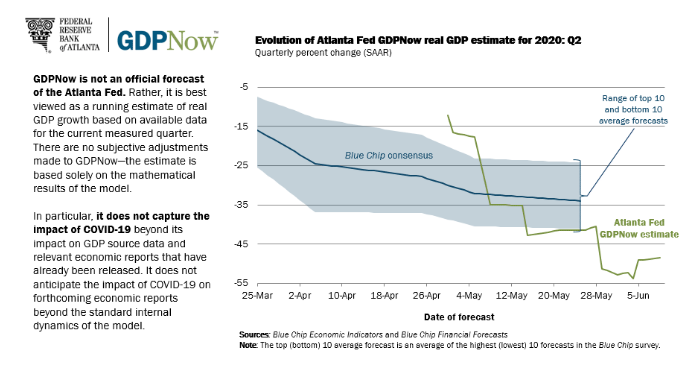

Of course, we expected the pullback, especially from Nasdaq (/NQ) 10,000 but 3,200 on on the S&P 500 (/ES) was also going to be a good resistance line and resistance was not futile in this round as we quickly dropped almost 10% back to test the 3,000 line and now back below the 3,135 line that marks our own 10% line on the Big Chart, which follows our fabulous 5% Rule™.

We had some RIDICULOUS gains during that rally and we knew it wouldn't last but now we have a real test of the market's resiliance as the virus resurges in many hot spots (something else we told you would happen) and a bit of fear is back in the market even as we are on the cusp of revealing the 2nd quarter's earnings disaster in about a month.

We did our last review of the STP on the 4th, right in our Morning Report so those are the positions that made $50,000 in 7 days, right there for public consumption. I feel it is a public service to teach people how to hedge their portfolios properly, so, since our STP is working perfectly to protect our long portfolios at the moment, let's take a look at one of our other monthly portfolios, our Money Talk Portfolio, since they will be interviewing me this afternoon for the show on Wednesday at 7pm on Bloomberg Canada.

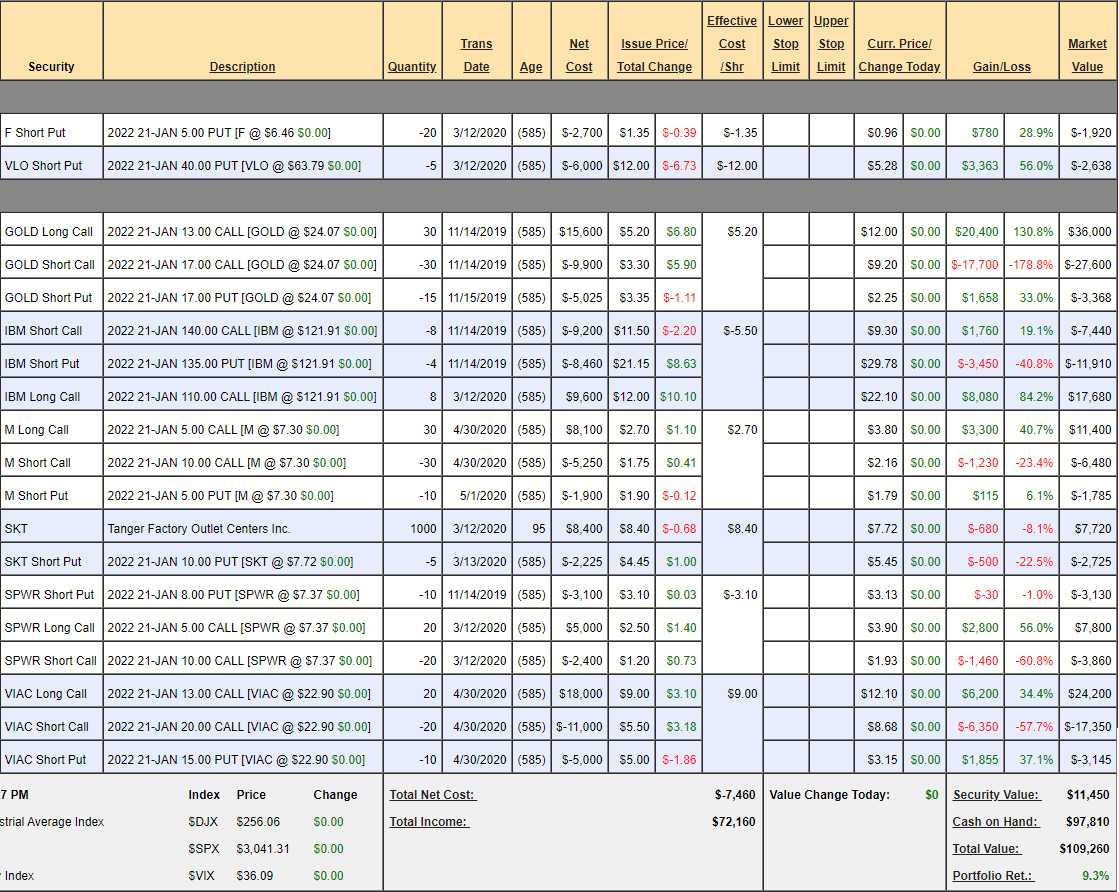

The Money Talk Portfolio is constrained to trades that we make on the show so about once every 2-3 months we make changes. My last appearance was on April 29th and the MTP was up 1.8% at the time, recovering from the hit it took as we were unable to adjust it during the downturn. We added two positions, Viacom (VIAC) and Macy's (M) and now the portfolio is up 9.3% for the year but now it's time to add a hedge.

- Ford (F) – If Ford drops below $5 and we are assigned, our net entry on 2,000 shares would be $3.65 – I'm not worried about this at all and we fully expect to make the remaining $1,920 on this short put.

- Valero (VLO) – Although I don't like the way they've dropped back, our strike price ($40) is so low and our net ($28) is simply silly so I don't see the point in taking the 56% profit off the table when we could make another $2,638 BUT, the trade still has 18 months to go and, if the market tanks we will have another chance to sell puts so why take even a slight chance in an uncertain market? Let's cash this one out.

- GOLD – Our 2020 Trade of the Year is still going strong and miles above our strike price and the net on the $12,000 spread is $5,032 if they hold $17 so the upside potential is still $6,968 (138%) from here so I guess we'll keep this one – especially since they should do pretty well in a re-crash anyway – especially if the Government spends another few Trillion Dollars for the next round of bailouts.

- IBM (IBM) – Last year's Trade of the Year (see the theme?). Just when they were doing well they took quite a dive but our spread is wide with $110 calls and it's potential payback is $24,000 from the current net $1,670 (we started with a net credit) so this one is still good for a new trade, even after we've made $6,390 already the additional upside potential is $22,330 (1,337%) – so that's a keeper.

- Macy's (M) – Our newest trade idea is also a winner already as our net $950 entry is already worth net $3,135 for a $2,185 (230%) proift in just over a month – don't you love options? Still, it's a $15,000 spread so the upside potential is $11,865 (378%) from here so it's good for a new trade – even after missing the first 230% – don't you love options?

- Tanger Factory Outlet (SKT) – They were making a nice comeback right to our target at $10 and then failed harshly but nothing fundamental has changed, the value is there – just not the sentiment. It's a $10,000 spread at net $5,025 so $4,975 (99%) left to gain is another keeper and also good for a new trade.

- Sunpower (SPWR) – I love these guys for the long-term and still very cheap! This spread is a $10,000 spread that's currently net $810 so $9,190 (1,134%) left to gain from here! Can a top solar company make it back to $10 in 18 months? This one is in almost every one of our Member Portfolios….

- Viacom (VIAC) – Also new and just a bit profitable at net $3,705 from our $2,000 entry but still, not bad for the first month but it's only on track as it's a $14,000 spread that's in the money so all VIAC has to do for 18 months is hold $20 and we make another $10,295 (277%). It's no SPWR, but a much more conservative way to make money on a blue chip stock..

We have a good, solid group of positions here that have the potential to gain another $67,543 (67.5%) if all goes well but we need a hedge and, on the show, we're going to discuss how over-priced TSLA (TSLA) is compared to Toyota (TM) so why not combine them into a single hedge like this:

- Buy 4 TSLA Jan $1,090 puts for $300 ($120,000)

- Sell 4 TSLA Jan $1,015 puts for $250 ($100,000)

- Sell 5 TM Jan $120 puts for $9 ($4,500)

That's net $15,500 on the $30,000 spread so we make $14,500 (93%) if TSLA fails to stay over $1,015 into January and, in theory, if TSLA is doing that well, TM should not be doing bad either so the risk should be no more than $15,500 but I very much doubt we'd lose that and, if all goes well, we win on both ends.

The good thing about shorting overpriced positions is that, even if the market does well, you can still win if TSLA runs into a wall of reality sometime.