"Baby here we stand again

Where we've been so many times before

Even though you looked so sure

As I was watching you walking out my door

But you always walk back in like you did today

Acting like you never even went away

Well I don't know if I can

Open up and let you in baby

Here come those tears

Here come those tears again" – Jackson Browne

That's right it's Tuesday so the S&P must be testing the 10% line and last Tuesday we failed but the Tuesday before that we popped over so it's a real coin flip this morning.

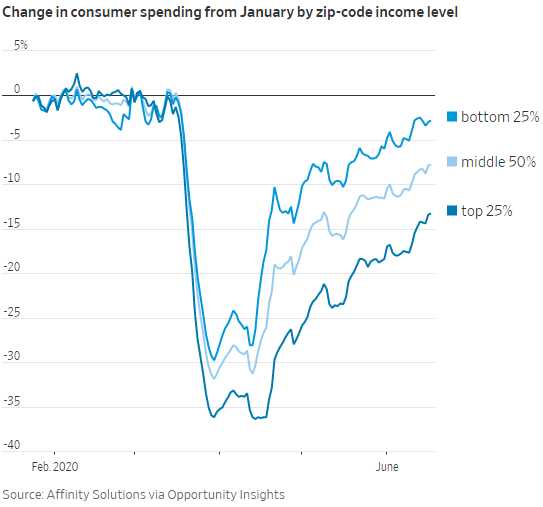

Things are looking good so far because those 30M unemployed people are still getting their $600 WEEKLY bonus checks ($18Bn/week, $72Bn/month) and those will last until July 31st and that has kept the economy from totally collapsing and has kept Consumer Spending at reasonable levels at the Bottom 25% of wage earners are now outspending the Top 25% relative to where they were before the crisis.

Things are looking good so far because those 30M unemployed people are still getting their $600 WEEKLY bonus checks ($18Bn/week, $72Bn/month) and those will last until July 31st and that has kept the economy from totally collapsing and has kept Consumer Spending at reasonable levels at the Bottom 25% of wage earners are now outspending the Top 25% relative to where they were before the crisis.

Pumping an annualized $864Bn into bonus checks for the Unemployed is 5% of the GDP we're adding and that's making all those economic numbers look much better than they are, not to mention the base $15Bn a week of regular unemployment benerfits that are being handed out – that's another annualized $780Bn (4% of GDP).

Then we add in the $1,200 stimulus checks for 170M tax filers ($204Bn) and $500 for 50M dependents ($25Bn) and that's another $229Bn in Q2 is an annualized $916Bn (5% of GDP) so this economic bounce is here because we spent an annualized $2.56Tn to get here – that's money that Donald Trump borrowed on your behalf so he can get re-elected in November. Great!

But the money is about to run out and apparently investors believe that Congress will quickly apporove another round of stimulus right away – before they go on their "break" on July 3rd. Of course, since Congress takes a break to go home and they are all home anyway – why can't they just get some work done?

But the money is about to run out and apparently investors believe that Congress will quickly apporove another round of stimulus right away – before they go on their "break" on July 3rd. Of course, since Congress takes a break to go home and they are all home anyway – why can't they just get some work done?

Any additional spending Congress approves gets added to this year's $3Tn deficit and this is not even taking into account the very sharp decrease in collections that will come from all those small businesses and their employees that will not have income to pay taxes on in the second quarter. The Government has already decided that 1-2% of the population will die in order to start those tax revenues flowing again, so let's get out their and risk our lives to prop up the system – who's with me?

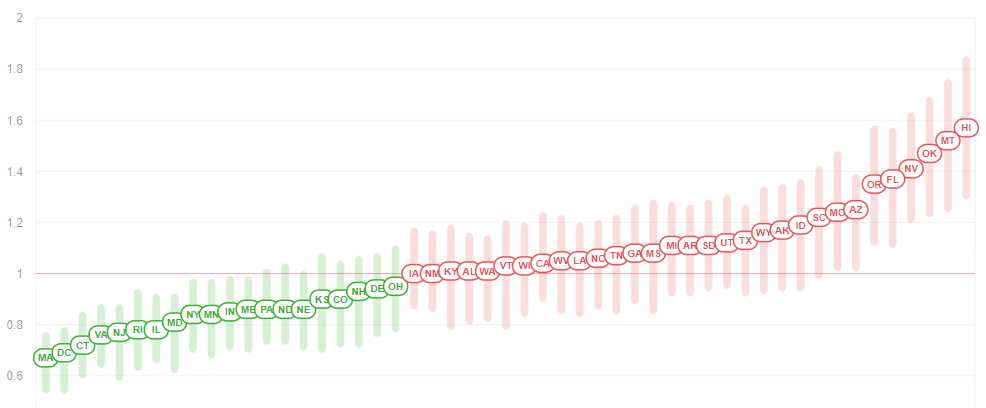

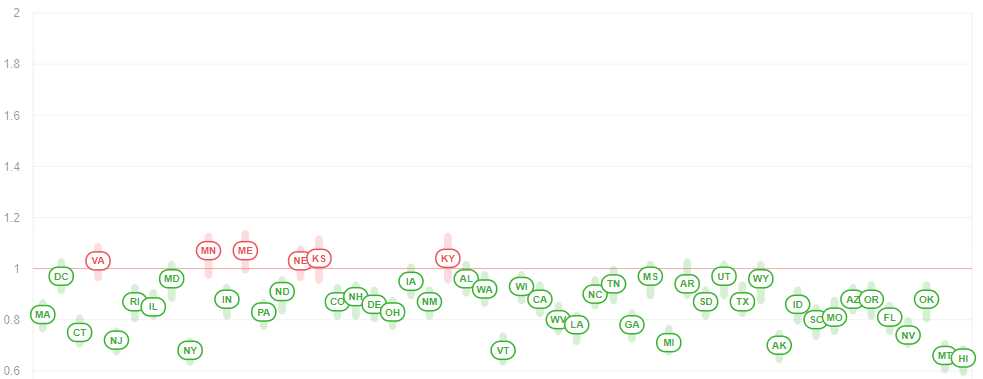

As many as 31 states have R0 figures above 1, according to the Rt.live website, meaning that each person with the virus infects at least one other. Morgan Stanley estimates R0 for the entire U.S. stands at 1.1 — a rate at which the epidemic would double every 52 days. Sending people back to work in those states, with inadequate PPE equipment, testing or tracking is political negligence at best, murder at worst.

Here is how that chart looked in April and May, during the lockddown:

You don't need to be an epidemiologist (and it's bad that we even know that word now!) to see that this is BAD! We have gone from slowing the spread of the disease to expanding it at new levels – and that spread is coming from an even larger base of citizens than we had in March, when Trump could still count them on one hand.

I know I sound silly saying this when the markets are bouncing back but it's not like we didn't make money during the crash and correction (BECAUSE we were careful!) and all I am saying now is that we are heading for another crash and it's going to be a lot more expensive to correct than the first one, which has required $2.7Tn in hard Federal Spending and another $4Tn allocated to the Fed, who have already spent $2.5Tn of it propping up rich people and the corporations they own.

Let's be careful out there!