Nice move up yesterday, this is a good time to take a look at the Short-Term Portfolio (STP).

Nice move up yesterday, this is a good time to take a look at the Short-Term Portfolio (STP).

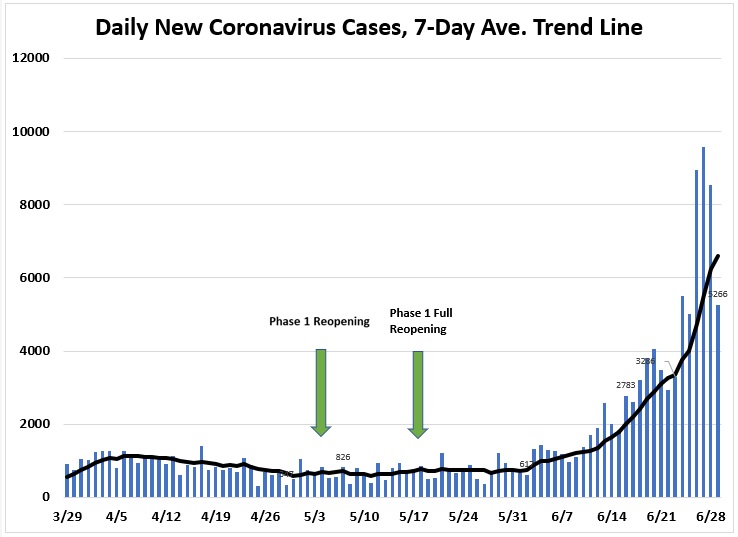

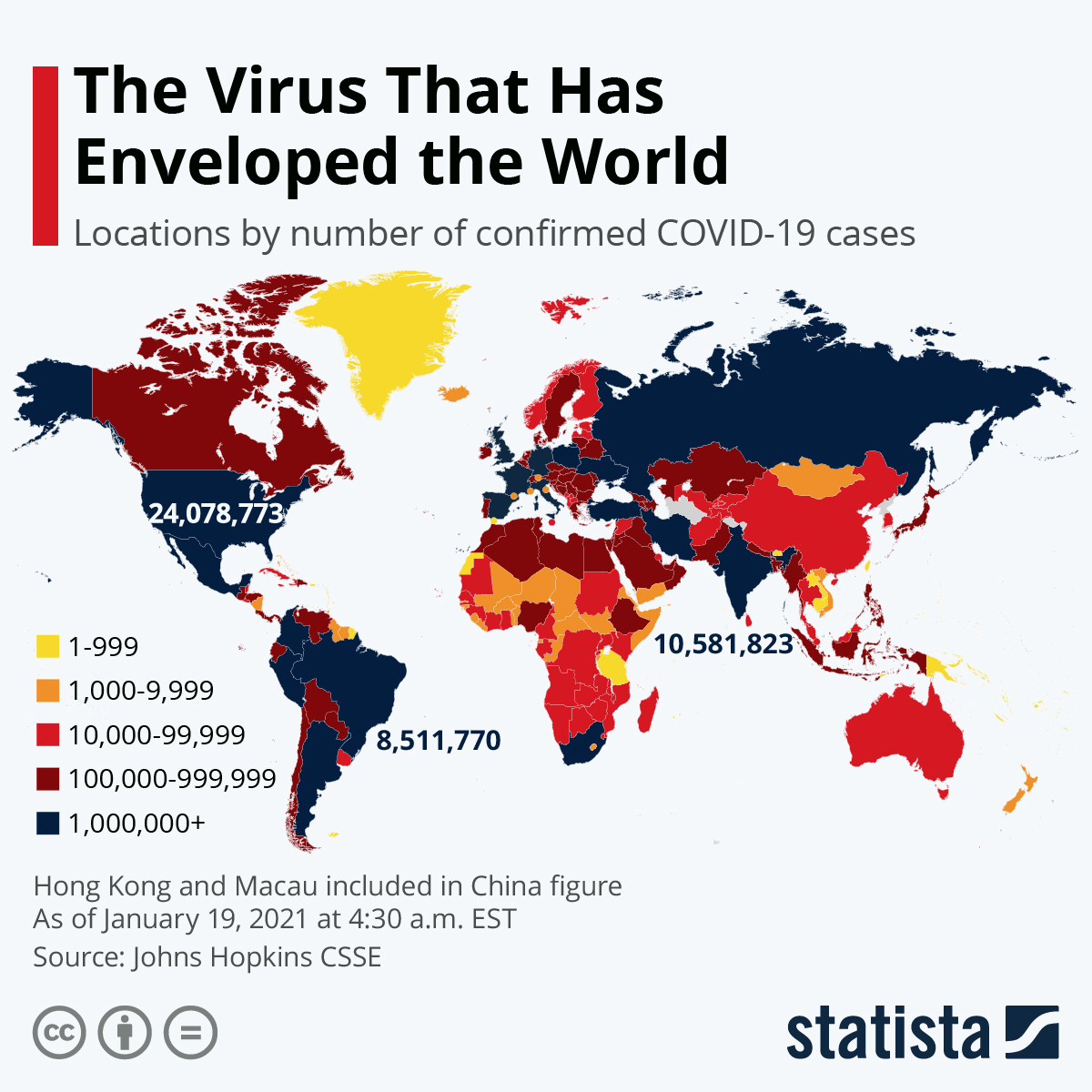

As you know, I'm a bit skeptical of the rally because over 10.4M people (yes, up 400,000 since Sunday) on the planet now have or had Covid-19 and less than 1/2 of them are "recovered" or "dead" so at a rate of 200,000 infections per day, we'll be at 20M by the end of August and most of those people will be newly infected so going from 5M actively infected to 10M (at least) actively infected means there will be twice as many people spreading the virus in 50 days or less so twice as contagious and growing twice as fast (400,000 per day) and we're already over-running hopsitals in several US states.

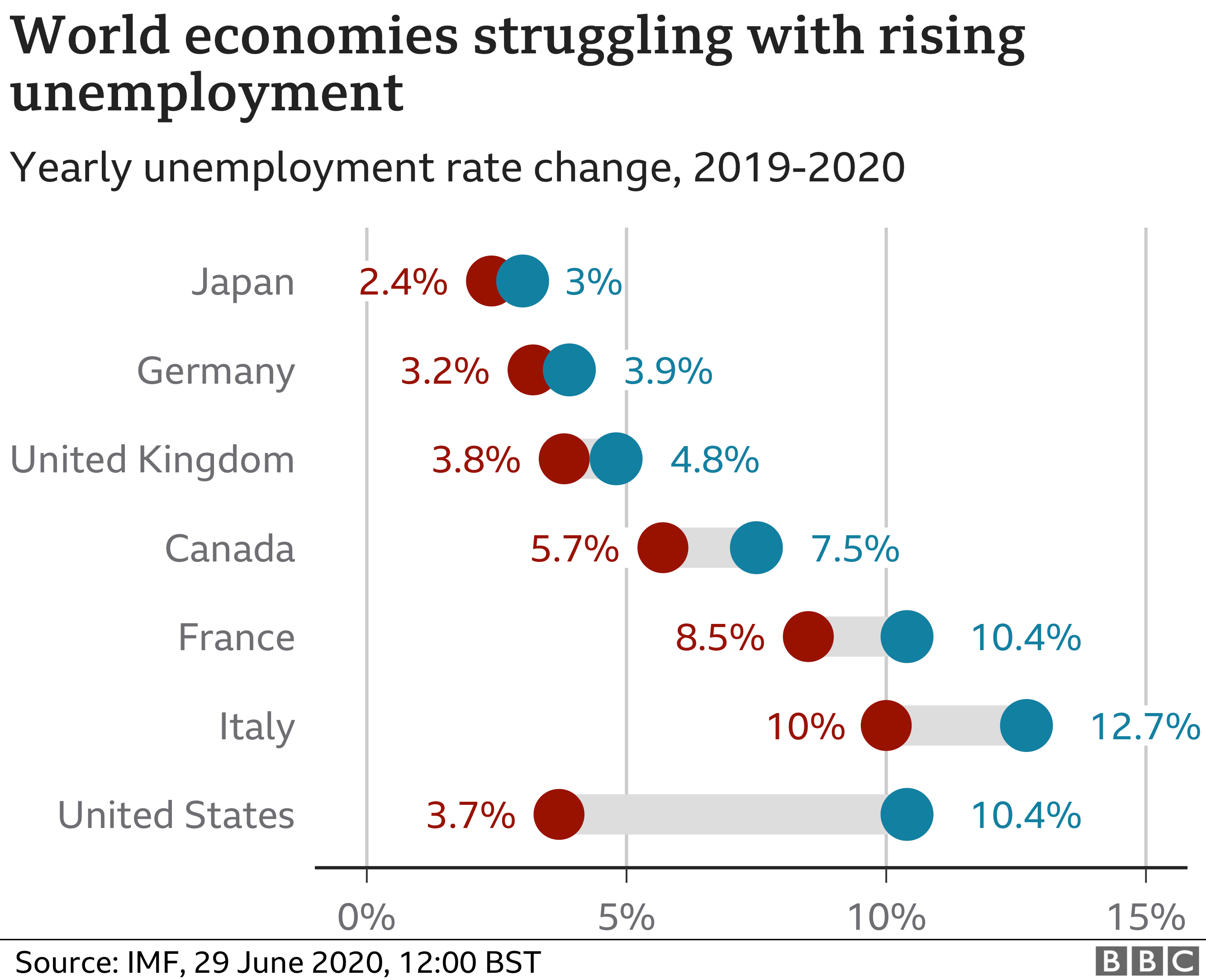

The economy is still very much shut-down and yesterday the markets were excited about some production growth in Asia but, when you were down 30%, growing 2% back is not really a reason to put on party hats – certainly not a 500-point rally. But that brings us to the TREMENDOUS amounts of stimulus in the economy.

The economy is still very much shut-down and yesterday the markets were excited about some production growth in Asia but, when you were down 30%, growing 2% back is not really a reason to put on party hats – certainly not a 500-point rally. But that brings us to the TREMENDOUS amounts of stimulus in the economy.

I think the Government/Fed spent the right amount ($6.7Tn) to get us through 6 months but this isn't going to be 6 months and those unemployment bonuses run out at the end of July so either they put another $3Tn to work or Q3 will be a bigger disaster than Q2 and I'm sure we have diminishing returns (and mounting debt) – that pretty much sums up my "concerns" for the Economy at the moment.

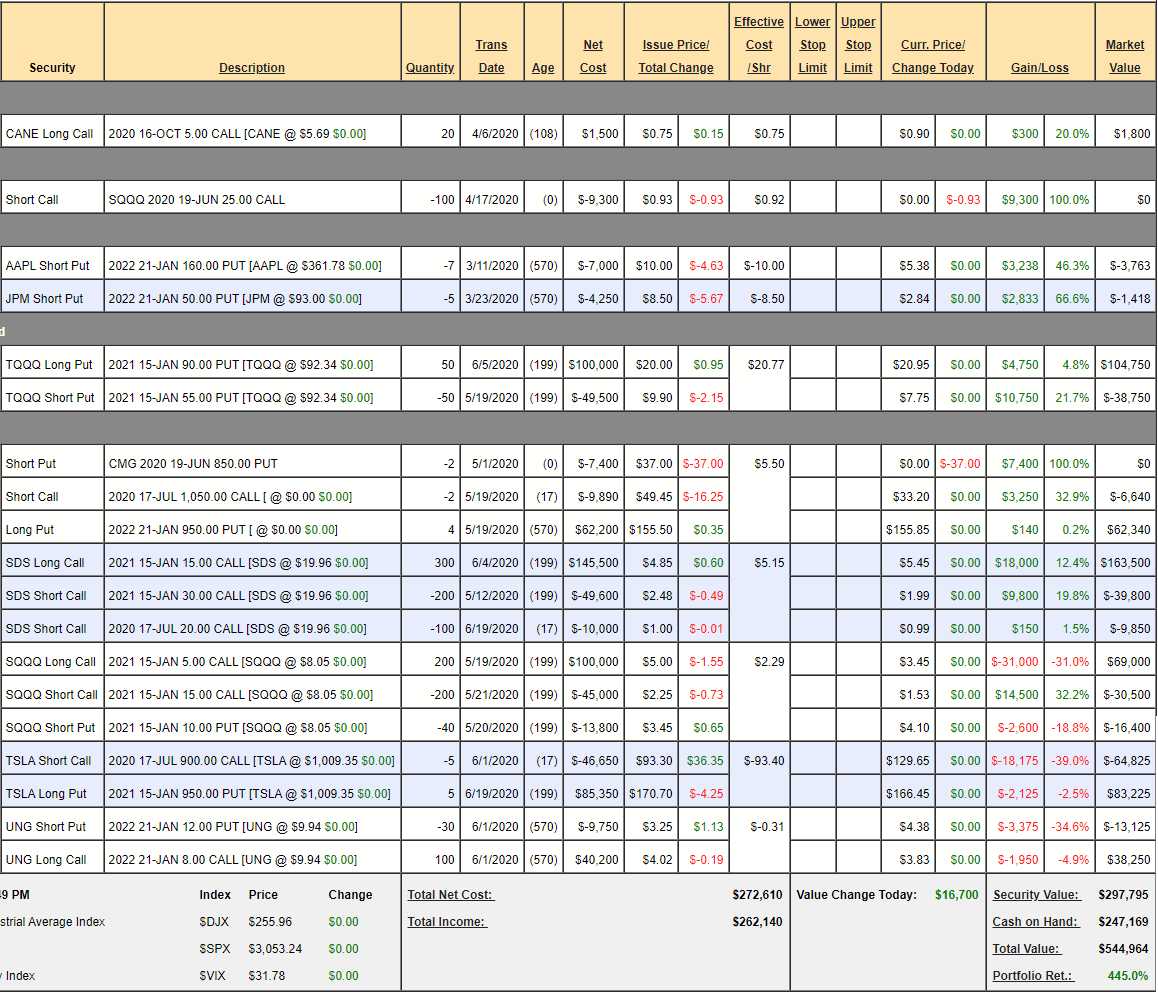

So, the question is, are we hedged enough or CAN WE BE HEDGED ENOUGH to protect our long positions? Our Long-Term Portfolio is up 70% at the monet at about $850,000 and our Short-Term Portfolio is up 445% at $545,000 so combined $1.395M is more than a double off our $600,000 combined start so all is well but that's because we got lucky and were bearish into the crash (because we feared the virus early on) and DID NOT have a lot of longs (which dropped almost 50% at the lows) and then we hit the turn on the nose and doubled down on our longs ahead of the stimulus and made great money on the way back up (3x from our 50% down position).

So, the question is, are we hedged enough or CAN WE BE HEDGED ENOUGH to protect our long positions? Our Long-Term Portfolio is up 70% at the monet at about $850,000 and our Short-Term Portfolio is up 445% at $545,000 so combined $1.395M is more than a double off our $600,000 combined start so all is well but that's because we got lucky and were bearish into the crash (because we feared the virus early on) and DID NOT have a lot of longs (which dropped almost 50% at the lows) and then we hit the turn on the nose and doubled down on our longs ahead of the stimulus and made great money on the way back up (3x from our 50% down position).

This is not the same thing! Now we have a VERY LARGE portfolio of longs and yes, a lot more hedges but we've been in neutral for a month out of fear of a crash and I think we would actually do better just getting back to almost all cash and just having some speculative fun while we wait for the Q3 cycle to resolve itself.

You know me, if we have cash on the side I'm going to be grabbing bargains right and left during earnings season but it's going to be very hard to protect $1.4M from another 20% correction – and the next one may not bounce back very fast as this planet may be heading into another depression if there's no vaccine/cure by the winter – when Corona Virus meets Rhinovirus and every single person you see will look like a ticking time bomb of infection.

We all get the flu almost every year, now we're all going to be wondering "Is this it?" for some part of the winter. Every time someone next to you sneezes it won't be "God Bless You" but "Get away from me!". No, I don't look forward to this at all and how is that going to make for a happy, friendly economic outlook?

We all get the flu almost every year, now we're all going to be wondering "Is this it?" for some part of the winter. Every time someone next to you sneezes it won't be "God Bless You" but "Get away from me!". No, I don't look forward to this at all and how is that going to make for a happy, friendly economic outlook?

So, while I may be a bit slow to pull the trigger on cutting our long portfolios – that's because they are up significantly for the year so we could take a 20% hit and still have a good year but, if you are not well-hedged or have not made huge gains – DO NOT RISK YOUR MONEY – as the next crash may not bounce back like the first one did.

We've made no changes to the STP since our last Review on June 19th, when it was at $521,687 and the S&P was at 3,140. Now we're down 87 at 3,053 and the Portfolio is up $23,277 at $564,964 so up 4.2% on a 2.5% drop in the S&P means our hedges are functioning well and we're pretty well balanced so, as we begin to unwind our longs, we run the risk of over-hedging in the STP – have to be careful about that too!

Still, for the moment, we need to risk losing on the short side as I REALLY don't want to give up our long gains before we have a chance to unwind. Keep in mind I do expect more stimulus so I'd like to catch that boost before cashing in our longs but what if it never comes?

- CANE – Went ripping higher early June and I feel good about the bottom call we made.

- SQQQ – A leftover leg that expired worthless. I'll do the rest later.

- AAPL – 46% profit already!

- JPM – 66.6%? Draw your own conclusions as to whether that's a sign or not! I say take in and run now, no sense waiting 18 months to make $1,418 – even if there is the slightest risk of a problem.

- TQQQ – This was more for fun than anything as I wanted to see if it would outperform SQQQ and look – it has! More money on a 3x ETF means more room for decay and, even though we're out of the money, the combo is still working. Up $15,500 on our net $50,500 entry (no margin required) is 30.6% in just over a month and the potential to pay back $175,000 in a major correction.

- CMG – We got more bearish and bought back the short puts last time so now we're just waiting but CMG holding up so far. As this is now set, the short calls are at the money with 3 weeks to play and our long put spread can pay very bigly if CMG falls below $850 again, even $750 would net back about $60,000 and another $20,000 per $100 below.

- SDS – Our newest hedge. Already in the green despite the S&P 500 stubbornly staying over 3,000 so far. This is a big one and the short July calls are at the money but lots of room to run on the Jan $15s and we can roll those short July calls higher when they lose their premium (all premium now). It's a potential $400,000 (ish) spread (hard to tell on the rolls) currently at net $113,850 and we only paid $85,900 for it so – great hedge!

- SQQQ – If AAPL ever stops going up, the Nasdaq is DOOMED! Maybe that will never happen but if AAPL ever corrects, no force on Earth, not even the Fed can save the Nasdaq. This hedge has a $200,000 potential and is currently net $28,650 so obviously great for a new hedge as it's $60,000 in the money! Aren't options amazing?

- TSLA – Ouch so far! We were originally down $29,000 and now we rolled the long calls up and lost another $2,125 so far. If TSLA stays up here next week, we have to roll to short Sept $950 calls (now $166) but the short July $900s at $166 have $60 in premium so no reason not to let that burn off first.

- UNG – We doubled down on the longs and got a nice pop yesterday but a long way to go on what now is massive upside potential into hurricane season (it's also a hedge of our hedges for an economic recovery).

So great hedges but not if we unwind a lot of longs and don't need them – then they become bearish bets and that's a bit scary with stimulus pending so still a bit on the fence but, remember, that's because we could lose $400,000 and be at net $1M in the LTP/STP and that's still up $400,000 for the year (while the market would be tanking) so THAT is the only reason we haven't cashed out yet – there is still $400,000 very much at risk from a 10% sudden correction followed by a bad week that takes us down 20% – that would be too fast to get away from.

Anything else and we'll be fine!