Winning!

Winning!

As Trump predicted in 2016 we are so tired of winning at this point, aren't we? The US is clearly winning the virus race with a record 59,400 infections on Wednesday – our 5th National Record in the past 9 days – WINNING! On Tuesday we celebrated our 3,000,000 infection in the US and we're officially at 1% of the total population infected so that's 1/100 people carrying the virus (that we know of without adequate testing – which the President says causes more cases) and it remains airborne so see how well you do today avoiding coming in contact with 100 people or things that have been touched by 100 people….

There is a certain logic to "getting it over with" – they probably can't stop it from spreading, there is no miracle cure and we're all going to get it eventually so why prolong the agony? Well, one reason is that hospitals are out of room for new patients and also out of supplies which means the virus can spread out of control when we try to treat infected people and more infected people means less room and less supplies and that will cause more people to die and not just from the virus but hospital staff is pulled away from other duties as well – endangering non-Covid patients.

That is why we need to "flatten the curve". The US already has one of the worst-performing Health Care systems in the World and this is a stress test we are clearly failing. “It’s been chaos for us,” said Randy Bury, President of the Good Samaritan Society, which has struggled to keep its 200 nursing homes supplied with hand sanitizer, masks and gowns. “The supply chain in the United States is not healthy, and we’ve learned we cannot depend on the Government.”

That is why we need to "flatten the curve". The US already has one of the worst-performing Health Care systems in the World and this is a stress test we are clearly failing. “It’s been chaos for us,” said Randy Bury, President of the Good Samaritan Society, which has struggled to keep its 200 nursing homes supplied with hand sanitizer, masks and gowns. “The supply chain in the United States is not healthy, and we’ve learned we cannot depend on the Government.”

Trump has resisted using federal powers to address the problem, saying in March that individual governors should find their own gear because “We’re not a shipping clerk.” With the National Strategic Stockpile depleted, states have been left to fend for themselves, though the Federal Emergency Management Agency has been distributing modest shipments of gear to nursing homes and long-term care facilities.

As to the markets, Zero Hedge nailed it this morning:

At this stage markets are basically just a liquidity meth lab, an artificial behemoth constructed and subsidized by the Fed stepping in on any downside in markets. Following $3 trillion in liquidity injections in 3 months ($12 trillion annualized) markets have entirely disconnected from the economy and any traditional valuation metrics. The Fed’s role in managing markets is becoming ever larger and has now expanded into buying $AAPL and $VZ bonds among others in addition to monetizing US debt. Call it what you like, just don’t call it capitalism, rather a nationalization of sorts.

Indeed just in June we saw the Fed making policy announcements 3 times, each time following the S&P 500 seeing downside action toward retesting its 200MA and each time markets reacted with bounces and rallies. Call it a coincidence if you like, but it’s not. These markets remains closely managed and watched by the Fed.

Wall Street analysts have largely been made obsolete as earnings growth metrics have long been rendered irrelevant with everybody bowing to the Fed put as the primary reason for buying stocks.

With no earnings growth during for the last two years, it is folly to pretend markets are about anything else but the Fed.

That's what we've been doing since early June. As I noted yesterday, every bone in my body is screaming "GET OUT" but how can we walk away from all this free money that's being printed for us? That's fine for those of us in the Top 1%, who are able to take advantage of all the free money that's flying around but, for the rest:

That's what we've been doing since early June. As I noted yesterday, every bone in my body is screaming "GET OUT" but how can we walk away from all this free money that's being printed for us? That's fine for those of us in the Top 1%, who are able to take advantage of all the free money that's flying around but, for the rest:

The unemployed and poor are dependent on government handouts, the middle class is sweating staring at permanent job losses mounting as the top 1% and billionaire stock owner class is subsidized by the Fed as stocks keeps rising despite the worst economic backdrop in decades. All the while the Fed is steadfastly denying against all evidence that it is contributing to ever expanding wealth inequality even though that is precisely what it is doing.

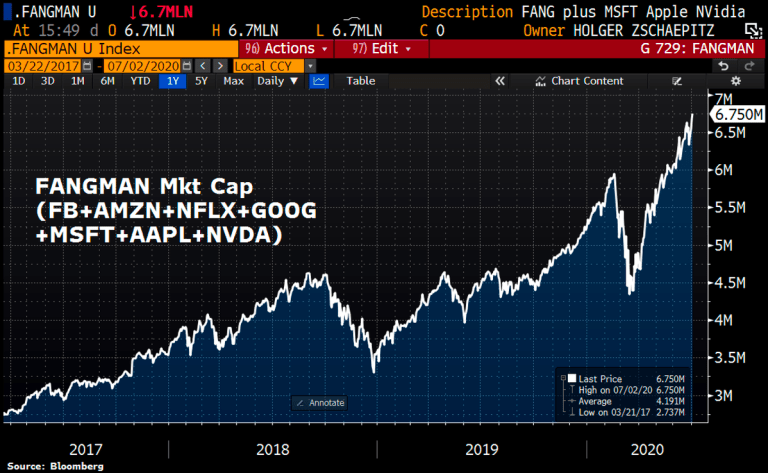

7 Nasdaq stocks (FB, AMZN, NFLX, GOOG, MSFT, AAPL and NVDA) are now "worth" $6.75 TRILLION. The p/e of AAPL has gone from 16 to 24 in the past 12 months and AMZN's PEG Ratio has gone from 1.32 to over 3 in the past 12 months meaning traders are getting 2/3 less bang for their Amazon buck than they were last year.

7 Nasdaq stocks (FB, AMZN, NFLX, GOOG, MSFT, AAPL and NVDA) are now "worth" $6.75 TRILLION. The p/e of AAPL has gone from 16 to 24 in the past 12 months and AMZN's PEG Ratio has gone from 1.32 to over 3 in the past 12 months meaning traders are getting 2/3 less bang for their Amazon buck than they were last year.

Is this sustainable? Of course not but post WWI Germany began their hyperinflationary climb (over 10% annually) in 1919, as did we in 2019, and it didn't peak out until 1923, when the paper mark was worth 1/1,000,000,000,000th of what it was in 1917. They had a fabulous stock market too because stocks are an asset you trade your worthless paper money for so, to some extent, they protect you against inflation. I mentioned yesterday that HMY was one of our recent Top Trade Picks and this is a great example of what hyperinflation looks like for gold stocks:

Perhaps it's because we discussed it as it's a smallish miner but it was on the way to a breakout yesterday anyway and we got it back around $3 so we're done with this silliness anyway. NAK is still fun to speculate on and GOLD is soon to break out – especially if gold makes a run for 2,000 so perhaps we'll take a 2nd stab at our Stock of the Year as we hit the midpoint of the cycle.

November 14th, 2019 was a very different World than the one we live in today but our logic is still the same:

It has been lower and may be lower again but the ongoing global uncertainty could push Gold (/YG) while a trade deal with China can get copper back closer to $3, making profits on that side of the mine as well. If it were just about the business, GOLD would not be our stock of the year but it's also about what kind of trade we can set up and how certain we are it will pay off and here's where GOLD shines. Our Trade of the Year will be:

- Sell 15 GOLD 2022 $17 puts for $3.50 ($5,250)

- Buy 30 GOLD 2022 $13 calls for $5 ($15,000)

- Sell 30 GOLD 2022 $17 calls for $3 ($9,000)

The net cash outlay on the spread is $750 and it pays $12,000 if GOLD is over $17 in Jan of 2022 for a profit of $11,250 (1,500%). The ordinary margin requirement on the 15 short puts is $4,971.75 so it's a very efficient way to make $11,250. The worst-case scenario is you are assigned 1,500 shares of GOLD at $17 plus the 0.50/share loss from the $750 outlay so $17.50 is not much worse then the $16.44 you'd have to pay now to buy the shares yet you only need it to stay flat to make $11,250 – seems like a good deal to me

We'll put up a new way to trade GOLD in our Live Member Chat Room later today.