Wheee, what fun!

Wheee, what fun!

Although the Dow fell 500 points into the close yesterday we still finished the day in the green as we had quite the low-volume rally in the morning (before the market opened). That brought in what they call the "bag holders" to buy the "rally" before they got whipsawed in the selling frenzy that over took the market in the afternoon as California announced it was going back to lockdown as the virus rages out of control (again).

WHO Says Pandemic to Linger; Cases Pass 13 Million: Virus Update.

See, that's what I'm talking about! What a coincidence that news item popped up there… That's right, not all the news is GREAT and we're still very concerned about what's going on in the World and, without new stimulus officially being announced, the market is looking just a little bit tired of rallying on rumors of virus cures, etc. and now we are getting REAL earnings reports that are not, on the whole, very pretty.

- Core CPI: +0.6% vs. +0.1% consensus and -0.1% prior.

- Citigroup builds up reserves as macro outlook worsens

- Wells Fargo misses on earnings, slashes dividend

- Travelers sees Q2 loss on catastrophe losses, non-fixed income portfolio

- Spotify -3% after two-notch downgrade

- Delta -1% after issuing cautious outlook

- Singapore Slumps Into Recession With 41.2% Fall in Quarterly GDP.

- Ten Thousand Day Traders an Hour Are Buying Tesla Shares.

- U.S. 12-Month Deficit Tops $3 Trillion as Virus Stimulus Spending Soars.

- Chinese Economy Faces ‘Unprecedented’ Challenges Amid Pandemic, Top Official Admits.

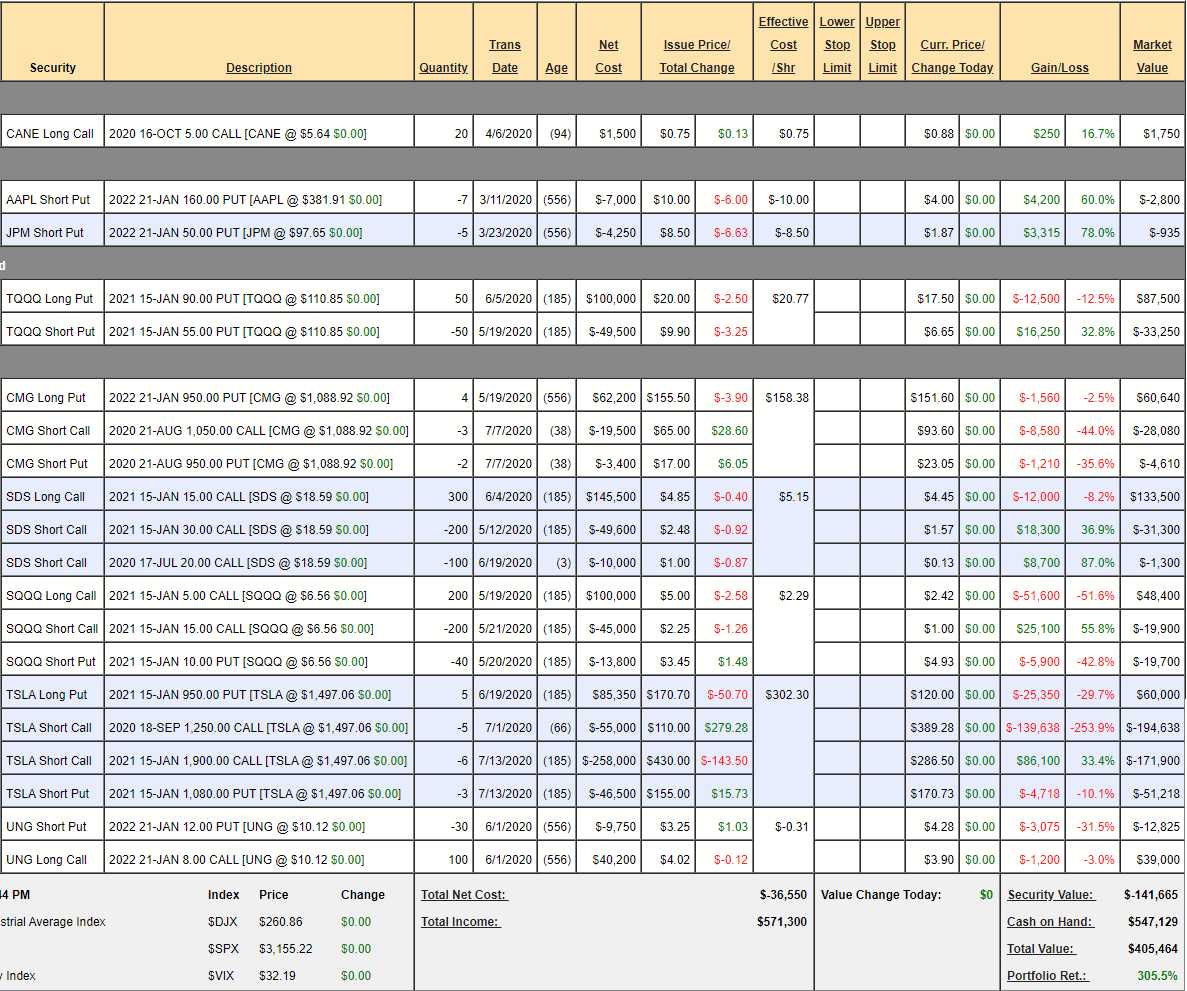

I'm sure everything will be "FINE" eventually but, for now, I'd say a little caution would be recommended – just in case it isn't. We keep our hedges in the Short-Term Portfolio (STP) but those are getting killed recently because of Tesla's (TSLA) wild ride though we did take advantage of yesterday's spike up to sell more short calls, we're still way behind on that position though it is an excellent hedge against a market crash as I very much doubt TSLA will be immune:

There's not much we're looking to do here adjustment-wise as there's about $400,000 worth of downside protection in the basic hedges (TQQQ, SDS and SQQQ) and the TSLA and CMG plays will do well in a bearish market as well so our Long-Term Portfolio (LTP) is well-protected and hovering at around $875,000 (up 75%) so we're up over 100% from our $500,000 + $100,000 start in our paired portfolios and I have said often that we should consider net $1,200,000 a stop line to close out with a double – which is good for less than a year's work, so why risk it?

The TSLA trade is making the STP extremely volatile and, this morning, they are up $200 again but I'm very long-term confident that TSLA is not worth $350Bn when GM is at $35Bn (at $25) and Ford (F) is at $24Bn at $6. In fact, since F is at $6, how about we offer to buy it for $4 by selling 25 of the 2022 $5 puts for $1.10 ($2,750) so we net in for $3.90 and that's like free money so let's make it the basis of a new trade for the Butterfly Portfolio:

- Sell 25 F 2022 $5 puts for $1.10 ($2,750)

- Buy 50 F 2022 $4 calls for $2.75 ($13,750)

- Sell 50 F 2022 $7 calls for $1.25 ($6,250)

- Sell 15 F Aug $6 calls for 0.60 ($900)

That's net $3,850 on the $15,000 spread so the upside potential if F is at $7 in 2022 is $11,150 (289%) but, while we're waiting, we'll make money selling short-term calls, which also hedges us from more downside. Our worst case is being assigned 2,500 shares of F at $5 ($12,500) and losing the entire $3,850 but that would have to be a serious misplay on our part and, of course, we'd still own the stock, which should have some value.

That "worst case" puts us in 2,500 shares of F at $6.54 per share net but it would have to be below $5 to trigger that (otherwise we just lose the $3,850) so let's say $4.50 and then we double down on F at $4.50 and own 5,000 shares at about $5.50 and that's still only $27,500 and we can do it all again to "risk" owning 10,000 shares at $4.50 if it all goes wrong again.

So, if we don't REALLY want to own 10,000 shares of F at $4.50 then we're not comfortable with our "worst case" and we probably shouldn't be offering to buy 2,500 shares for net $3.90, which is the basis of this trade. But, if we would LOVE to buy 10,000 shares of F for $4.50 ($45,000) then there's really no downside to initiating this trade, is there? In fact, we'll be disappointed if all we end up with is $11,150 in profits we'll be paid NOT to own F if it's over $7.

Trading is a lot easier when you learn to think 3-4 moves ahead. Like, 3-4 moves from now, I'd love to be short TSLA at $1,900 since it's worth less than $500 at best!

| Year End 31st Dec | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | TTM | 2020E | 2021E | CAGR / Avg |

|---|---|---|---|---|---|---|---|---|---|---|

|

$m

|

3,198 | 4,046 | 7,000 | 11,759 | 21,461 | 24,578 | 26,022 | 27,440 | 37,795 | 50.4% |

|

$m

|

-187 | -717 | -667 | -1,632 | -388 | -69.0 | 736 | |||

|

$m

|

-294 | -889 | -675 | -1,961 | -976 | -862 | -144 | 834 | 2,243 | |

|

$

|

-2.36 | -6.93 | -4.68 | -7.47 | -5.72 | -4.87 | -0.871 | |||

|

$

|

-2.36 | -6.93 | -4.68 | -7.47 | -5.21 | -4.15 | -0.316 | 4.43 | 11.5 | |

|

%

|

+160 | |||||||||

|

x

|

338 | 130 | ||||||||

|

|

2.11 | 2.18 | ||||||||

Come on, are you going to pay $350 BILLION for $2.2Bn in POTENTIAL earnings?