Remember the virus?

Remember the virus?

The stock market sure doesn't but the US, on the whole, just reported it's second-highest jump in infections and governors and mayors were scrambling to issue new mask orders and limit the size of gatherings. Several large school districts also said they would open the academic year with online classes, bucking pressure from President Trump and his administration to get students back into classrooms as quickly as possible.

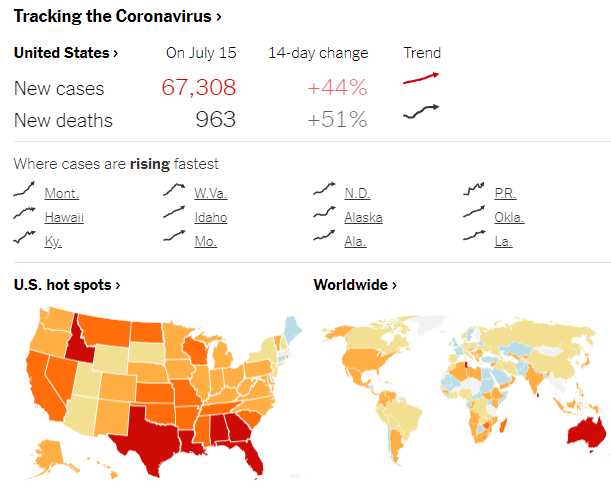

The new restrictions reflect a painful reality that America’s outbreak, which has increased in 41 states over the past two weeks, may worsen in the coming weeks and months. Wednesday’s tally of more than 67,300 new infections was about 1,000 cases shy of the record set late last week, according to a New York Times database, as the country’s total number of cases passed 3.5 Million. Meanwhile, 963 more of Trump's "Virus Soldiers" died yesterday in their brave struggle to keep the economy open for the President's Re-Election – no matter how many lives it costs.

As you can see from the S&P Chart, we were rebounding just fine in May, while we were still locked down as life was ajdusting to the "new normal" – as it did in the rest of the World. 2 months ago, on May 16th, we had less than 1.5M viral infections in the US and we had drastically slowed the spread – even with many states not following the lockdown protocols. BUT, then we had this rush to "re-open" into the Holiday Weekend and, in just two months since then, we have added 2M more cases and the chart is RAPIDLY accellerating as we hit two new records in the past 5 days.

DESPITE pouring $2.7Tn of direct stimulus into the economy and another $4Tn of aid from the Fed – we are STILL not back at our February highs – excpet the Nasdaq, which is way off in fantasy land at 10,550, after testing 11,000 on Monday. The Nasdaq was at 9,500 in February so it's up 11% during the pandemic while the S&P is less than 200 (5.8%) points off it's high.

Are pandemics GOOD for the economy? It would seem so, wouldn't it. But it's only good for the economy in the same way your house is much wetter after a fire, not because the fire makes your house wetter but because the firement use water to put out the fire. When the fire dies down and they turn off the hoses, you are left with a wet, burnt wreck of a house and it's very few people who shout "YAY!!!" as they survey the damage.

Are pandemics GOOD for the economy? It would seem so, wouldn't it. But it's only good for the economy in the same way your house is much wetter after a fire, not because the fire makes your house wetter but because the firement use water to put out the fire. When the fire dies down and they turn off the hoses, you are left with a wet, burnt wreck of a house and it's very few people who shout "YAY!!!" as they survey the damage.

We "only" have an $18.5Tn economy so adding $4Tn in stimulus SHOULD boost it by 21.6% and another $2.7Tn from the Government should be good for another 14.5% so we've SPENT 36% of our ENTIRE economy to keep the S&P 500 where it was in February. That's a lot of water!

Congress is about to allocate more money for more stimulus and you can bet the Fed isn't stopping despite record-breaking profits from their Member Banks at the expense of the taxpayers. It's as if the firemen worked for the water company and the wetter they made things the more money they made… The Fed is NOT the Government, they are a Banking Cartel with Government oversight but they work for GS, JPM, C, etc. – not the other way around.

That's why earnings, so far, have been good – the major Financial Institutions report early in the cycle and it's easy to do well when you are a banker and the Fed and the Government push $6.7Tn through your doors so you can lend it to taxpayers (their own money!) and charge originaltion fees and interest on programs that are backed by the Government (using more taxpayer money) so you can't possibly lose. It's good to be the king!

Insight/2020/07.2020/07.10.2020_EI/S&P%20500%20Earnings%20Growth%20End%20of%20Qtr%20Estimate%20vs%20Actual.png?width=912&name=S&P%20500%20Earnings%20Growth%20End%20of%20Qtr%20Estimate%20vs%20Actual.png)

Delta (DAL) lost $4.43 per $28 share but no one cares, Wells Fargo is a bad bank and lost 0.66 per $25 share but Goldman Sachs (GS) made $6.26 per $216 share, blowing away expectations of $3.91. C doubled expectations, JPM beat by a bit, FRC beat, BNY beat, PNC is another bad bank that lost $1.90 per $102 share but Progressive (PGR) more than doubled expectations and made $3 per $85 share (thanks Flo!).

United Health (UNH) made $7.12 in Q2 vs $3.08 expectations and their shares are $3.05 and that's more Government reimbursemnets boosting those revenues – your tax Dollars at work! We can't afford to give health care to poor people but we can pay an extra $3Bn in profits to UNH to provide services to people who already paid them for insurance?

BAC and SCHW both beat this morning as did Domino's (DPZ) and JNJ had a nice beat, as did Morgan Stanley (MS) and Abbot Labs (ABT). This evening we hear from Netflix and tomorrow BlackRock (BLK) will show us how to leverage all that free money along with FHN, STT, RF, CFG and ALLY.

Next week is when earnings get more interesting as we start hearing from energy companies and heavy-hitting industrials (the people who have massive accounting staffs and are able to report earnings quickly after the quarter ends).

Then comes the bad news….