“"We are asking everybody, when you are not able to socially distance, wear a mask," Trump said. “Whether you like the mask or not, they have an impact."

The US has learned "a great deal" about "the China virus", and unfortunately, things will probably "get worse before they get better" Trump said.

“Some areas of our country are doing very well, others are doing less well,” the President said. “It will probably, unfortunately, get worse before it gets better. Something I don’t like saying about things, but that’s the way it is.”

Yes, that's the way it is.

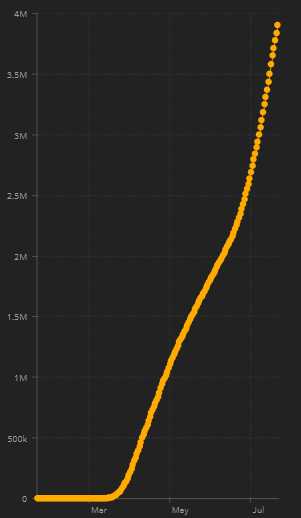

It's also the way it was in February, March, April, May and June but better late than never, on July 21st, in taking the most simple precaution against the rampant spread of a virus that has now killed 142,073 Americans (twice as many as died in the 20-year Vietnam war) and infected, by tomorrow, 4M others. Last night was the first "daily" briefing on the virus since April, when Trump decided Dr. Fauci was upstaging him and, even worse, contradicting him. At the time, the US had less than 1M cases.

It's also the way it was in February, March, April, May and June but better late than never, on July 21st, in taking the most simple precaution against the rampant spread of a virus that has now killed 142,073 Americans (twice as many as died in the 20-year Vietnam war) and infected, by tomorrow, 4M others. Last night was the first "daily" briefing on the virus since April, when Trump decided Dr. Fauci was upstaging him and, even worse, contradicting him. At the time, the US had less than 1M cases.

You're a stock trader – how does that chart of US infections look to you? Almost as good as Tesla but, unlike TSLA, this chart won't suddenly turn around an uninfect people. In fact, it looks like it's about to have a massive breakout and that's why, finally, the President is scared enough to change his tune – he is presiding over one of the biggest catastrophes in human history and his name, his family name and his "brand' will forever be associated with this disaster.

And it is a disaster and, even if the stock market refuses to recognize it – you'd better because, like not wearing face masks, ignoring the virus will not protect your portfolio and you PROBABLY won't die – but you might. You KNOW you might. So you MIGHT make more money and that would be fun but your portfolio also MIGHT die and, with the virus, we are attempting to avoid dying by staying inside and not having fun for a while – so we can live to have fun another day. Why would you not do the same with your porfolios?

We have a lot of protection in our Short-Term Portfolio ($350,000) and we have a lot of gain in our Long-Term ($951,000), and we're back to a combined $1.3M, even though the STP has been crushed (so far) by our short position on Tesla, which is up 286% for the year and reports earnings tonight. Will TSLA take off like the virus and have an even stronger wave or will it crash and burn like — a Tesla? We will find out this evening.

Here are the main results expected in Tesla’s Q2 report, compared to consensus estimates compiled by Bloomberg:

Revenue: $5.2 billion vs. $6.35 billion Y/Y

Adjusted loss per share: 15 cents vs. $1.12 Y/Y

GAAP net loss: $285.2 million vs. $408.33 million Y/Y

If the company makes a GAAP profit, they are eligible to be included in the S&P 500 so we'll see if Musk can pull a rabbit out of his hat on this one. Tesla did deliver 90,650 cars in Q2 and that's up from 88,400 in Q1 and the Shanghai GigaFactory came on-line and began making deliveries too and 11,095 (included) model 3s were sold in China.

“To justify the current stock price, we believe one must assume that by 2025 Tesla will set 2.2mn units (making it as large as German luxury brands, while trading at an elevated 30x+ PE [price/earnings] multiple,” Credit Suisse analyst Dan Levy said in a note late last week. In it, Levy raised his price target on shares of Tesla to $1,400 – below the stock’s current level – and maintained a Neutral rating.

With a $300Bn market cap, there is nothing TSLA can do to justify being at 300-1,000x earnings this year, this buying frenzy is on expectations that TSLA's inclusion in the S&P 500 will cause a buying frenzy for the stock and squeeze it even higher but that correlation does not hold up well for stocks that are already widely held and may even be a sell signal for large investors to sell into the increased liquidity.

We'll find out tonight so stay tuned!