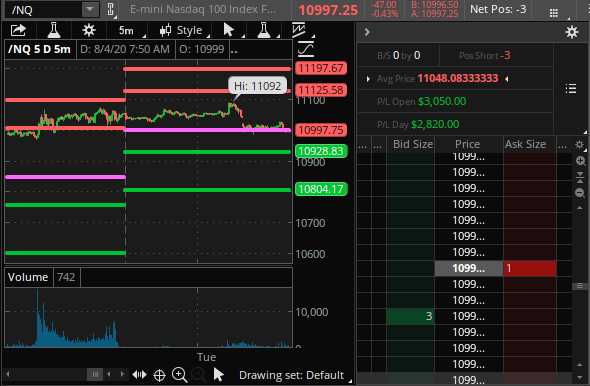

We're still at 11,000 on the Nasdaq.

We're still at 11,000 on the Nasdaq.

We punched over it a bit yesterday and we're into our second round of shorts on the Nasdaq (/NQ) Futures now and you can still catch them crossing the 11,000 line with tight stops above, which is a more conservative way to play. We scaled back in overnight, taking advantage of the spike up to end up with 3 short at 11,048 average so 11,000 is now our stop line to lock in the net $1,000 per contract gains (there were some losses that are offset).

The Russell (/RTY) is below 1,500 so, as long as that stays below, it's still good to short /NQ and the Dow (/YM) failed 26,600 and the S&P (/ES) failed 3,300 again and we're probably on the way back to 3,150, which is the Must Hold Line on our Big Chart and also now the 50 dma(ish). Our tracking chart for the S&P is more conservative as we don't think this bull run will last so the Must Hold line on the SPX is still 2,850 and thats' a solid 15% drop from where we are now:

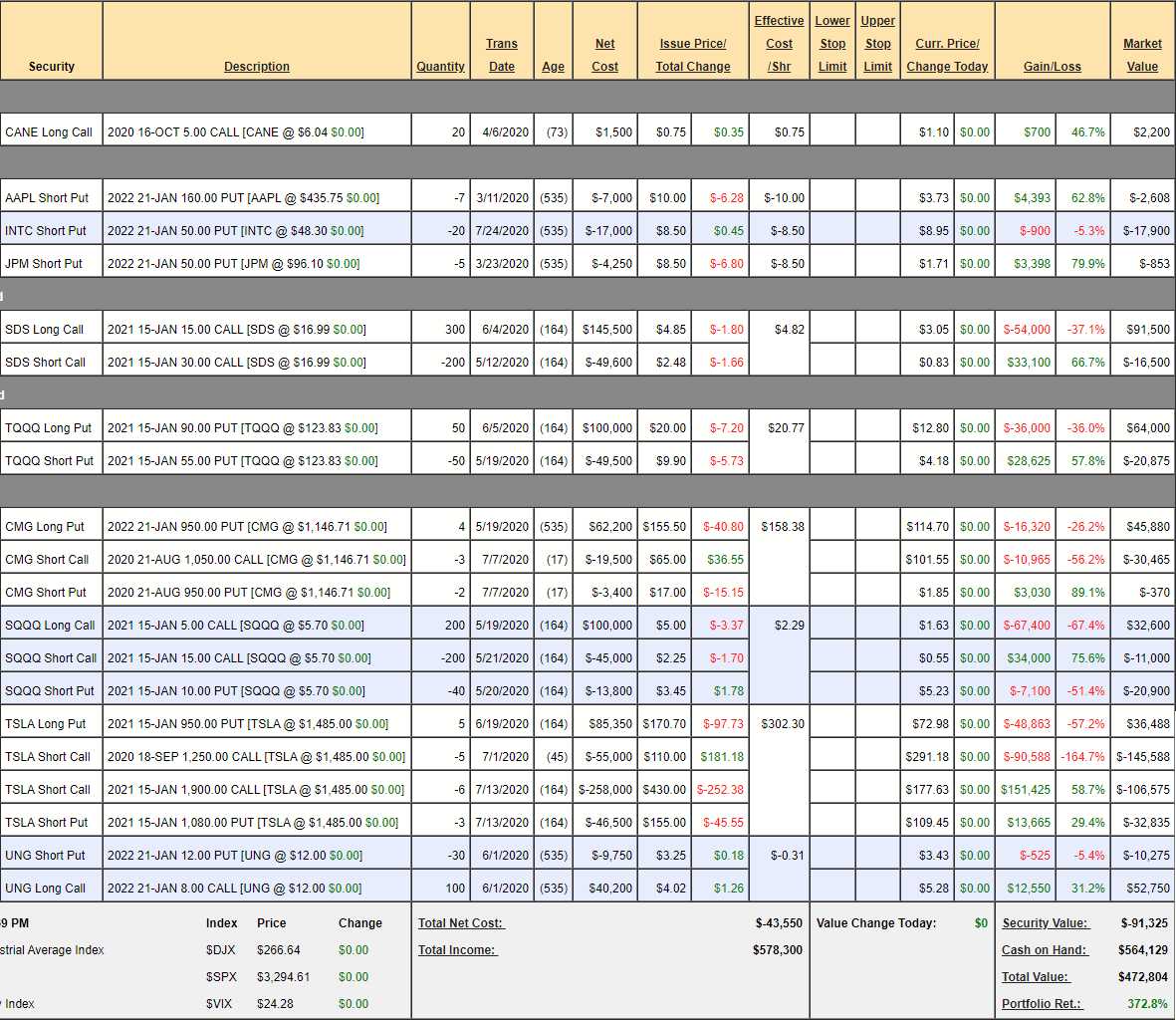

Our hedges in the Short-Term Portfolio are holding up well and the portfolio itself is up 373% for the year as the STP loves volatility – and we've had plenty of that. Although it's early in the month, not much is happening today so it's a good time to go over our hedges and see if there's anything we should adjust (there wasn't last time). We haven't touched the positions since July 14th (3 weeks) other than adding the short INTC puts but, since then, the Long-Term Portfolio (LTP) has gained $75,000 AND the Short-Term Portfolio (STP) is up $70,000 too – not bad for leaving things alone!

- CANE – I thought sugar consumption may go up during a pandemic and so far, so good and we're well over our very conservative target. Keep in mind that we sold the Oct $5 puts for 0.75 so our net entry is $4.25 and we make 0.75 (17.6% against risk) if CANE is simply above $5 after 8 months – that's a nice rate of return! And, of course, Sugar isn't going to be free so the risk isn't actually $4.25, is it?

- That's something a lot of trade technicians fail to consider as they tend to ignore the Fundamentals of a position. When you buy a house for $500,000, you don't consider your risk to be that it will go to zero, right? If that were the case, you would never buy a house, nor would the bank lend you money for it. You need to understand the real value of an investment in order to understand the real risks of owning it. That way, when you see these great options deals – it becomes very obvious that you should jump on them.

- AAPL – Speadking of obvious. Here we collected $7,000 in exchange for promising to buy 700 shares of AAPL for net $150 ($105,000). Again, notice when sold the puts – March 11th. Apple wasn't done going down but we didn't know that but we did KNOW that we would certainly love to buy 700 shares for $150 and keep it forever and ever – even if the virus did destroy the World.

- INTC – We just took advantage of these and they are still down, so good for a new trade with a net $41.50 entry.

- JPM – These are up so much we should probably kill them rather than wait 18 months to make the last 20%. Yes, let's take that money and run. Our entry was perfect on this one and we've been rewarded for it.

- SDS – The ETF is at $17 so the spread is $60,000 in the money and we paid net $96,000 for it. More importantly we paid net $2.37 for it and the long calls are still $3.05, so there's no pressure to roll it yet to salvage the net cost of the spread (by investing more and moving it to a longer-term asset). Having decided that, the next thing we need to consider is are we being adequaterly protected?

- SDS is a 2x ETF so if the S&P drops 15% then SDS will go up 30% to $22.10 and we have the short $30 calls so lots of room there and our calls will be about $5 or $150,000 vs the current net $75,000 on the spread so we have $75,000 worth of protection here.

- TQQQ – The is a 3x inverse ETF at $123 so if the Nasadq falls 15%, TQQQ will fall 45% to $67.50, just over our target range. We paid net $8.62 for the spread and the long puts are still $12.80 so, like SDS, no immediate need to roll and $67.50 would be $22.50+ on the puts for $112,500 and thespread is currently net $43,125 so about $80,000 of protection here.

- In this case, the $110 puts are $20 so $7.20 to roll up $20 in strike is worth it for more protection. The 2022 $110 puts are $34, not worth it so we'll go for the higher strike and see how that goes.

- CMG – Still crazy high at $1,150 and we sold the Aug $1,050s for $65 but at least the short puts will expire worthless. Earnings took them down 5% but they are recovering but not so fast that I'm worried. Next earnings are 10/20 so we can roll the 3 Aug $1,050 calls at $109 ($32,700) to 4 short Sept $1,100s at $85 ($34,000) and we can sell 2 of the Jan $900 puts for $30 ($6,000) and that gives us plenty of cushion to work with. Not yet, but that's the plan.

- SQQQ – Our primary hedge is a 3x ETF that's at $5.66 so a 15% drop in the Nasdaq will take it up 45% to $8.20 and our $5 calls will be worth $3.20+ which is only $64,000. Currently the spread is net $700, so we're getting $63,300 worth of protection but that's not as much as we thought we'd have.

TSLA – Another dagerous MoMo play.

- TSLA – What a crazy stock! Not in a million years is this worth $1,500 but, currently, that's what it's priced at. They went bast earnings so not much chance they are derailed but I can't see the Jan $1,900 short calls not paying us the full $106,575 and the short puts should pay us $32,835 but the puts we own could lose $36,488 and the 5 short Sept $1,250 calls at $291 ($145,500) can be rolled to the Jan $1,600 calls at $265 and then we could sell more puts so I'm not too worried. It would be lovely if we also end up collecting the other $145,588.

- Keep in mind, this is also a hedge – one that pays about $300,000 if the market crashes and TSLA turns out not to be immune (they weren't in March).

- UNG – Going like gangbusterds now. We have 100 long

So we're still in good shape with good protection.