The S&P 500 topped out yesterday at 3,387.

The S&P 500 topped out yesterday at 3,387.

That was just shy of the 3,393 high we hit in February, the day before we plunged 1,200 points (35%) over the next four weeks. HOPEFULLY we won't repeat that disaster but, just in case we do, we're beginning to cash in our positions and, today, we're going to once again roll up our hedges to help lock in our gains.

The market is up not 35% (that's what we dropped from) but 50% abover 2,200 and that's a pretty good run. According to our 5% Rule™, we should be expecting a 20% pullback (of the 1,100 gain) from 3,300 back to 3,080 as a weak retracement and a stronger pullback would give back 40% of the gains, to our Must Hold Line at 2,860. That would NOT be bearish if the Must Hold line does, in fact, hold – it will just feel that way.

Still, no point in riding out the dip if we don't have to so we're going to raise more CASH!!! and there are plenty of great stocks to buy, like WBA, INTC, BA and VIAC (see Tuesday's Report and yesterday's Live Trading Webinar) so we'll have somewhere to put that cash if the market doesn't crash but I'll feel a lot better heading into the Back to School Disaster with more CASH!!! in our portfolios.

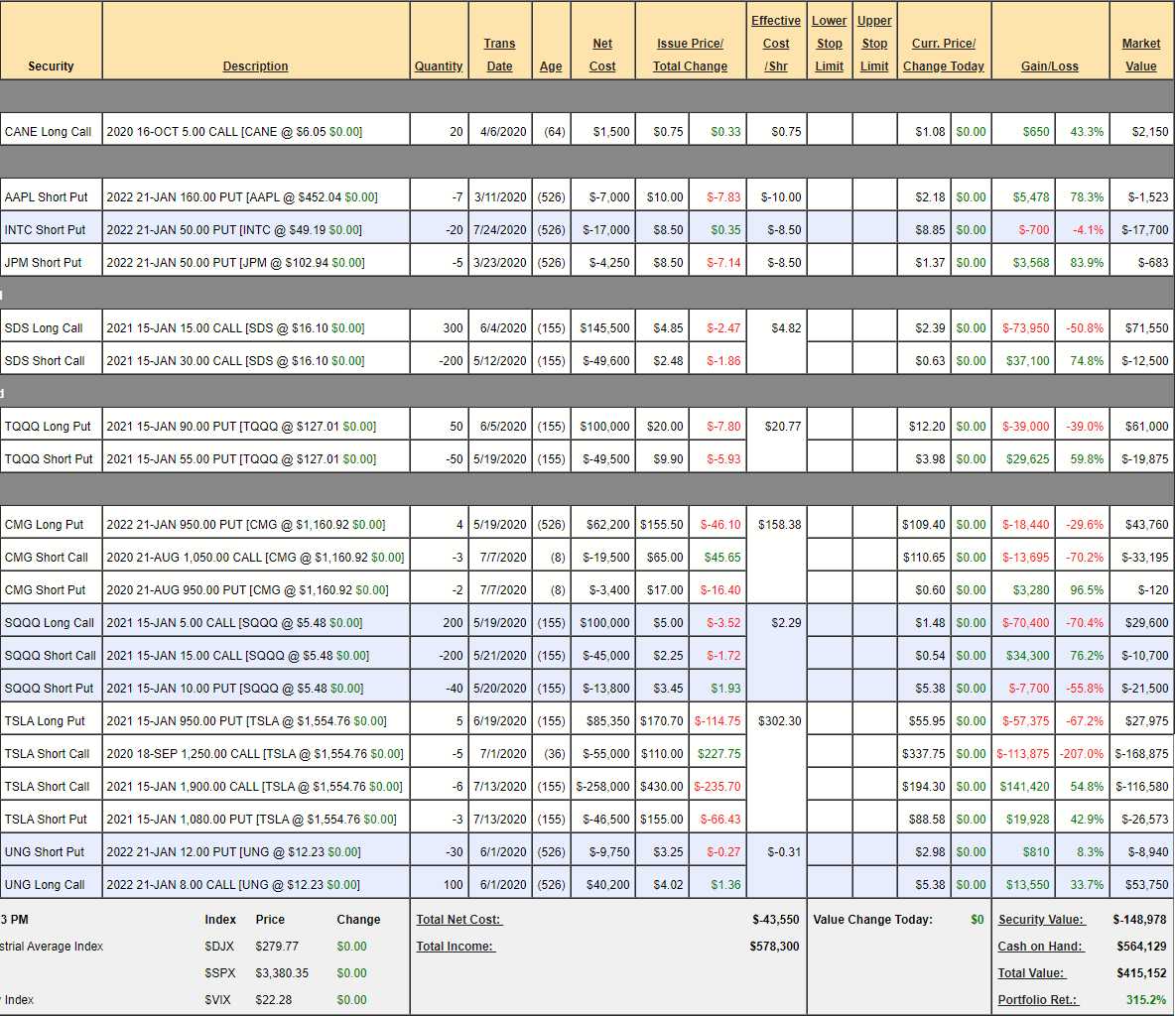

Our Long-Term Portfolio Positions are up over 100% for the year and they are protected by our Short-Term Portfolio, which is up 315% for the year at $415,152. That's actually down about 100% as TSLA has once again spiked up on us but we think we can outlast the Tesla bulls – even as the stock hits $1,600 again today. It's time, once again, to make some adjustments as the Nasdaq tests 11,150 as well this morning:

- CANE – Just a simple bet on Sugar. I don't see any reason not to ride it out as it's breaking up nicely.

- AAPL – On track and we don't need the margin but we may as well buy it back and clear the slot.

- INTC – Good for a new trade.

- JPM – Not enough left in this one to bother keeping it open for 18 months so we'll cash it in.

We use the short puts to help offset the cost of our hedges. In this case, the AAPL and JPM short puts made us over $9,000. The hedging concept is very simple, we pick blue-chip stocks that are undervalued and we offer to buy them for even lower prices. In this case we offered to buy AAPL for $160, INTC for $50 and JPM for $50 so we REALLY want to own those stocks at those prices in our LTP which means the money we are being paid to make that promise is essentially free.

If the market goes lower, our main hedges (TQQQ, SQQQ, SDS) will go up and we'll have more money to buy our stocks with and, if the market goes higher, it's not that likely our short put stocks won't go up too and then the money we collected helps offset the loss on our hedges, a well-balanced system!

SDS – Speaking of main hedges… This is aggressive as we're only 2/3 covered and the S&P is back at it's highs. We are still in the money but the short calls are up 75% so we're kind of done with those and now we should be realistic. If the S&P drops 20%, SDS goes up 40% from $16 to $22.40 so that's our target. Our time-frame is still January but let's play it like this:

- Close the 200 short Jan $30 calls at 0.60 ($12,000)

- Roll the 300 Jan $15 calls at $2.35 ($70,500) to 300 2022 $15 calls at $3.70 ($111,000)

- Sell 200 Jan $22 calls for $1.10 ($22,000)

So we're spending net $30,500 and we're buying another year of protection and we're still only 2/3 covered and, if there's a total disaster, we can roll the short calls to a higher strike and have more coverage. If the S&P stays up, we can sell more short calls and start making up what we spent. At $20 + we'll have $150,000 on our spread, the current net is about $60,000 + $30,000 more we're spending so $90,000 means at least $60,000 worth of protection here.

- TQQQ – We may as well buy back the Jan $55 puts at $4 ($20,000) as they will only get in the way of cashing in the long puts. The Jan $90 puts are $12.20 ($61,000) and we can roll those up to the Jan $100 puts at $15.50 for $3.30 ($16,500) and that buys us $50,000 more protection. If the Nasdaq falls 20%, TQQQ drops 60% to $50 and those $100 puts would be worth $50 ($250,000) and currently net $40,000 + $36,500 we're spending is $76,500 so $173,500 is our net protection here.

- CMG – The short Aug $1,050 calls are in the money but we think CMG is very toppy here at $35Bn since they only made $350M last year so it's a fast-food franchise trading at 100 times earnings. Even in this market, that's ridiculous! We're going to roll the 3 short Aug $1,050s at $110 ($33,000) to 3 Sept $1,050 calls at $125 ($37,500) and we're not even going to sell more puts at the moment as it's too risky.

- TSLA – This stock is so insane! It was on a nice path down but now back to $1,600 and there's not much to do but grin and bare it as we should save our money for adjustments if we have to make them. The stock is splitting and people seem very excited but that still doesn't make the company worth $300Bn, which is 10x sales and 300Bn times profits. Remember, this is also a hedge – it will do well if the market crashes and pay us about $300,000 if TSLA goes back to $1,200.

- UNG – A long play on natural gas into hurricane season. So far, so good.

So we have a good $500,000 of downside protection, about 1/2 the value of our Long-Term Portfolio and, since the STP is $400,000 now, even if the LTP were completely wiped out and the LTP gained $500,000, we'd still have $900,000, which is 50% more than the $600,000 we started the year with.

Now I can sleep soundly over the weekend!