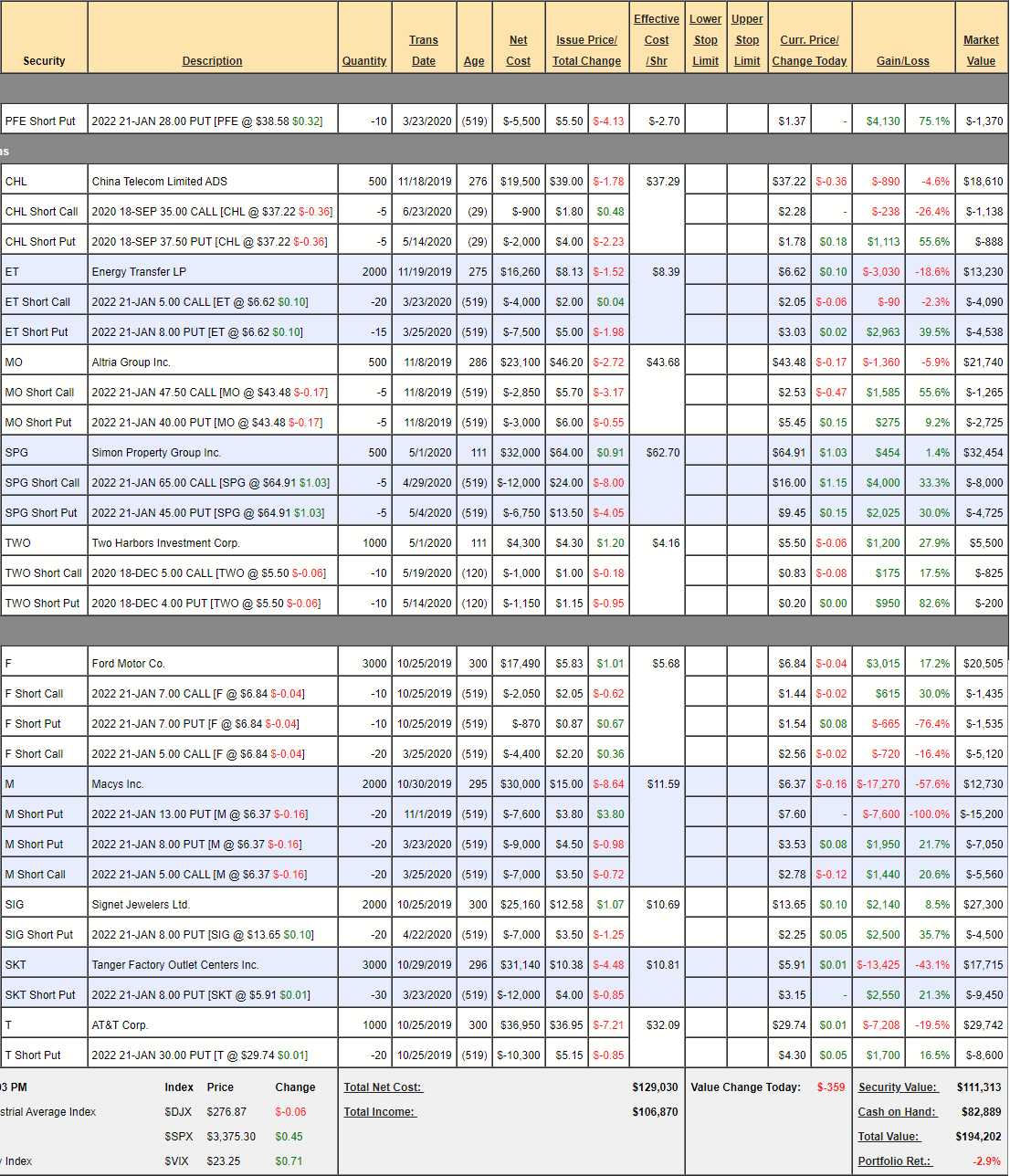

Dividend Portfolio Review: $194,202 is down 2.9% and that's a 7.2% improvement from last month so nice comeback - especially for a portfolio without any internal hedges. We rode out a downturn once and I hope we don't have to do it again but, like the Butterfly Portfolio, these are super-solid, battle-tested positions I would hate to part with.

- PFE - Up too much to leave it on so we'll close this one.

- CHL - Just paid us a very fat dividend so no reason to sell them and they are even on track with the short puts and calls.

- ET - Also right where we want them.

- MO - A bit lower than we hoped but on track and paying our dividends so it's fine.

- SPG - Right on track. This one makes for a good bullish bet at this price.

- TWO - On track.

- F - Suspended the dividend but we still love them at 1/13th TSLA's price.

- M - Also no dividends being paid but I'm still hopeful on the recovery.

- SIG - Suspended dividends. We're aggressively long and hopefully they are consolidating for a move up.

- SKT - Suspended dividends and we're aggressively long.

- T - Still paying a dividend. We have been buying T at $30 or less ever since PSW started and it's still a great thing to do. They paid us 0.52 on July 9th, that's $4.08/yr on a $29.74 share - that's 7% dividend AND you get to own T at $29.74. How can you people say there aren't things to buy when there are things like this to buy?

For the T-less LTP, let's add the following:

- Sell 25 T 2022 $28 puts for $3.25 ($8,125)

- Buy 75 T 2022 $28 calls for $3.40 ($25,500)

- Sell 75 T 2022 $33 calls for $1.40 ($10,500)

That's net $6,875 on $37,500 spread so there's $30,625 (445%) of upside potential if T can simply move up 10% over the next 18 months and, since our worst case is owning 2,500 shares of T for $28 ($70,000) + $6,875 if we're wiped out on the spread, that's about $30, which is the current price so our worst case is owning T and collecting 7% dividends - not a bad worst case.